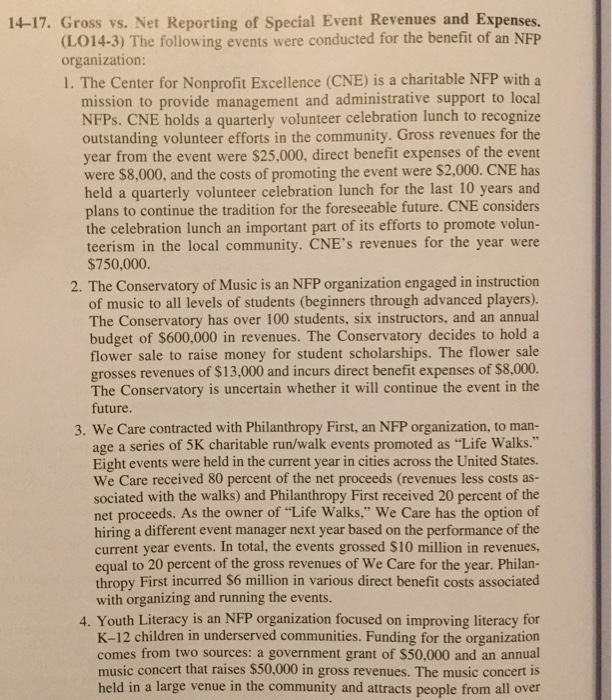

14-17. Gross vs. Net Reporting of Special Event Revenues and Expenses. (LO14-3) The following events were conducted for the benefit of an NFP organization l. The Center for Nonprofit Excellence (CNE) is a charitable NFP with a mission to provide management and administrative support to local NFPs. CNE holds a quarterly volunteer celebration lunch to recognize outstanding volunteer efforts in the community. Gross revenues for the year from the event were $25,000, direct benefit expenses of the event were $8,000, and the costs of promoting the event were $2,000. CNE has held a quarterly volunteer celebration lunch for the last 10 years and plans to continue the tradition for the foreseeable future. CNE considers the celebration lunch an important part of its efforts to promote volun- teerism in the local community. CNE's revenues for the year were $750,000 2. The Conservatory of Music is an NFP organization engaged in instruction of music to all levels of students (beginners through advanced players) The Conservatory has over 100 students, six instructors, and an annual budget of $600,000 in revenues. The Conservatory decides to hold a flower sale to raise money for student scholarships. The flower sale grosses revenues of $13,000 and incurs direct benefit expenses of $8,000. The Conservatory is uncertain whether it will continue the event in the future. 3. We Care contracted with Philanthropy First, an NFP organization, to man age a series of 5K charitable run/walk events promoted as "Life Walks Eight events were held in the current year in cities across the United States. We Care received 80 percent of the net proceeds (revenues less costs as sociated with the walks) and Philanthropy First received 20 percent of the net proceeds. As the owner of "Life Walks," We Care has the option of hiring a different event manager next year based on the performance of the current year events. In total, the events grossed $10 million in revenues, equal to 20 percent of the gross revenues of We Care for the year. Philan- thropy First incurred S6 million in various direct benefit costs associated with organizing and running the events. 4. Youth Literacy is an NFP organization focused on improving literacy for K-12 children in underserved communities. Funding for the organization comes from two sources: a government grant of $50,000 and an annual music concert that raises $50,000 in gross revenues. The music concert is held in a large venue in the community and attracts people from all over