Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14-24 Computation of Apportionment Percentages. Q Corporation conducts a multistate business that operates in States A and B. For the current taxable year, Q

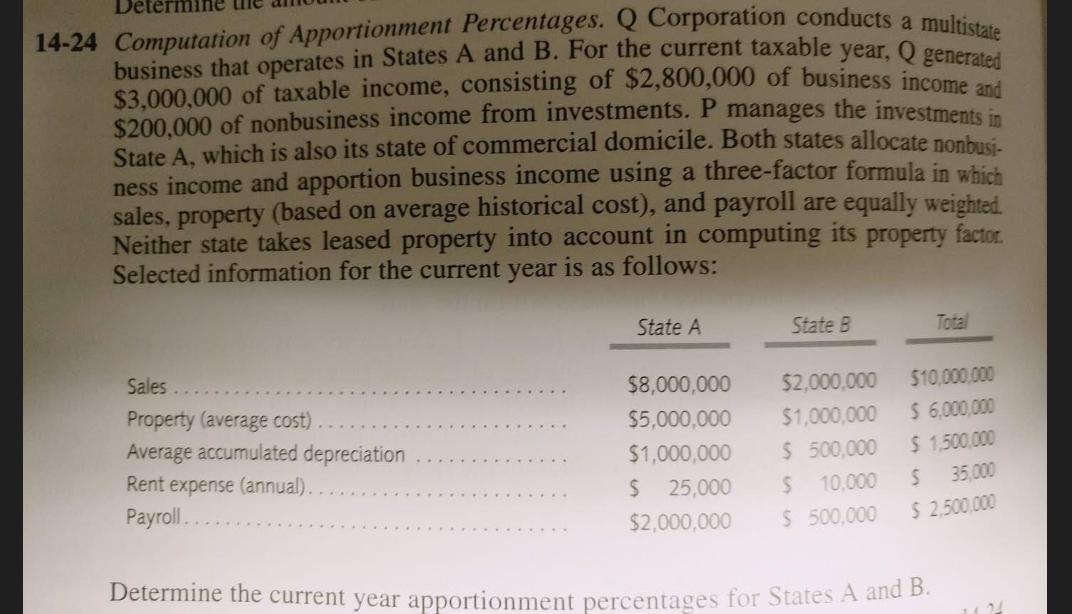

14-24 Computation of Apportionment Percentages. Q Corporation conducts a multistate business that operates in States A and B. For the current taxable year, Q generated $3,000,000 of taxable income, consisting of $2,800,000 of business income and $200,000 of nonbusiness income from investments. P manages the investments in State A, which is also its state of commercial domicile. Both states allocate nonbusi- ness income and apportion business income using a three-factor formula in which sales, property (based on average historical cost), and payroll are equally weighted. Neither state takes leased property into account in computing its property factor. Selected information for the current year is as follows: Sales Property (average cost) Average accumulated depreciation Rent expense (annual). Payroll.. State A State B Total $8,000,000 $2,000,000 $10,000,000 $5,000,000 $1,000,000 $6,000,000 $1,000,000 $ 500,000 $ 1,500,000 $ 25,000 $ 10,000 $ 35,000 $2,000,000 $ 500,000 $2,500,000 Determine the current year apportionment percentages for States A and B.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the current year apportionment percentages for States A and B we need to calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started