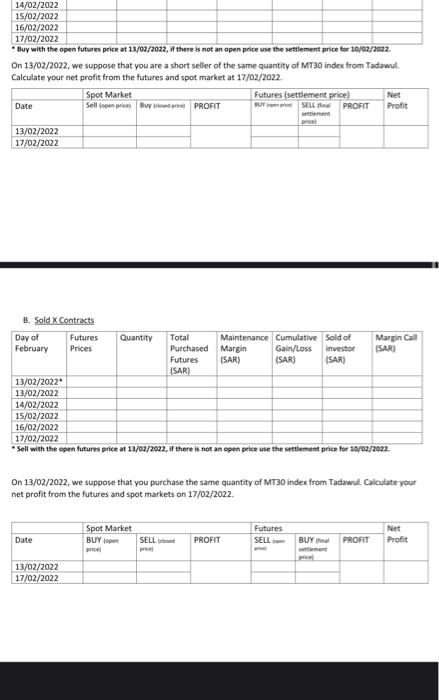

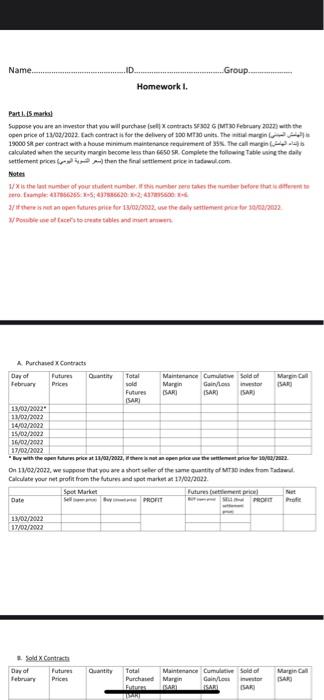

14/02/2022 15/02/2022 16/02/2022 17/02/2022 * Buy with the open futures price at 13/02/2022, if there is not an open price use the settlement price for 10/02/2022. On 13/02/2022, we suppose that you are a short seller of the same quantity of MT30 index from Tadawut Calculate your net profit from the futures and spot market at 17/02/2022 Spot Market Futures (settlement price) Net Date Selle price Buy PROFIT BUYSELL PROFIT Profit 13/02/2022 17/02/2022 B. Sold X Contracts Day of Futures Quantity Total Maintenance Cumulative sold of Margin Call February Prices Purchased Margin Gain/Loss investor ISAR) Futures (SAR) (SAR) (SAR) (SAR) 13/02/2022" 13/02/2022 14/02/2022 15/02/2022 16/02/2022 17/02/2022 Sell with the open futures price at 13/02/2022, if there is not an open price use the settlement price for 19/02/2022. On 13/02/2022. we suppose that you purchase the same quantity of MT30 index from Tadawul. Calculate your net profit from the futures and spot markets on 17/02/2022 Spot Market Net Futures SELL Date BUY SELL PROFIT BUY PROFIT Profit Price 13/02/2022 17/02/2022 Name. ID Group Homework I. Part1.mars Suppose you are an investor that you will purchase el contracts 32 GM February 2022) with the Open price of 13/03/2022. Each contract is for the delivery of MTO units. The 19000 SR ser contract with a house minimum maintenance requirement of 35. The call margin- calculated when the security margin become less than ESO SR. Complete the following Table in the daily settlement prices and then the final settlement price intadewi.com 1X is the latter of your number is better before ram: 256376630-240 teiset pertures 13/02/2002 se the days to 2002/2022 W Pombe laces to estables and new A Purchased Contracts Day of Futures Quantity Total Maintenance Curve Soldo Marc Fabry Prices sold Margin Gain/ ISAR Futures SARI ISARI ISAR ISAR 13/02/2002 11/02/2002 14/02/2002 15/02/2002 16/02/2002 17/02/2002 Buy with the open future price at 11/09/2073, there is not an open price we the price for 10/22 On 11/09/2023.wepose that you are a short ter of the quantity of Mindes from fade Calculate your net profit from the futures and sport market 17/09/2023 Spot Market Futures Net Date PROFIT PRO 13/02/2002 17/02/2002 Sold XCanti Day of Futures February Prices Quantity Total Maintenance Cumulative Sold of Purchased Margn Gain int LISARI SAR SAR Maria SAR 14/02/2022 15/02/2022 16/02/2022 17/02/2022 * Buy with the open futures price at 13/02/2022, if there is not an open price use the settlement price for 10/02/2022. On 13/02/2022, we suppose that you are a short seller of the same quantity of MT30 index from Tadawut Calculate your net profit from the futures and spot market at 17/02/2022 Spot Market Futures (settlement price) Net Date Selle price Buy PROFIT BUYSELL PROFIT Profit 13/02/2022 17/02/2022 B. Sold X Contracts Day of Futures Quantity Total Maintenance Cumulative sold of Margin Call February Prices Purchased Margin Gain/Loss investor ISAR) Futures (SAR) (SAR) (SAR) (SAR) 13/02/2022" 13/02/2022 14/02/2022 15/02/2022 16/02/2022 17/02/2022 Sell with the open futures price at 13/02/2022, if there is not an open price use the settlement price for 19/02/2022. On 13/02/2022. we suppose that you purchase the same quantity of MT30 index from Tadawul. Calculate your net profit from the futures and spot markets on 17/02/2022 Spot Market Net Futures SELL Date BUY SELL PROFIT BUY PROFIT Profit Price 13/02/2022 17/02/2022 Name. ID Group Homework I. Part1.mars Suppose you are an investor that you will purchase el contracts 32 GM February 2022) with the Open price of 13/03/2022. Each contract is for the delivery of MTO units. The 19000 SR ser contract with a house minimum maintenance requirement of 35. The call margin- calculated when the security margin become less than ESO SR. Complete the following Table in the daily settlement prices and then the final settlement price intadewi.com 1X is the latter of your number is better before ram: 256376630-240 teiset pertures 13/02/2002 se the days to 2002/2022 W Pombe laces to estables and new A Purchased Contracts Day of Futures Quantity Total Maintenance Curve Soldo Marc Fabry Prices sold Margin Gain/ ISAR Futures SARI ISARI ISAR ISAR 13/02/2002 11/02/2002 14/02/2002 15/02/2002 16/02/2002 17/02/2002 Buy with the open future price at 11/09/2073, there is not an open price we the price for 10/22 On 11/09/2023.wepose that you are a short ter of the quantity of Mindes from fade Calculate your net profit from the futures and sport market 17/09/2023 Spot Market Futures Net Date PROFIT PRO 13/02/2002 17/02/2002 Sold XCanti Day of Futures February Prices Quantity Total Maintenance Cumulative Sold of Purchased Margn Gain int LISARI SAR SAR Maria SAR