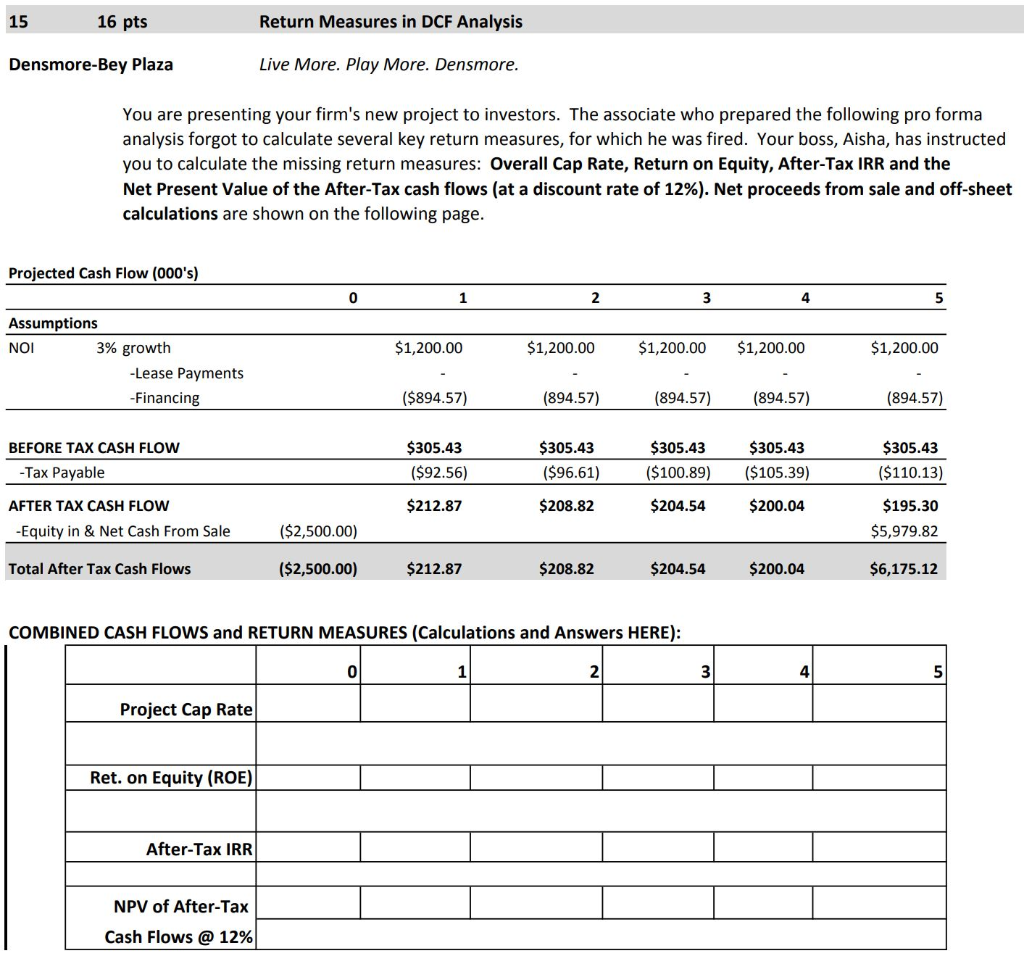

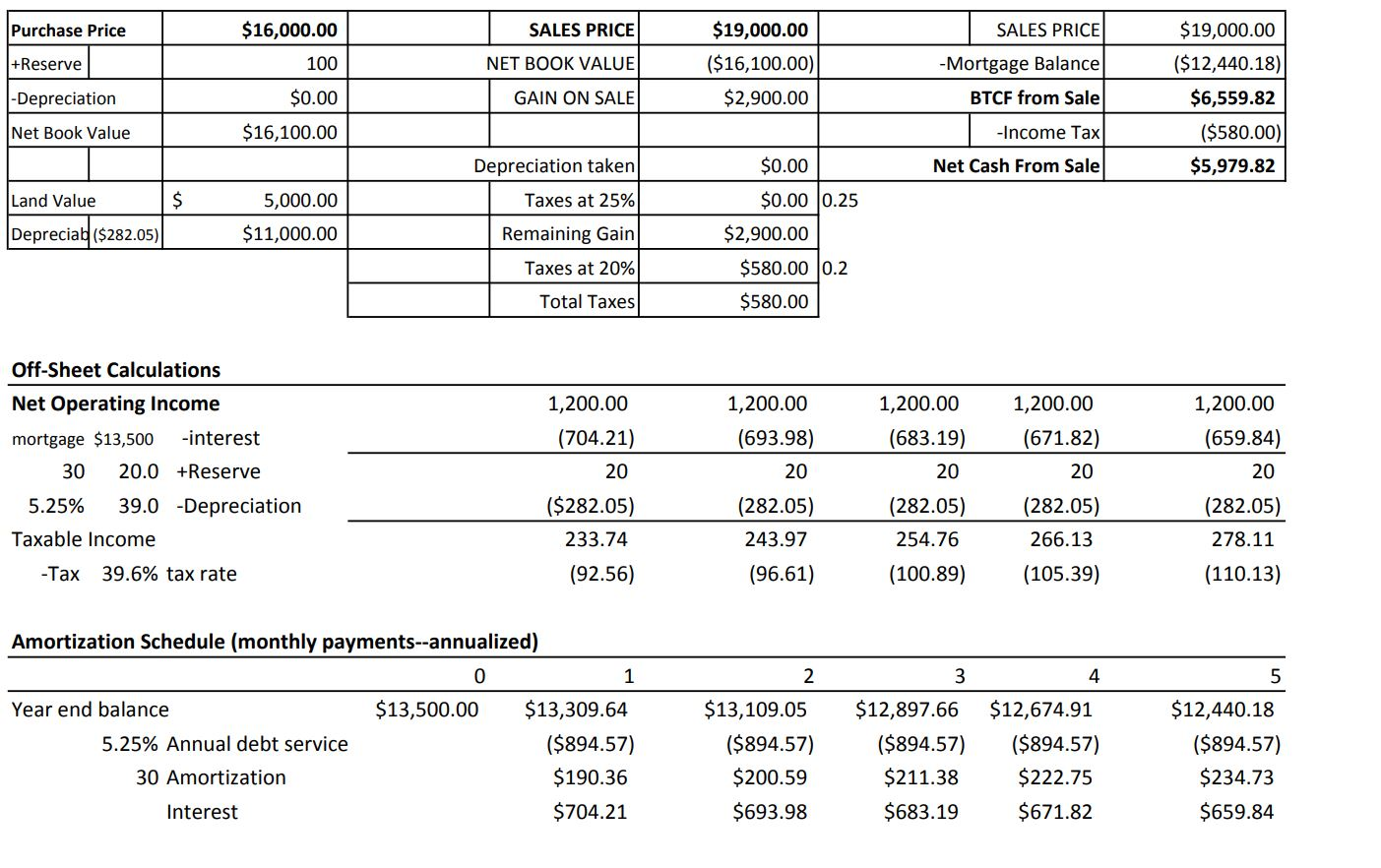

