Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14) To purchase studio space, on April 3, 2025 a pianist takes out a 30-year loan of $120,000 at final payment is scheduled to

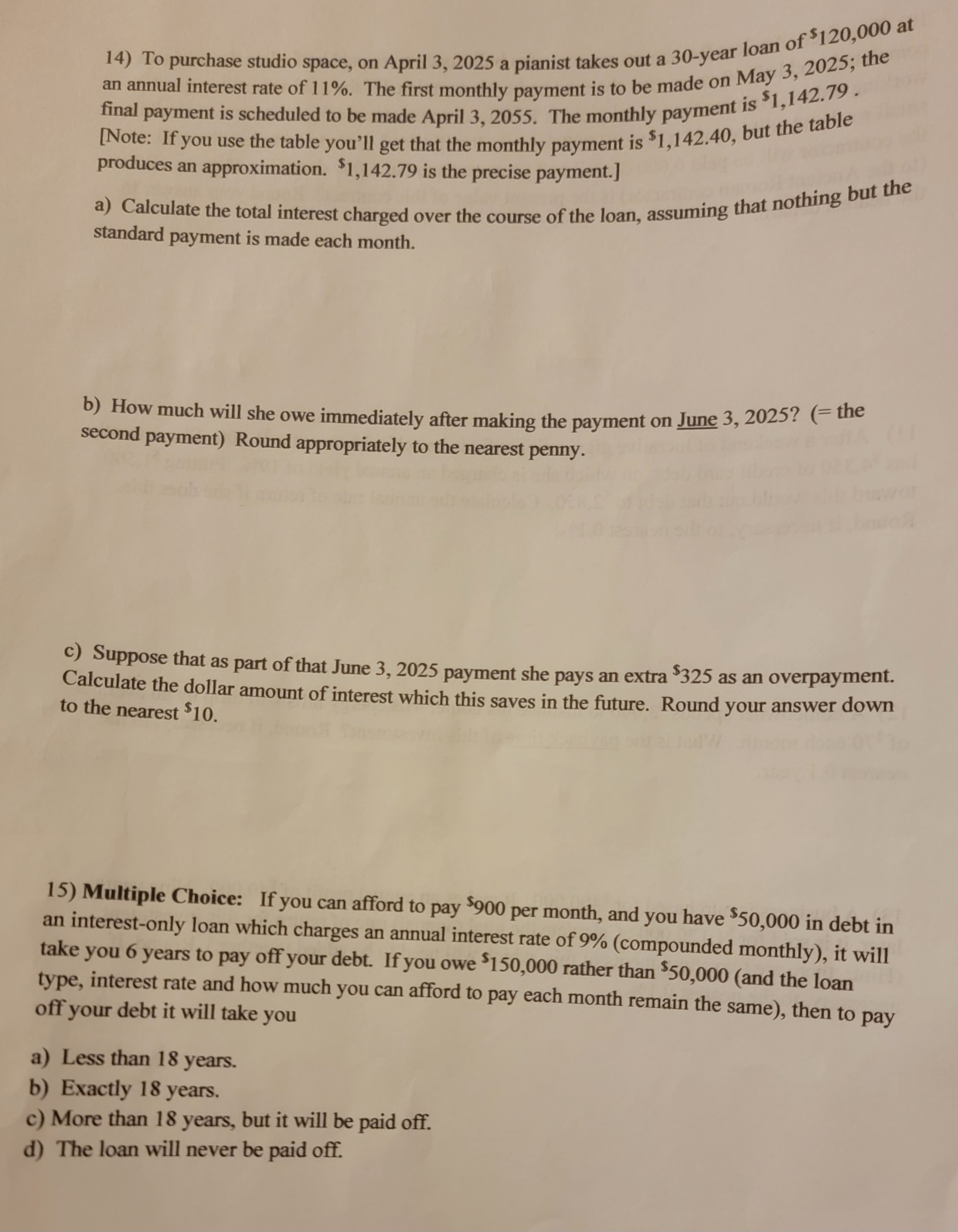

14) To purchase studio space, on April 3, 2025 a pianist takes out a 30-year loan of $120,000 at final payment is scheduled to be made April 3, 2055. The monthly payment is $1,142.79. an annual interest rate of 11%. The first monthly payment is to be made on May 3, 2025; the [Note: If you use the table you'll get that the monthly payment is $1,142.40, but the table produces an approximation. $1,142.79 is the precise payment.] a) Calculate the total interest charged over the course of the loan, assuming that nothing but the standard payment is made each month. b) How much will she owe immediately after making the payment on June 3, 2025? (= the second payment) Round appropriately to the nearest penny. c) Suppose that as part of that June 3, 2025 payment she pays an extra $325 as an overpayment. Calculate the dollar amount of interest which this saves in the future. Round your answer down to the nearest $10. 15) Multiple Choice: If you can afford to pay $900 per month, and you have $50,000 in debt in an interest-only loan which charges an annual interest rate of 9% (compounded monthly), it will take you 6 years to pay off your debt. If you owe $150,000 rather than $50,000 (and the loan type, interest rate and how much you can afford to pay each month remain the same), then to pay off your debt it will take you a) Less than 18 years. b) Exactly 18 years. c) More than 18 years, but it will be paid off. d) The loan will never be paid off.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the total interest charged over the course of the loan we can use the formula for the total amount paid over the course of the loan Tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started