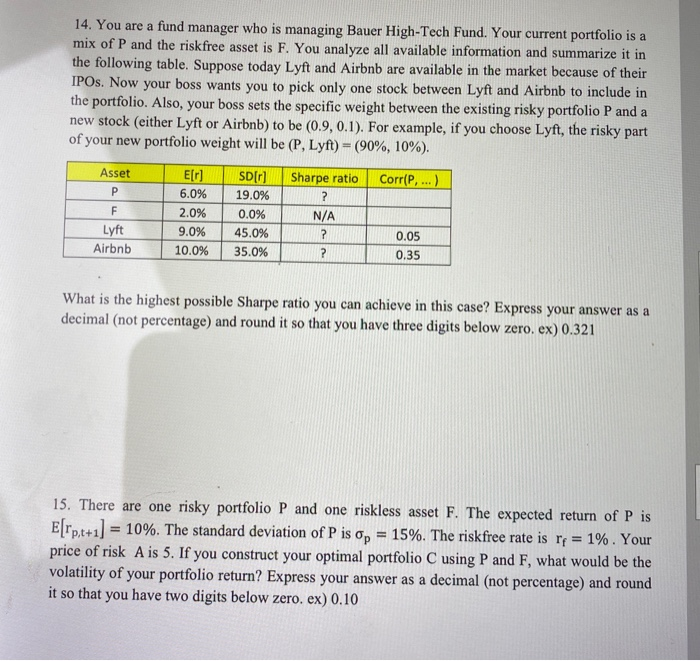

14. You are a fund manager who is managing Bauer High-Tech Fund. Your current portfolio is a mix of P and the riskfree asset is F. You analyze all available information and summarize it in the following table. Suppose today Lyft and Airbnb are available in the market because of their IPOs. Now your boss wants you to pick only one stock between Lyft and Airbnb to include in the portfolio. Also, your boss sets the specific weight between the existing risky portfolio P and a new stock (either Lyft or Airbnb) to be (0.9, 0.1). For example, if you choose Lyft, the risky part of your new portfolio weight will be (P, Lyft) = (90%, 10%). E[0] Sharpe ratio Corr(P, ...) Asset P F Lyft Airbnb 6.0% 2.0% 9.0% 10.0% SD[r] 19.0% 0.0% 45.0% 35.0% 0.05 0.35 What is the highest possible Sharpe ratio you can achieve in this case? Express your answer as a decimal (not percentage) and round it so that you have three digits below zero, ex) 0.321 15. There are one risky portfolio P and one riskless asset F. The expected return of P is Erp.t+1) = 10%. The standard deviation of P is op = 15%. The riskfree rate is rp = 1%. Your price of risk A is 5. If you construct your optimal portfolio C using P and F, what would be the volatility of your portfolio return? Express your answer as a decimal (not percentage) and round it so that you have two digits below zero. ex) 0.10 14. You are a fund manager who is managing Bauer High-Tech Fund. Your current portfolio is a mix of P and the riskfree asset is F. You analyze all available information and summarize it in the following table. Suppose today Lyft and Airbnb are available in the market because of their IPOs. Now your boss wants you to pick only one stock between Lyft and Airbnb to include in the portfolio. Also, your boss sets the specific weight between the existing risky portfolio P and a new stock (either Lyft or Airbnb) to be (0.9, 0.1). For example, if you choose Lyft, the risky part of your new portfolio weight will be (P, Lyft) = (90%, 10%). E[0] Sharpe ratio Corr(P, ...) Asset P F Lyft Airbnb 6.0% 2.0% 9.0% 10.0% SD[r] 19.0% 0.0% 45.0% 35.0% 0.05 0.35 What is the highest possible Sharpe ratio you can achieve in this case? Express your answer as a decimal (not percentage) and round it so that you have three digits below zero, ex) 0.321 15. There are one risky portfolio P and one riskless asset F. The expected return of P is Erp.t+1) = 10%. The standard deviation of P is op = 15%. The riskfree rate is rp = 1%. Your price of risk A is 5. If you construct your optimal portfolio C using P and F, what would be the volatility of your portfolio return? Express your answer as a decimal (not percentage) and round it so that you have two digits below zero. ex) 0.10