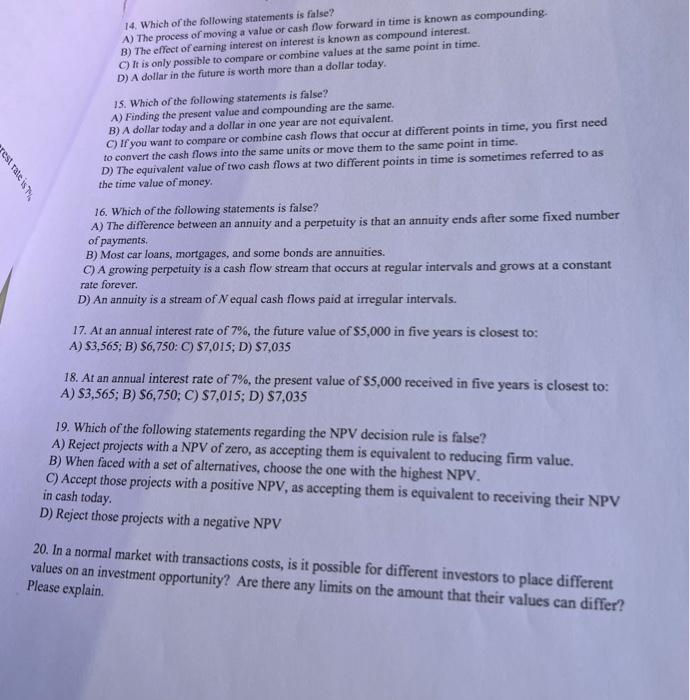

14. Which of the following statements is false? A) The process of moving a value or cash flow forward in time is known as compounding. B) The effect of earning interest on interest is known as compound interest. C) It is only possible to compare or combine values at the same point in time. D) A dollar in the future is worth more than a dollar today. 15. Which of the following statements is false? A) Finding the present value and compounding are the same. B) A dollar today and a dollar in one year are not equivalent. C) If you want to compare or combine cash flows that occur at different points in time, you first need to convert the cash flows into the same units or move them to the same point in time. D) The equivalent value of two cash flows at two different points in time is sometimes referred to as the time value of money. 16. Which of the following statements is false? A) The difference between an annuity and a perpetuity is that an annuity ends after some fixed number of payments. B) Most car loans, mortgages, and some bonds are annuities. C) A growing perpetuity is a cash flow stream that occurs at regular intervals and grows at a constant rate forever. D) An annuity is a stream of N equal cash flows paid at irregular intervals. 17. At an annual interest rate of 7%, the future value of $5,000 in five years is closest to: 18. At an annual interest rate of 7%, the present value of $5,000 received in five years is closest to: 19. Which of the following statements regarding the NPV decision rule is false? A) Reject projects with a NPV of zero, as accepting them is equivalent to reducing firm value. B) When faced with a set of alternatives, choose the one with the highest NPV. C) Accept those projects with a positive NPV, as accepting them is equivalent to receiving their NPV in cash today. D) Reject those projects with a negative NPV 20. In a normal market with transactions costs, is it possible for different investors to place different values on an investment opportunity? Are there any limits on the amount that their values can differ? Please explain