Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. 16. 17. 18. In 2005 , Gerard buys a property that contains land and a building for $700,000. He adds $60,000 of capital improvements

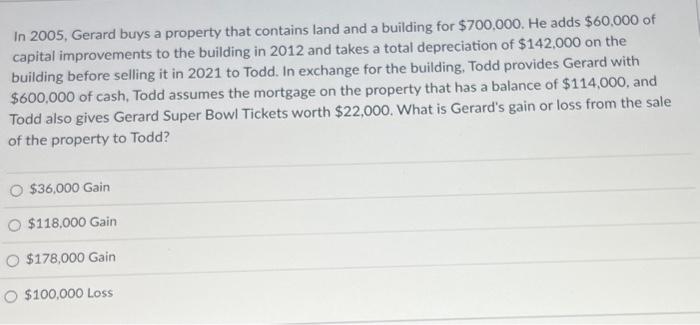

15.

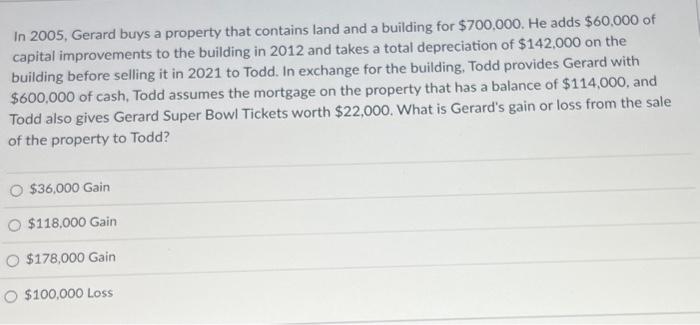

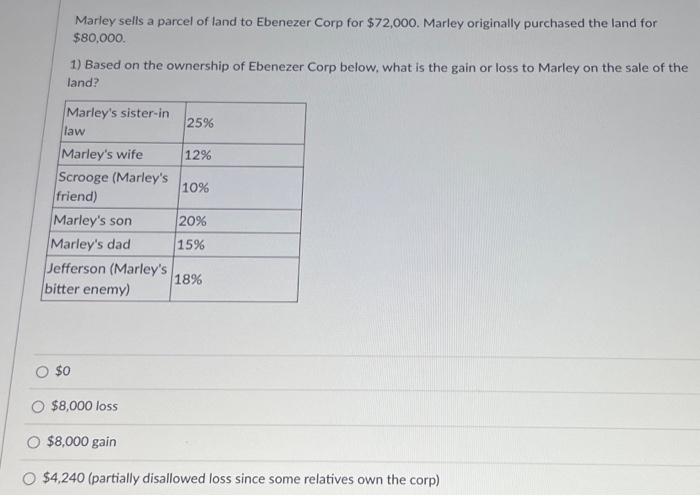

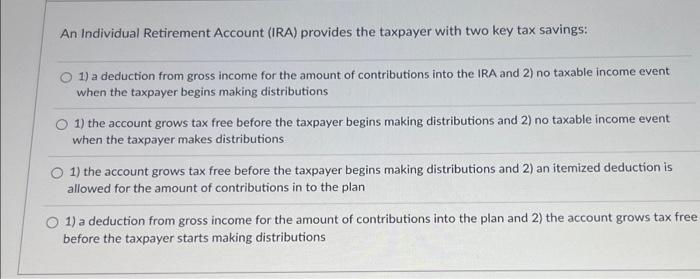

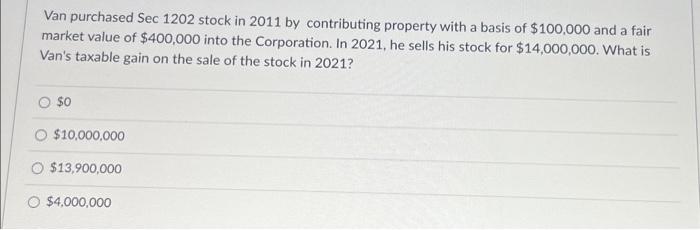

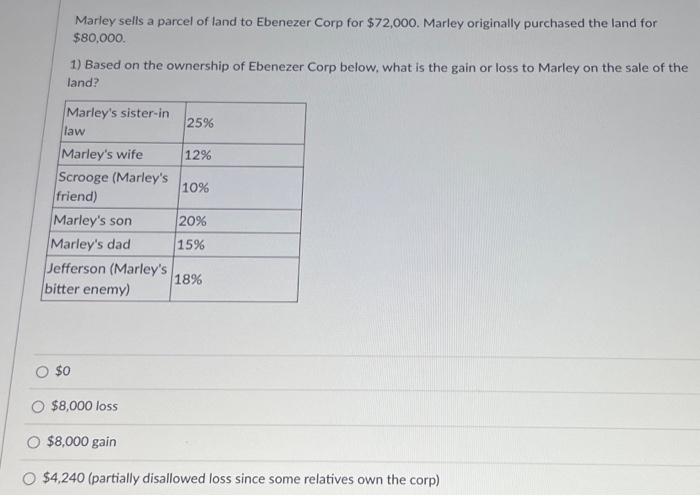

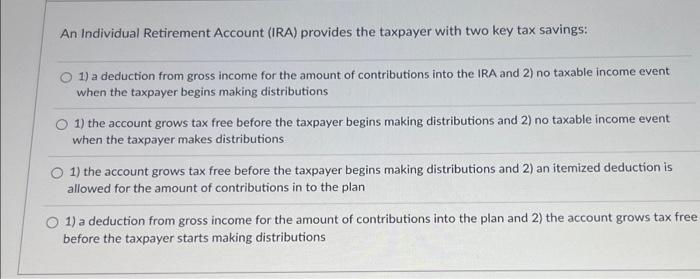

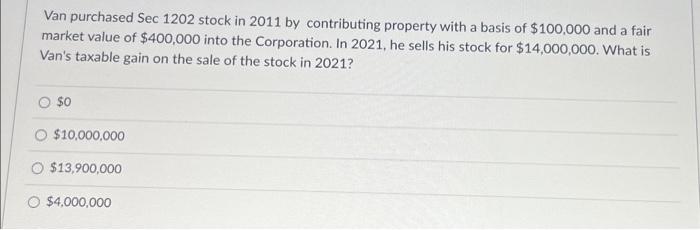

In 2005 , Gerard buys a property that contains land and a building for $700,000. He adds $60,000 of capital improvements to the building in 2012 and takes a total depreciation of $142,000 on the building before selling it in 2021 to Todd. In exchange for the building, Todd provides Gerard with $600,000 of cash, Todd assumes the mortgage on the property that has a balance of $114,000, and Todd also gives Gerard Super Bowl Tickets worth $22,000. What is Gerard's gain or loss from the sale of the property to Todd? $36,000 Gain $118,000 Gain $178,000 Gain $100,000 Loss Marley sells a parcel of land to Ebenezer Corp for $72,000. Marley originally purchased the land for $80,000. 1) Based on the ownership of Ebenezer Corp below, what is the gain or loss to Marley on the sale of the land? $0 $8,000 loss $8,000gain $4,240 (partially disallowed loss since some relatives own the corp) An Individual Retirement Account (IRA) provides the taxpayer with two key tax savings: 1) a deduction from gross income for the amount of contributions into the IRA and 2) no taxable income event when the taxpayer begins making distributions 1) the account grows tax free before the taxpayer begins making distributions and 2) no taxable income event when the taxpayer makes distributions 1) the account grows tax free before the taxpayer begins making distributions and 2) an itemized deduction is allowed for the amount of contributions in to the plan 1) a deduction from gross income for the amount of contributions into the plan and 2) the account grows tax fre before the taxpayer starts making distributions Van purchased Sec 1202 stock in 2011 by contributing property with a basis of $100,000 and a fair market value of $400,000 into the Corporation. In 2021 , he sells his stock for $14,000,000. What is Van's taxable gain on the sale of the stock in 2021? $0 $10,000,000 $13,900,000 $4,000,000

16.

17.

18.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started