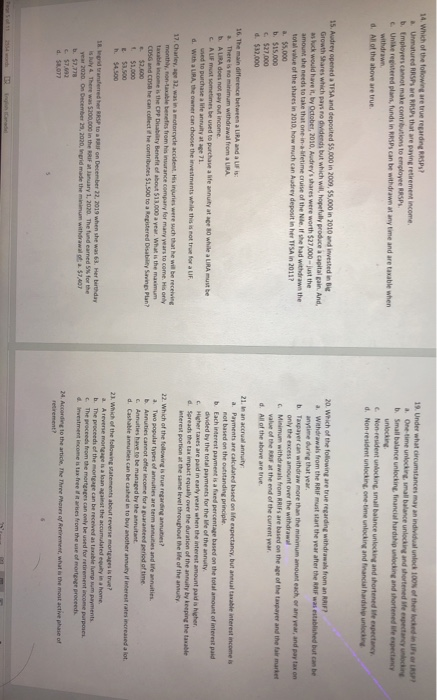

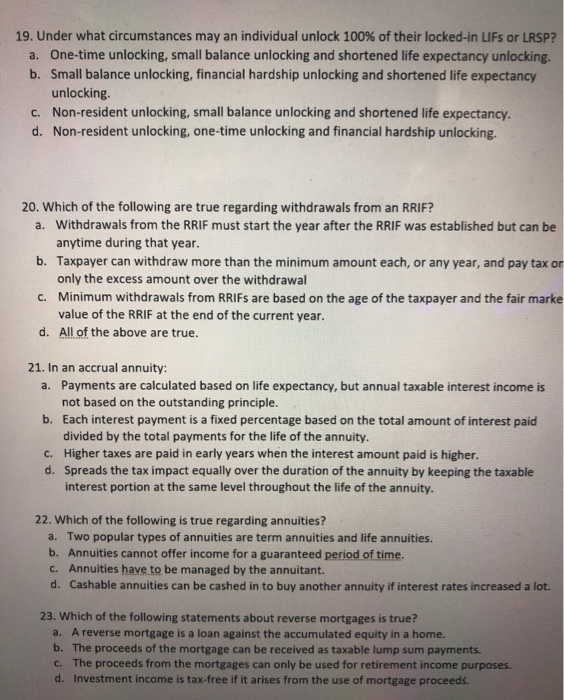

14. Which of the oblowing are true regarding RASP? matured RASPs are RASPs that are paying retirement income b. Employers can make contrbutions to employee SPS. Unibertered plom, funds in RASPs can be withdrawn at any time and are taxable when withdrawn d. All of the above are true 19. Under what circumstances may an individual unlock to the locked in SP One-time unlocking mall balance unlocking and shortened expectan d ing b. Small balance unlocking financial hardhu cking and shortened are expectancy unlocking Non resident unlocking small balance unlocking and shortened we expectancy d. Non resident unlocking one time unlocking and financial hardship unlocking 15. Audrey opened TISA and deposited 55.000 in 2009, 55,000 in 2010 and investeding Growth Shares which pays to dividends but which will hopefully produce a capital gain. And. sluck would have it, by October, 2010, Audrey's shares were worth $27.000 -just the amoum she needs to take that one in a fetime cruise of the Nile. If she had withdrawn the total value of the shares in 2010, how much can Audrey deposit in her TFSA in 2011? 3. 55.000 b. $15,000 C $27.000 $32.000 20. Wich of the following are true regarding withdrawal from an RRIFT a Withdrawals from the RIF must start the year after the RAF was established but can be anytime during that year b. Taxpayer can withdraw more than the minimum amount each oanvar, and pay taxon only the excess amount over the withdrawal C Minimum withdrawals from RIFs are based on the age of the payer and the fair market value of the RF the end of the current year d. All of the above are true 16. The main difference between a URA and a UF: There is no minimum withdrawal from a URA b. ALIRA does not pay income AUF must sometimes be used to purchase alle annuty at age 30 while a URA must be used to purchase alle annullatge . d. With a URA, the owner can choose the investments while this is not true for a UF 21. is an accrualannuity a. Payments are calculated based on fe expectancy, but annual table interest income is not based on the outstanding principle. b. Each interest payment is and percentage based on the total amount of interest paid divided by the total payments for the life of the annuity c. Higher fans are paid in early years when the interest amount pad is higher d. Spreads the tax impact equally over the duration of the annuity by keeping the taxable interest portion at the same level throughout the We of the annuity. 17. Charley 32. was in a motorcycle accidentes injuries were wch that he will be receiving monthly non- tate benefits from insurance company for many years to come. His only acable income is the CPP Disabaty Benefit of about $13.000 a year. What is the maximum COSG and she can collect the contributes $1.500 to a Registered Disab Savings Plan? 22. Which of the following is true regardanties? Two popular types of annuities are term antites and are annuities Annuities cannot offer income for a guaranteed period of time Annuities have to be managed by the annuitant d. Cashable annuities can be cashed is to buy another annuty i interest rates increased a lot 18. brod e red her RRSPRIF on December 22, 2018 when she was 6. Her birthday Is There was $100,000 in the RIF Manuary 1, 2020. The fund earned for the year 2020 on December 23, 2020, nurid made the minimum withdrawal 57,407 b. 57,778 21. Which of the following Matements about reverse mortgages is true? 2 Areven mortage is a loan in the accumulated in a home, b. The proceeds of the mortgage can be received as a belum um payments. The proceeds from the momees can only be used for r ement income purpose investment income tax free om the 24 According to the article. The Three Phares of what is the most active phase of 19. Under what circumstances may an individual unlock 100% of their locked-in LIFs or LRSP? a. One-time unlocking, small balance unlocking and shortened life expectancy unlocking. b. Small balance unlocking, financial hardship unlocking and shortened life expectancy unlocking C. Non-resident unlocking, small balance unlocking and shortened life expectancy. d. Non-resident unlocking, one-time unlocking and financial hardship unlocking. 20. Which of the following are true regarding withdrawals from an RRIF? a. Withdrawals from the RRIF must start the year after the RRIF was established but can be anytime during that year. b. Taxpayer can withdraw more than the minimum amount each, or any year, and pay tax or only the excess amount over the withdrawal C. Minimum withdrawals from RRIFs are based on the age of the taxpayer and the fair marke value of the RRIF at the end of the current year. d. All of the above are true. 21. In an accrual annuity: a. Payments are calculated based on life expectancy, but annual taxable interest income is not based on the outstanding principle. b. Each interest payment is a fixed percentage based on the total amount of interest paid divided by the total payments for the life of the annuity. C. Higher taxes are paid in early years when the interest amount paid is higher. d. Spreads the tax impact equally over the duration of the annuity by keeping the taxable interest portion at the same level throughout the life of the annuity. 22. Which of the following is true regarding annuities? a. Two popular types of annuities are term annuities and life annuities. b. Annuities cannot offer income for a guaranteed period of time. c. Annuities have to be managed by the annuitant. d. Cashable annuities can be cashed in to buy another annuity if interest rates increased a lot. 23. Which of the following statements about reverse mortgages is true? a. A reverse mortgage is a loan against the accumulated equity in a home b. The proceeds of the mortgage can be received as taxable lump sum payments. C. The proceeds from the mortgages can only be used for retirement income purposes. d. Investment income is tax-free if it arises from the use of mortgage proceeds