Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TUTOR-MARKED ASSIGNMENT (TMA) This assignment is worth 18% of the final mark for FIN379 Personal Financial Planning. The cut-off date for this assignment is

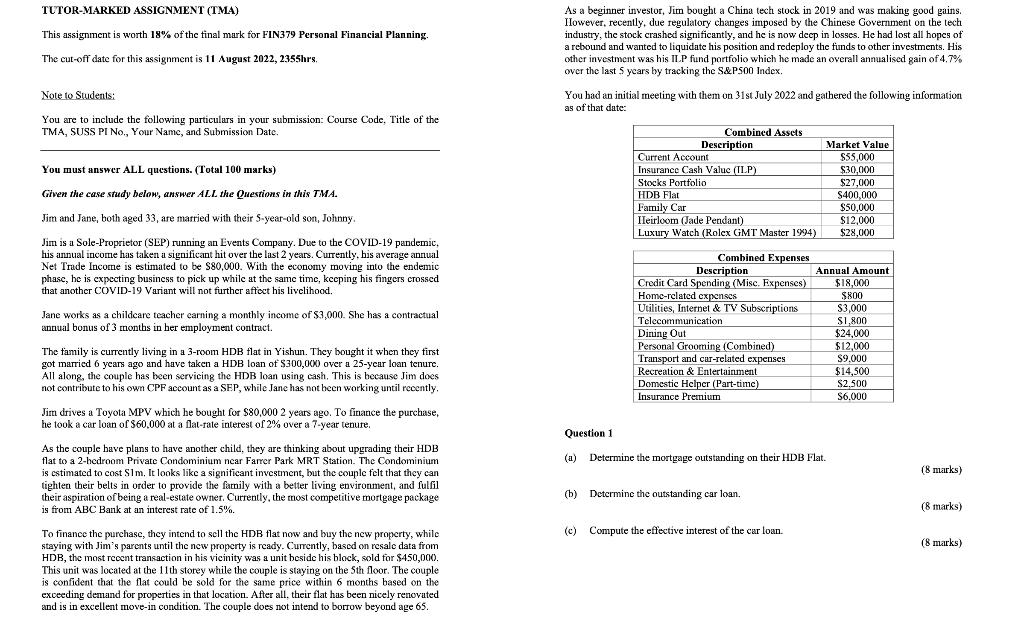

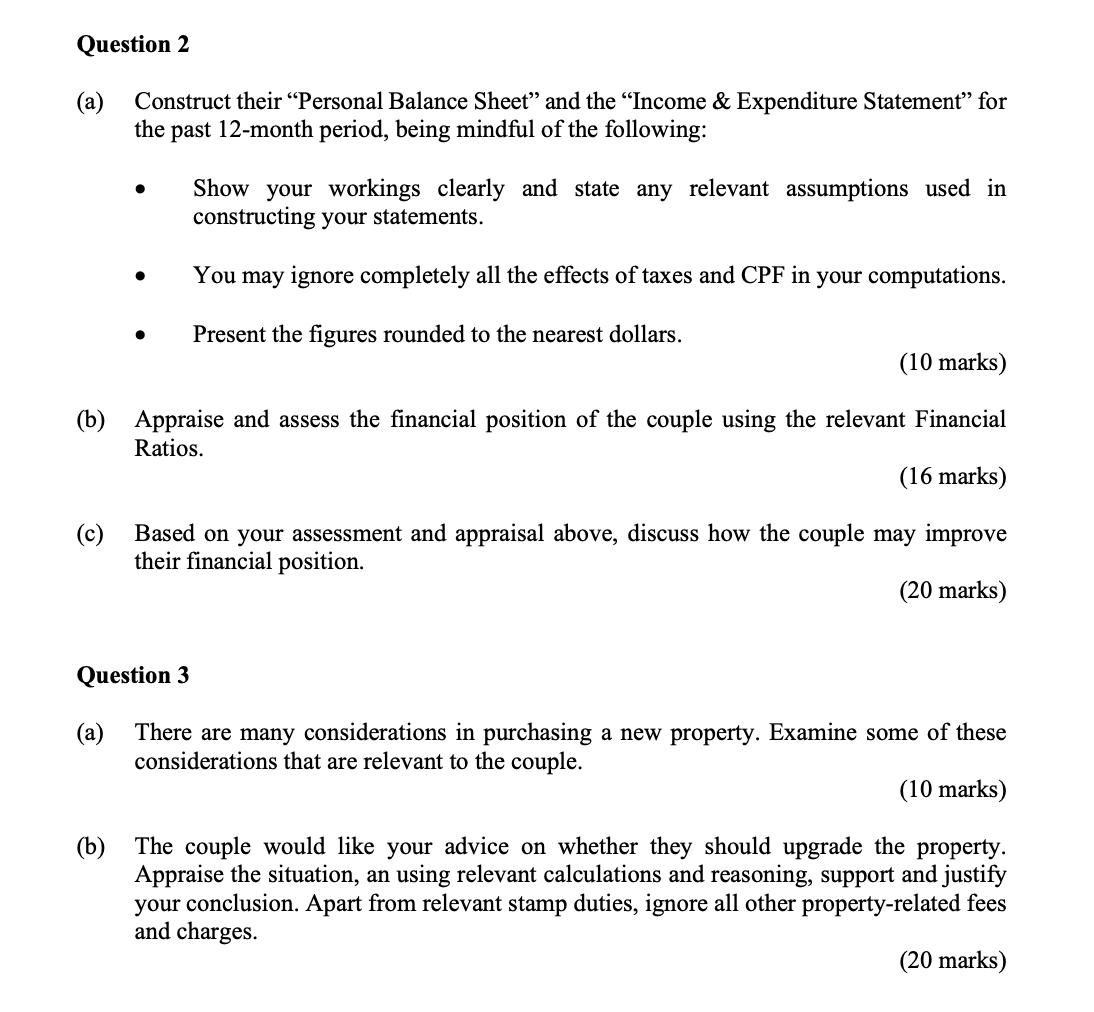

TUTOR-MARKED ASSIGNMENT (TMA) This assignment is worth 18% of the final mark for FIN379 Personal Financial Planning. The cut-off date for this assignment is 11 August 2022, 2355hrs. Note to Students: You are to include the following particulars in your submission: Course Code, Title of the TMA, SUSS PI No., Your Name, and Submission Date. You must answer ALL questions. (Total 100 marks) Given the case study below, answer ALL the Questions in this TMA. Jim and Jane, both aged 33, are married with their 5-year-old son, Johnny. Jim is a Sole-Proprietor (SEP) running an Events Company. Due to the COVID-19 pandemic, his annual income has taken a significant hit over the last 2 years. Currently, his average annual Net Trade Income is estimated to be $80,000. With the economy moving into the endemic phase, he is expecting business to pick up while at the same time, keeping his fingers crossed that another COVID-19 Variant will not further affect his livelihood. Jane works as a childcare teacher earning a monthly income of $3,000. She has a contractual annual bonus of 3 months in her employment contract. The family is currently living in a 3-room HDB flat in Yishun. They bought it when they first got married 6 years ago and have taken a HDB loan of $300,000 over a 25-year loan tenure. All along, the couple has been servicing the HDB loan using cash. This is because Jim does not contribute to his own CPF account as a SEP, while Jane has not been working until recently. Jim drives a Toyota MPV which he bought for $80,000 2 years ago. To finance the purchase, he took a car loan of $60,000 at a flat-rate interest of 2% over a 7-year tenure. As the couple have plans to have another child, they are thinking about upgrading their HDB flat to a 2-hedroom Private Condominium near Farrer Park MRT Station. The Condominium is estimated to cost S1m. It looks like a significant investment, but the couple felt that they can tighten their belts in order to provide the family with a better living environment, and fulfil their aspiration of being a real-estate owner. Currently, the most competitive mortgage package is from ABC Bank at an interest rate of 1.5%. To finance the purchase, they intend to sell the HDB flat now and buy the new property, while staying with Jim's parents until the new property is ready. Currently, based on resale data from HDB, the most recent transaction in his vicinity was a unit beside his block, sold for $450,000. This unit was located at the 11th storey while the couple is staying on the 5th floor. The couple is confident that the flat could be sold for the same price within 6 months based on the exceeding demand for properties