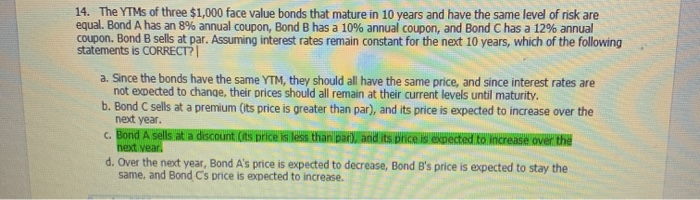

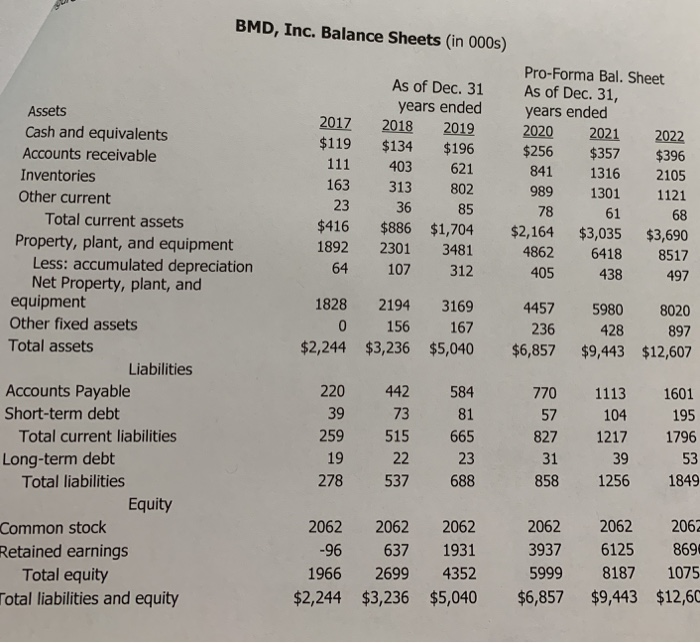

14. The YTMs of three $1,000 face value bonds that mature in 10 years and have the same level of risk are equal. Bond A has an 8% annual coupon Bond B has a 10% annual coupon, and Bond C has a 12% annual coupon. Bond B sells at par. Assuming interest rates remain constant for the next 10 years, which of the following statements is CORRECT? a. Since the bonds have the same YTM, they should all have the same price, and since interest rates are not expected to change, their prices should all remain at their current levels until maturity. b. Bond C sells at a premium (its price is greater than par), and its price is expected to increase over the next year. c. Bond A sells at a discount its price is less than par), and its price is expected to increase over the next year d. Over the next year, Bond A's price is expected to decrease, Bond B's price is expected to stay the same, and Bond Cs price is expected to increase. Growth will be an important topic of discussion, and everyone will want to know about sales and profitability forecasts. What were the company's rate of sales growth (%) and the rate (%) of net income growth in 2019? What are the rates of both sales and net income growth forecasted to be in each of the Pro-Forma years (2020, 2021, and 2022)? BMD, Inc. Balance Sheets (in 000s) 621 2017 $119 111 163 23 $416 1892 64 As of Dec. 31 years ended 2018 2019 $134 $196 403 313 802 36 85 $886 $1,704 2301 3481 107 312 Pro-Forma Bal. Sheet As of Dec. 31, years ended 2020 2021 2022 $256 $357 $396 841 1316 2105 989 13011121 78 61 68 $2,164 $3,035 $3,690 4862 6418 8517 405 438 497 Assets Cash and equivalents Accounts receivable Inventories Other current Total current assets Property, plant, and equipment Less: accumulated depreciation Net Property, plant, and equipment Other fixed assets Total assets Liabilities Accounts Payable Short-term debt Total current liabilities Long-term debt Total liabilities Equity Common stock Retained earnings Total equity Total liabilities and equity 1828 2194 156 $2,244 $3,236 3169 167 $5,040 4457 236 $6,857 5980 428 $9,443 8020 897 $12,607 770 1113 104 220 442 39 73 259515 19 22 278 537 584 81 665 23 688 1601 195 1796 1217 53 3139 858 1256 1849 2062 -96 1966 $2,244 2062 2062 637 1931 26994352 $3,236 $5,040 2062 3937 5999 $6,857 2062 2062 6125 869 8187 1075 $9,443 $12,60