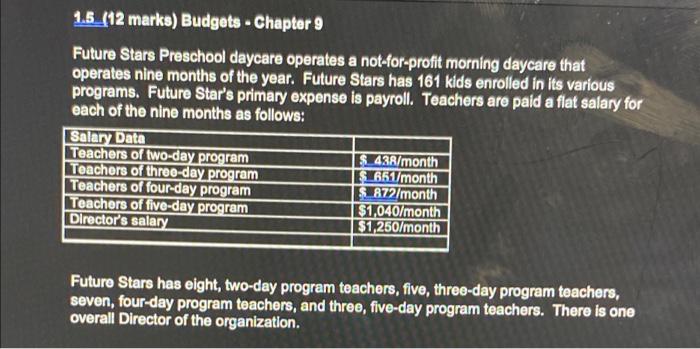

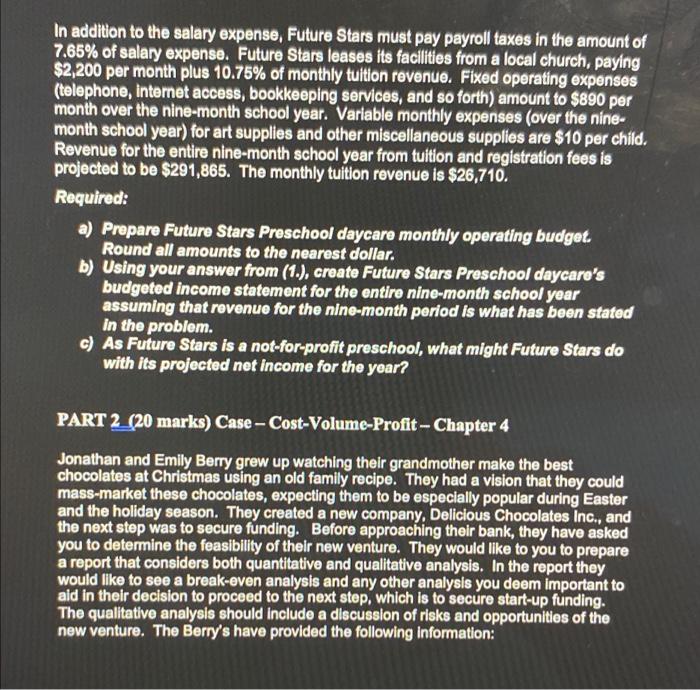

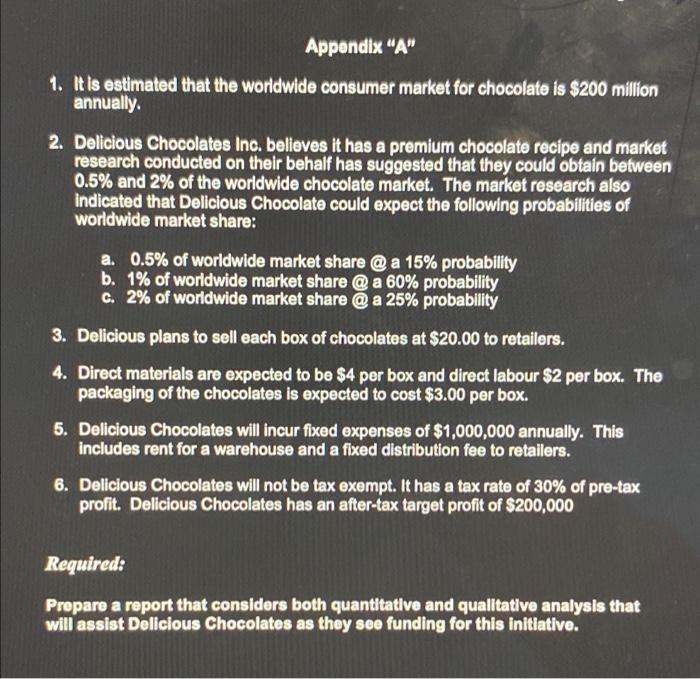

1.5. (12 marks) Budgets - Chapter 9 Future Stars Preschool daycare operates a not-for-profit morning daycare that operates nine months of the year. Future Stars has 161 kids enrolled in its various programs. Future Star's primary expense is payroll. Teachers are paid a flat salary for each of the nine months as follows: Salary Data Teachers of two-day program $ 438/month Teachers of three-day program $ 661/month Teachers of four-day program $ 872/month Teachers of five-day program $1,040/month Director's salary $1,250/month Future Stars has eight, two-day program teachers, five, three-day program teachers, seven, four-day program teachers, and three, five-day program teachers. There is one overall Director of the organization. In addition to the salary expense, Future Stars must pay payroll taxes in the amount of 7.65% of salary expense. Future Stars leases its facilities from a local church, paying $2,200 per month plus 10.75% of monthly tuition revenue. Fixed operating expenses (telephone, internet access, bookkeeping services, and so forth) amount to $890 per month over the nine-month school year. Variable monthly expenses (over the nine- month school year) for art supplies and other miscellaneous supplies are $10 per child. Revenue for the entire nine-month school year from tuition and registration fees is projected to be $291,865. The monthly tuition revenue is $26,710. Required: a) Prepare Future Stars Preschool daycare monthly operating budget. Round all amounts to the nearest dollar. b) Using your answer from (1.), create Future Stars Preschool daycare's budgeted income statement for the entire nine-month school year assuming that revenue for the nine-month period is what has been stated in the problem. c) As Future Stars is a not-for-profit preschool, what might Future Stars do with its projected net income for the year? PART 2 (20 marks) Case - Cost-Volume-Profit - Chapter 4 Jonathan and Emily Berry grew up watching their grandmother make the best chocolates at Christmas using an old family recipe. They had a vision that they could mass-market these chocolates, expecting them to be especially popular during Easter and the holiday season. They created a new company, Delicious Chocolates Inc., and the next step was to secure funding. Before approaching their bank, they have asked you to determine the feasibility of their new venture. They would like to you to prepare a report that considers both quantitative and qualitative analysis. In the report they would like to see a break-even analysis and any other analysis you deem Important to aid in their decision to proceed to the next step, which is to secure start-up funding. The qualitative analysis should include a discussion of risks and opportunities of the new venture. The Berry's have provided the following Information: Appendix "A" 1. It is estimated that the worldwide consumer market for chocolate is $200 million annually. 2. Delicious Chocolates Inc. believes it has a premium chocolate recipe and market research conducted on their behalf has suggested that they could obtain between 0.5% and 2% of the worldwide chocolate market. The market research also indicated that Delicious Chocolate could expect the following probabilities of worldwide market share: a. 0.5% of worldwide market share @ a 15% probability b. 1% of worldwide market share @ a 60% probability c. 2% of worldwide market share @ a 25% probability 3. Delicious plans to sell each box of chocolates at $20.00 to retailers. 4. Direct materials are expected to be $4 per box and direct labour $2 per box. The packaging of the chocolates is expected to cost $3.00 per box. 5. Delicious Chocolates will incur fixed expenses of $1,000,000 annually. This includes rent for a warehouse and a fixed distribution fee to retailers. 6. Delicious Chocolates will not be tax exempt. It has a tax rate of 30% of pre-tax profit. Delicious Chocolates has an after-tax target profit of $200,000 a Required: Prepare a report that considers both quantitative and qualitative analysis that will assist Delicious Chocolates as they see funding for this initiative. Question 1.3 - Golf Course (rounded calculations to the nearest dollar) Year o Years Year 2 Years Year Years I End of Exam