in that location. After all, their flat has been nicely renovated and is in excellent move-in condition. The couple does not intend to borrow beyond age 65. As a beginner investor, Jim bought a China tech stock in 2019 and was making good gains. However, recently, due regulatory changes imposed by the Chinese Government on the tech industry, the stock crashed significantly, and he is now deep in losses. He had lost all hopes of a rebound and wanted to liquidate his position and redeploy the funds to other investments. His other investment was his ILP fund portfolio which he made an overall annualised gain of 4.7% over the last 5 years by tracking the S&P500 Index. You had an initial meeting with them on 31st July 2022 and gathered the following information as of that date: Combined Assets Description Current Account Insurance Cash Valuc (ILP) Stocks Portfolio HDB Flat Family Car Heirloom (Jade Pendant) Luxury Watch (Rolex GMT Master 1994) Combined Expenses Description Credit Card Spending (Misc. Expenses) Home-related expenses Utilities, Internet & TV Subscriptions Telecommunication Dining Out Personal Grooming (Combined) Transport and car-related expenses Recreation & Entertainment Domestic Helper (Part-time) Insurance Premium (b) Determine the outstanding car loan. Market Value $55,000 $30,000 $27,000 $400,000 $50,000 Question 1 (a) Determine the mortgage outstanding on their HDB Flat. (c) Compute the effective interest of the car loan. $12,000 $28,000 Annual Amount $18,000 $800 $3,000 $1,800 $24,000 $12,000 $9,000 $14,500 $2,500 $6,000 (8 marks) (8 marks) (8 marks) Question 2 (a) Construct their "Personal Balance Sheet" and the "Income & Expenditure Statement" for the past 12-month period, being mindful of the following: (c) Show your workings clearly and state any relevant assumptions used in constructing your statements. You may ignore completely all the effects of taxes and CPF in your computations. Present the figures rounded to the nearest dollars. (10 marks) (b) Appraise and assess the financial position of the couple using the relevant Financial Ratios. (16 marks) Based on your assessment and appraisal above, discuss how the couple may improve their financial position. (20 marks) Question 3 (a) There are many considerations in purchasing a new property. Examine some of these considerations that are relevant to the couple. (10 marks) (b) The couple would like your advice on whether they should upgrade the property. Appraise the situation, an using relevant calculations and reasoning, support and justify your conclusion. Apart from relevant stamp duties, ignore all other property-related fees and charges. (20 marks)

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the mortgage outstanding on their HDB flat we need to calculate the remaining balance on their HDB loan Assuming they have been paying the loan regularly without any prepayments we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started