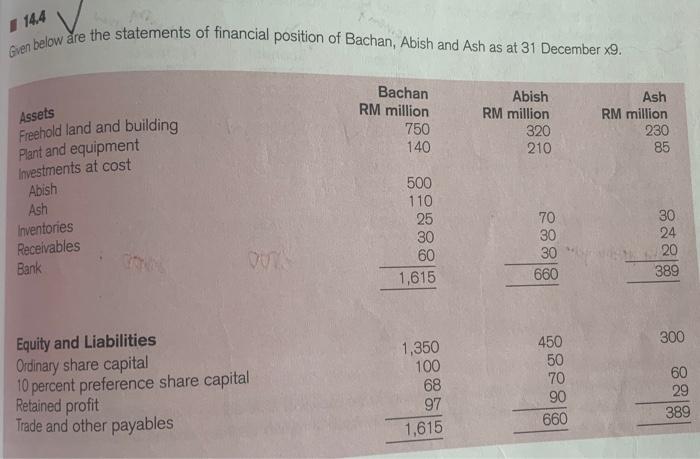

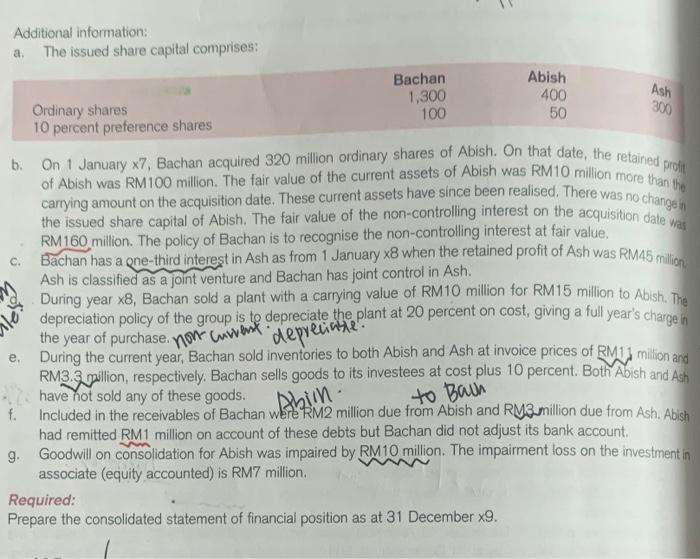

14.4 Gven below are the statements of financial position of Bachan, Abish and Ash as at 31 December 9. Assets Bachan RM million 750 140 Abish RM million 320 210 Ash RM million 230 85 Freehold land and building Plant and equipment Investments at cost Abish Ash Inventories Receivables Bank 500 110 25 30 60 1,615 70 30 30 660 30 24 20 389 w 300 Equity and Liabilities Ordinary share capital 10 percent preference share capital Retained profit Trade and other payables 1,350 100 68 97 1,615 450 50 70 90 60 29 389 660 Ash 300 50 changen C. Additional information: a. The issued share capital comprises: Bachan Abish 1,300 400 Ordinary shares 100 10 percent preference shares b. On 1 January x7, Bachan acquired 320 million ordinary shares of Abish. On that date, the retained profit of Abish was RM100 million. The fair value of the current assets of Abish was RM10 million more than the carrying amount on the acquisition date. These current assets have since been realised. There was no the issued share capital of Abish. The fair value of the non-controlling interest on the acquisition date was RM160 million. The policy of Bachan is to recognise the non-controlling interest at fair value. Bachan has a gre-third interest in Ash as from 1 January x8 when the retained profit of Ash was RM25 million Ash is classified as a joint venture and Bachan has joint control in Ash. During year x8, Bachan sold a plant with a carrying value of RM 10 million for RM 15 million to Abish. The depreciation policy of the group is te depreciate the plant at 20 percent on cost, giving a full year's charge in the year of purchase. non cuweist. During the current year, Bachan sold inventories to both Abish and Ash at invoice prices of RM1d million and RM3.3 million, respectively . Bachan sells goods to its investees at cost plus 10 percent. Bothy Aoish and Ach have not sold any of these goods. f. Included in the receivables of Bachan were RM2 million due from Abish and RM3 million due from Ash. Abish had remitted RM1 million on account of these debts but Bachan did not adjust its bank account g. Goodwill on consolidation for Abish was impaired by RM10 million. The impairment loss on the investment in associate (equity accounted) is RM7 million Required: Prepare the consolidated statement of financial position as at 31 December x9. le depreciate e. Abin. to Bain