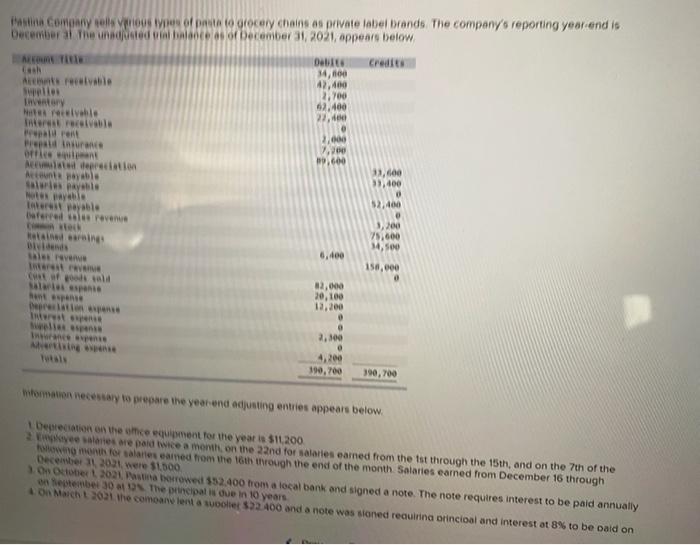

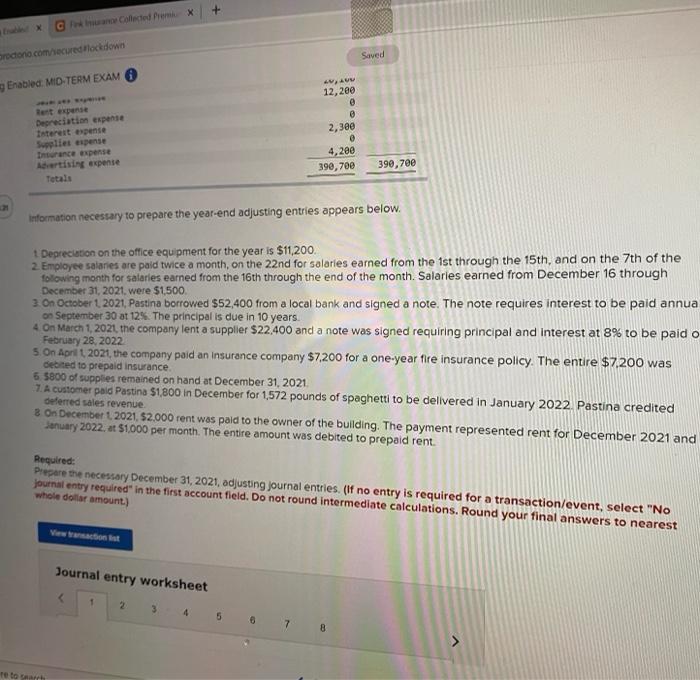

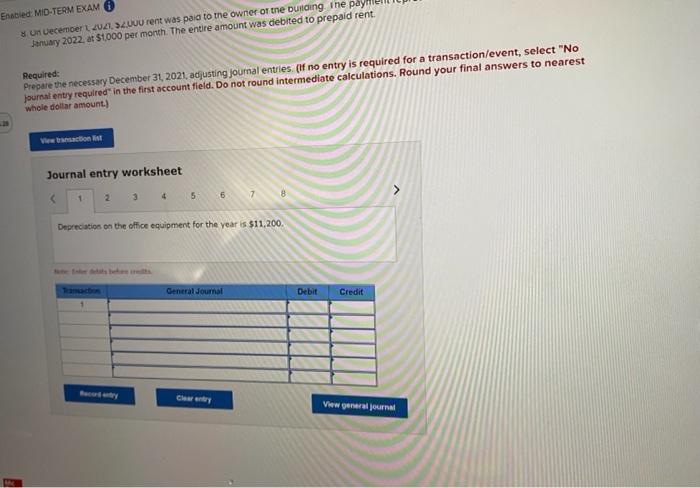

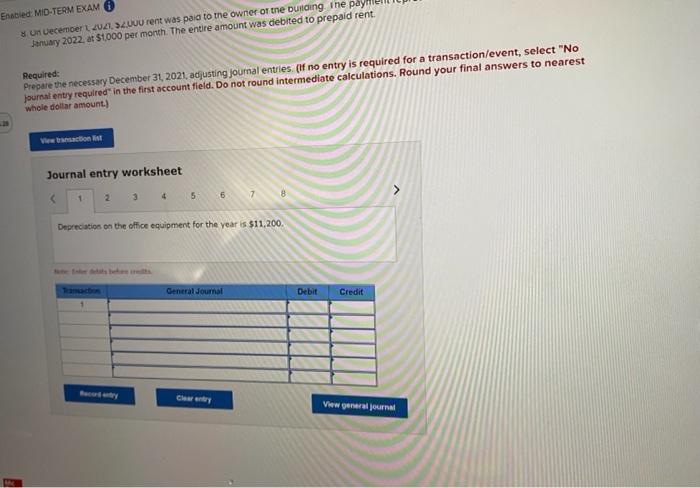

14.00 istina company tell you how of past to grocery chains as private label brands. The company's reporting year and is December at The unadjusted as of December 31, 2021, appears below MENTELE De Credit Antreable 4,400 Supplies 2,700 Ivory 62.400 Nivable 22,4 Interval wal pent 200 Prepaid in 7,200 of 9,600 Meme depreciation 33,600 Att payable 33,400 wins payable o pay Latest pole 12.400 Before revenue 200 75.600 34,500 0.400 Dividende i ve Tereta foto 158,000 M2,000 20,100 13,200 Depressie It wie 2,100 200 190,700 390,700 formation necessary to prepare the year end adjusting entries appears below. Depreciation on the oce equipment for the year is $11,200 2 years are partice a month on the 22nd for salaries earned from the Ist through the 15th, and on the 7th of the when mot for salaries eamed from the 16th through the end of the month Salaries earned from December 16 through December 2001 were $1.500 On October 2021 Pasta berrowed 532.400 from a local bank and signed a note. The note requires interest to be paid annually on September 30 The principal is due in 10 years 10 March 2021 the comoan lenta soole 322.400 and a note was sioned requirina oricioal and interest at 8% to be paid on X CharCollected Premix brodono comecured lockdown Saved Enabled. MID-TERM EXAM O WA 12,200 @ 2,300 Rent expense Depreciatim expense Interest expense Selles expense Intrance expense Artising expense Tetals 4,200 390,700 390,7ee Information necessary to prepare the year-end adjusting entries appears below. Depreciation on the office equipment for the year is $11,200. 2. Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1st through the 15th, and on the 7th of the folowing month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2021 were $1,500 3 on October 2021. Pastina borrowed $52,400 from a local bank and signed a note. The note requires interest to be paid annua on September 30 at 12%. The principal is due in 10 years. 4 on March 1, 2021, the company lent a supplier $22.400 and a note was signed requiring principal and interest at 8% to be paid o February 28, 2022 5 On Aprit 2021, the company paid an insurance company $7.200 for a one-year fire insurance policy. The entire $7.200 was debted to prepaid insurance 6 $800 of supplies remained on hand at December 31, 2021 7. A customer paid Pastina $1,800 in December for 1,572 pounds of spaghetti to be delivered in January 2022. Pastina credited deferred sales revenue 8 On December 1 2021, $2.000 rent was paid to the owner of the building. The payment represented rent for December 2021 and January 2022. at $1.000 per month. The entire amount was debited to prepaid rent. Required: Prepare the necessary December 31, 2021, adjusting Journal entries. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount) Views Journal entry worksheet 1 2 3 4 5 6 7 B > retot Enabled MID-TERM EXAM Un Vecemoer 2021. 32.000 rent was paid to the owner of the building. The pay January 2022. at 51000 per month. The entire amount was debited to prepaid rent. Required: Prepare the necessary December 31, 2021, adjusting Joumal entries (if no entry is required for a transaction/event, select "No Journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Viewraction ist Journal entry worksheet > 1 2 5 6 7 8 Depreciation on the office equipment for the year is $11,200. General Journal Debit Credit 1 Rece Cherry View general journal