Question

(14 of 21 ) Which of the following is true about the Sarbanes-Oxley Act? LO3 Sarbanes-Oxley was passed in effort to enforce better corporate

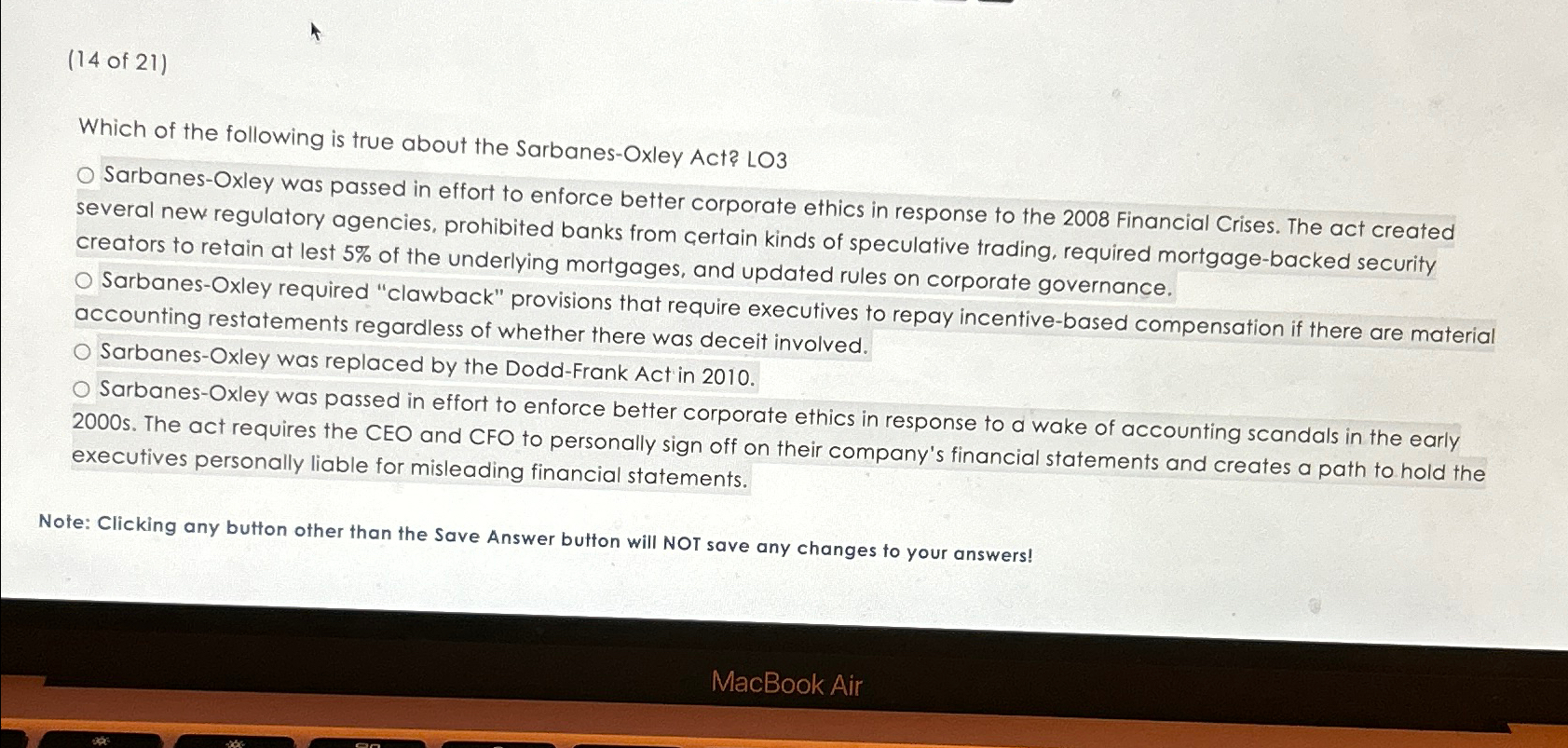

(14 of 21 )\ Which of the following is true about the Sarbanes-Oxley Act?

LO3\ Sarbanes-Oxley was passed in effort to enforce better corporate ethics in response to the 2008 Financial Crises. The act created several new regulatory agencies, prohibited banks from certain kinds of speculative trading, required mortgage-backed security reators to retain at lest

5%of the underlying mortgages, and updated rules on corporate governance.\ Sarbanes-Oxley required "clawback" provisions that require executives to repay incentive-based compensation if there are material accounting restatements regardless of whether there was deceit involved.\ Sarbanes-Oxley was replaced by the Dodd-Frank Act in 2010.\ Sarbanes-Oxley was passed in effort to enforce better corporate ethics in response to a wake of accounting scandals in the early 2000s. The act requires the CEO and CFO to personally sign off on their company's financial statements and creates a path to hold the executives personally liable for misleading financial statements.\ Note: Clicking any button other than the Save Answer button will NOT save any changes to your answers!\ MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started