Answered step by step

Verified Expert Solution

Question

1 Approved Answer

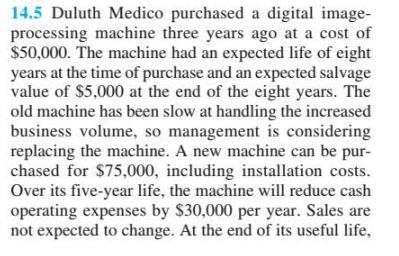

14.5 Duluth Medico purchased a digital imageprocessing machine three years ago at a cost of $50,000. The machine had an expected life of eight years

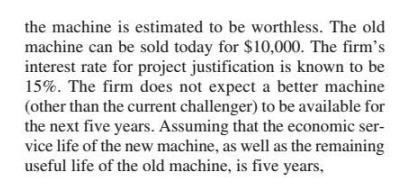

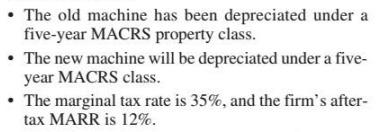

14.5 Duluth Medico purchased a digital imageprocessing machine three years ago at a cost of $50,000. The machine had an expected life of eight years at the time of purchase and an expected salvage value of $5,000 at the end of the eight years. The old machine has been slow at handling the increased business volume, so management is considering replacing the machine. A new machine can be purchased for $75,000, including installation costs. Over its five-year life, the machine will reduce cash operating expenses by $30,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The old machine can be sold today for $10,000. The firm's interest rate for project justification is known to be 15%. The firm does not expect a better machine (other than the current challenger) to be available for the next five years. Assuming that the economic service life of the new machine, as well as the remaining useful life of the old machine, is five years, - The old machine has been depreciated under a five-year MACRS property class. - The new machine will be depreciated under a fiveyear MACRS class. - The marginal tax rate is 35%, and the firm's aftertax MARR is 12%. (a) Determine the cash flows associated with each option (keeping the defender versus purchasing the challenger). (b) Should the company replace the defender now

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started