Answered step by step

Verified Expert Solution

Question

1 Approved Answer

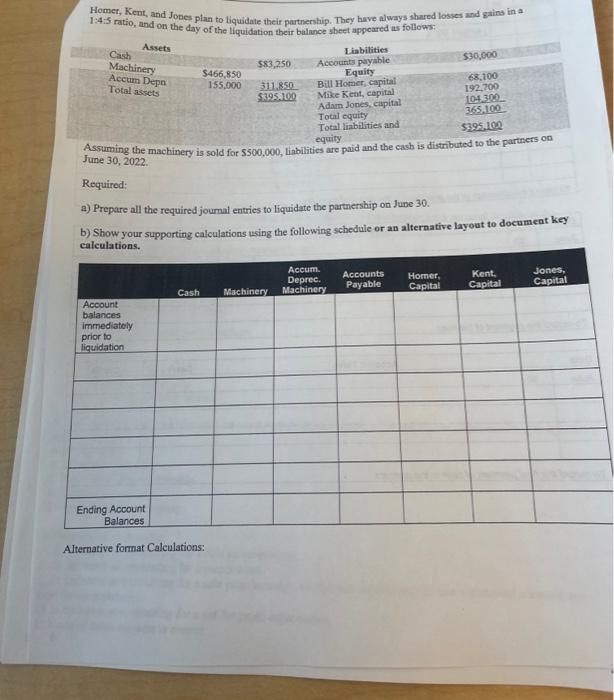

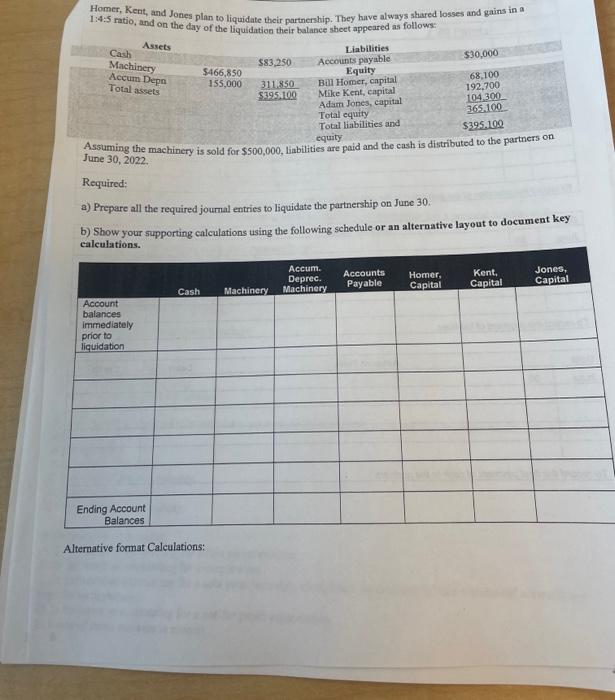

1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Homer, Kent, and Jones plan to liquidate their partnership. They

1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Homer, Kent, and Jones plan to liquidate their partnership. They have always shared losses and gains in a Cash Machinery Accum Depn Total assets Assets Account balances immediately prior to liquidation $466,850 155,000 $395.100 equity Assuming the machinery is sold for $500,000, liabilities are paid and the cash is distributed to the partners on June 30, 2022. Ending Account Balances Required: a) Prepare all the required journal entries to liquidate the partnership on June 30. b) Show your supporting calculations using the following schedule or an alternative layout to document key calculations. Cash $83,250 311,850 $395.100 Liabilities Accounts payable Equity Bill Homer, capital Mike Kent, capital Adam Jones, capital Total equity Total liabilities and Alternative format Calculations: Accum. Deprec. Machinery Machinery $30,000 68,100 192,700 104,300 365,100 Accounts Payable Homer, Capital Kent, Capital Jones, Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started