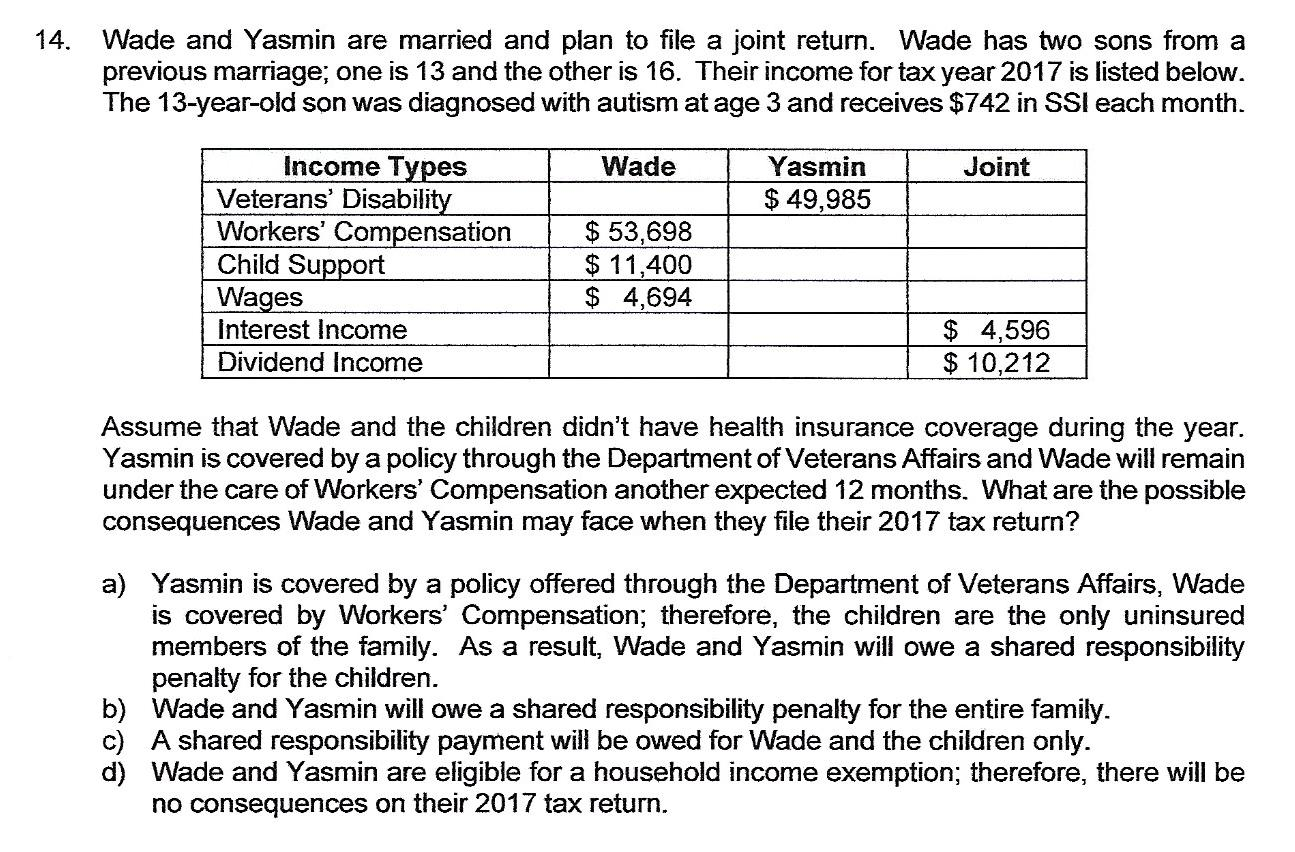

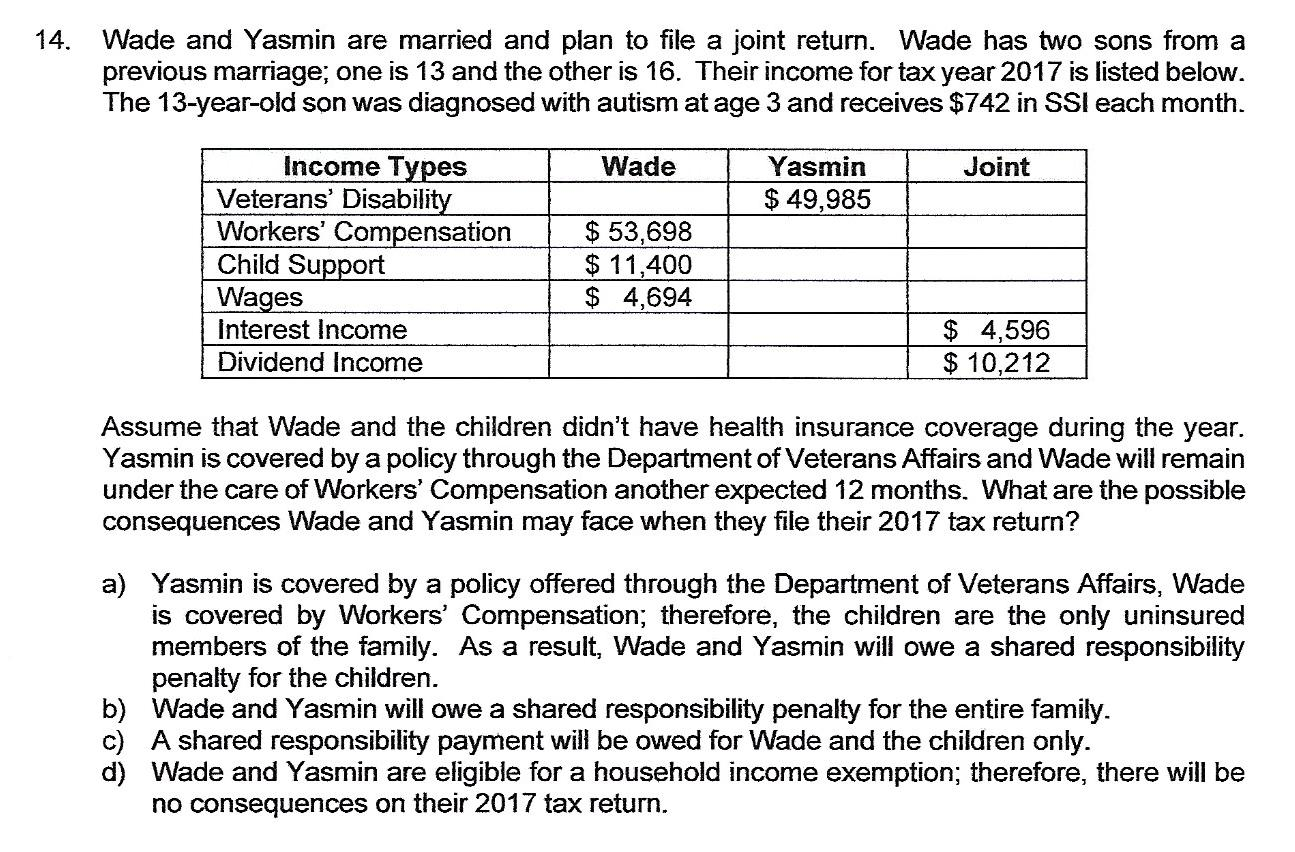

14. Wade and Yasmin are married and plan to file a joint return. Wade has two sons from a previous marriage; one is 13 and the other is 16. Their income for tax year 2017 is listed below. The 13-year-old son was diagnosed with autism at age 3 and receives $742 in SSI each month. Wade Joint Yasmin $ 49,985 Income Types Veterans' Disability Workers' Compensation Child Support Wages Interest Income Dividend Income $ 53,698 $ 11,400 $ 4,694 $ 4,596 $ 10,212 Assume that Wade and the children didn't have health insurance coverage during the year. Yasmin is covered by a policy through the Department of Veterans Affairs and Wade will remain under the care of Workers' Compensation another expected 12 months. What are the possible consequences Wade and Yasmin may face when they file their 2017 tax return? a) Yasmin is covered by a policy offered through the Department of Veterans Affairs, Wade is covered by Workers' Compensation; therefore, the children are the only uninsured members of the family. As a result, Wade and Yasmin will owe a shared responsibility penalty for the children. b) Wade and Yasmin will owe a shared responsibility penalty for the entire family. C) A shared responsibility payment will be owed for Wade and the children only. d) Wade and Yasmin are eligible for a household income exemption; therefore, there will be no consequences on their 2017 tax return. 14. Wade and Yasmin are married and plan to file a joint return. Wade has two sons from a previous marriage; one is 13 and the other is 16. Their income for tax year 2017 is listed below. The 13-year-old son was diagnosed with autism at age 3 and receives $742 in SSI each month. Wade Joint Yasmin $ 49,985 Income Types Veterans' Disability Workers' Compensation Child Support Wages Interest Income Dividend Income $ 53,698 $ 11,400 $ 4,694 $ 4,596 $ 10,212 Assume that Wade and the children didn't have health insurance coverage during the year. Yasmin is covered by a policy through the Department of Veterans Affairs and Wade will remain under the care of Workers' Compensation another expected 12 months. What are the possible consequences Wade and Yasmin may face when they file their 2017 tax return? a) Yasmin is covered by a policy offered through the Department of Veterans Affairs, Wade is covered by Workers' Compensation; therefore, the children are the only uninsured members of the family. As a result, Wade and Yasmin will owe a shared responsibility penalty for the children. b) Wade and Yasmin will owe a shared responsibility penalty for the entire family. C) A shared responsibility payment will be owed for Wade and the children only. d) Wade and Yasmin are eligible for a household income exemption; therefore, there will be no consequences on their 2017 tax return