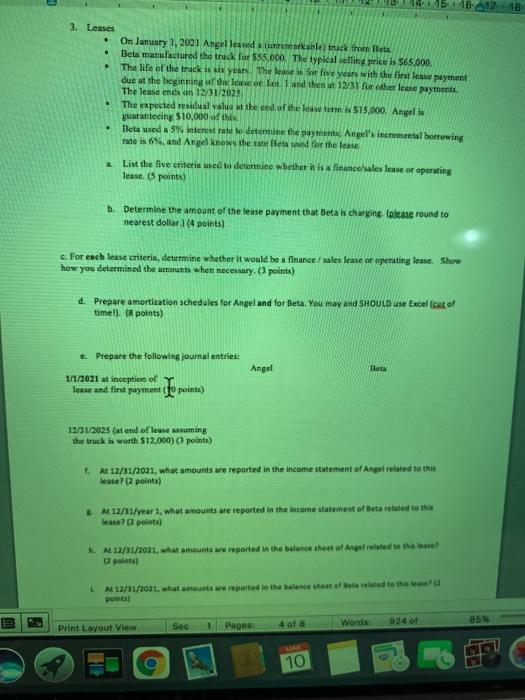

14521918 3. Leases . . . On January 1, 2001 Angel leased fra le truck throm leta Beta manufactured the thick for $55,000. The typical selling price is $65.000 The life of the truck six years. The lease is for five years with the first lease payment due at the beginning of the lemne e la 1 and the w12/31 fue other lease payments The lease ends on 12/31/2025 The expected residual value at the eed of the lease term S15,000. Angeli guaranteeing $10,000 of this Beta wed a 5% interest rate to determine the payments Angel's incremental borrowing rate is 6%, and Ange knows the rate Read the lease List the five criteria used to determine whether it is finance sales Tense or operating lease (5 points) b. Determine the amount of the lease payment that Beta is changing. (alcase round to nearest dollar (4 points) c. For each lease criteria, determine whether it would be a finance / sales lease be operating lease. Show how you determined the amounts when necessary.points) d. Prepare amortization schedules for Angel and for Beta. You may and SHOULD use Excel ( of timel). ( points) e. Prepare the following journal entries: Angel Beta 1/1/2021 at inception of leave and first payment to points) 12/31/2025 (at end of lease assuming the truck is worth 512.000) (points) 1. At 12/31/2021, what amounts are reported in the income statement of Angel related to this lease? (2 points) E M 12/31/year 1. what amounts are reported in the income statement of Beta tested to the lease points) M12/12/2021 what amounts we reported in the balance sheet of Angel related these? points) LA 12/11/2021, what amounts are reported in the balance sheet treated to this points! Sec 85% 1 Print Layout View Words 024 of 4 of a Pages: 10 14521918 3. Leases . . . On January 1, 2001 Angel leased fra le truck throm leta Beta manufactured the thick for $55,000. The typical selling price is $65.000 The life of the truck six years. The lease is for five years with the first lease payment due at the beginning of the lemne e la 1 and the w12/31 fue other lease payments The lease ends on 12/31/2025 The expected residual value at the eed of the lease term S15,000. Angeli guaranteeing $10,000 of this Beta wed a 5% interest rate to determine the payments Angel's incremental borrowing rate is 6%, and Ange knows the rate Read the lease List the five criteria used to determine whether it is finance sales Tense or operating lease (5 points) b. Determine the amount of the lease payment that Beta is changing. (alcase round to nearest dollar (4 points) c. For each lease criteria, determine whether it would be a finance / sales lease be operating lease. Show how you determined the amounts when necessary.points) d. Prepare amortization schedules for Angel and for Beta. You may and SHOULD use Excel ( of timel). ( points) e. Prepare the following journal entries: Angel Beta 1/1/2021 at inception of leave and first payment to points) 12/31/2025 (at end of lease assuming the truck is worth 512.000) (points) 1. At 12/31/2021, what amounts are reported in the income statement of Angel related to this lease? (2 points) E M 12/31/year 1. what amounts are reported in the income statement of Beta tested to the lease points) M12/12/2021 what amounts we reported in the balance sheet of Angel related these? points) LA 12/11/2021, what amounts are reported in the balance sheet treated to this points! Sec 85% 1 Print Layout View Words 024 of 4 of a Pages: 10