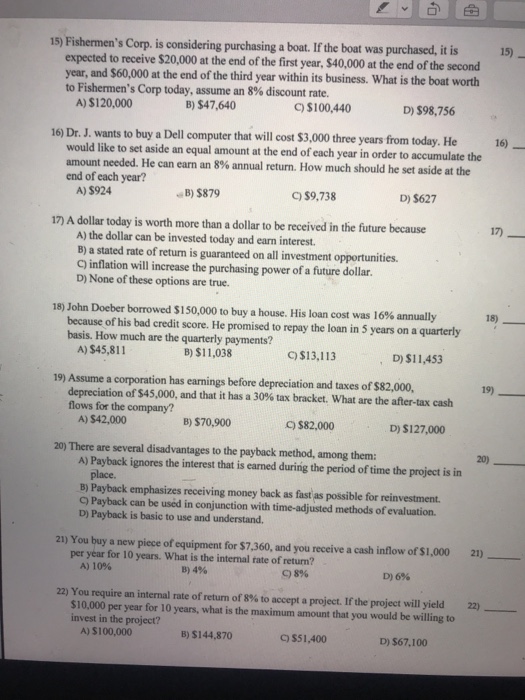

15) 15) Fishermen's Corp. is considering purchasing a boat. If the boat was purchased, it is expected to receive $20,000 at the end of the first year, $40,000 at the end of the second year, and $60,000 at the end of the third year within its business. What is the boat worth to Fishermen's Corp today, assume an 8% discount rate. A) $120,000 B) $47,640 C) $100,440 D) $98,756 16) 16) Dr. J. wants to buy a Dell computer that will cost $3,000 three years from today. He would like to set aside an equal amount at the end of each year in order to accumulate the amount needed. He can earn an 8% annual return. How much should he set aside at the end of each year? A) $924 B) $879 C) $9,738 D) $627 17) 17) A dollar today is worth more than a dollar to be received in the future because A) the dollar can be invested today and earn interest. B) a stated rate of return is guaranteed on all investment opportunities. C) inflation will increase the purchasing power of a future dollar. D) None of these options are true. 18) 18) John Doeber borrowed $150,000 to buy a house. His loan cost was 16% annually because of his bad credit score. He promised to repay the loan in 5 years on a quarterly basis. How much are the quarterly payments? A) $45,811 B) $11,038 c)$13,113 D) $11,453 19) 19) Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of$45,000, and that it has a 30% tax bracket, what are the after-tax cash flows for the company? A) $42,000 B) $70,900 C) $82,000 D) $127,000 20) There are several disadvantages to the payback method, among them: 20) A) Payback ignores the interest that is earned during the period of time the project is in place. B) Payback emphasizes receiving money back as fast as possible for reinvestment. C) Payback can be used in conjunction with time-adjusted methods of evaluation. D) Payback is basic to use and understand 21) You buy a new piece of equipment for $7,360, and you receive a cash inflow of $1,000 21) per year for 10 years. What is the intermal rate of return? B)4% A)10% C)8% D)6% 22) You require an internal rate of retum of 8% to accept a project. If the project will yield 22) $10.000 per year for 10 years, what is the maximum amount that you would be willing to invest in the project? A) $100,000 B) $144,870 C) $51,400 D) $67,100