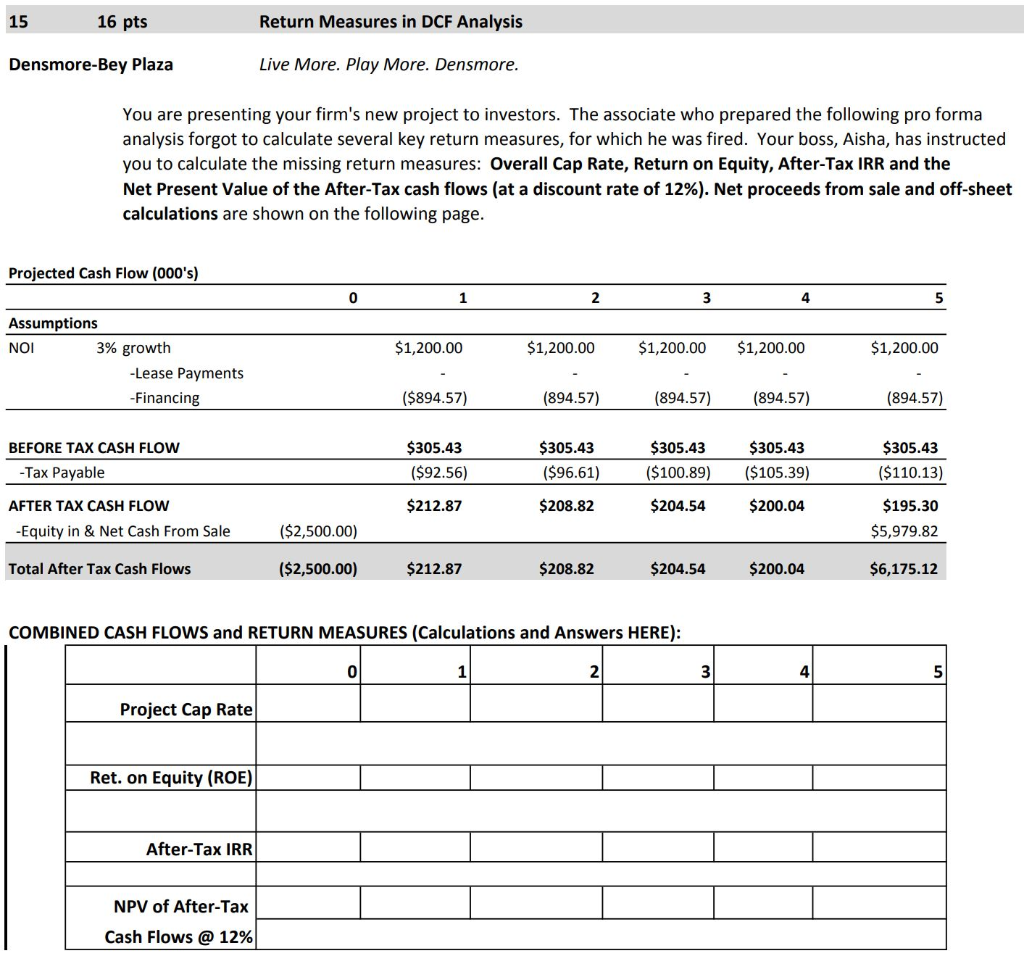

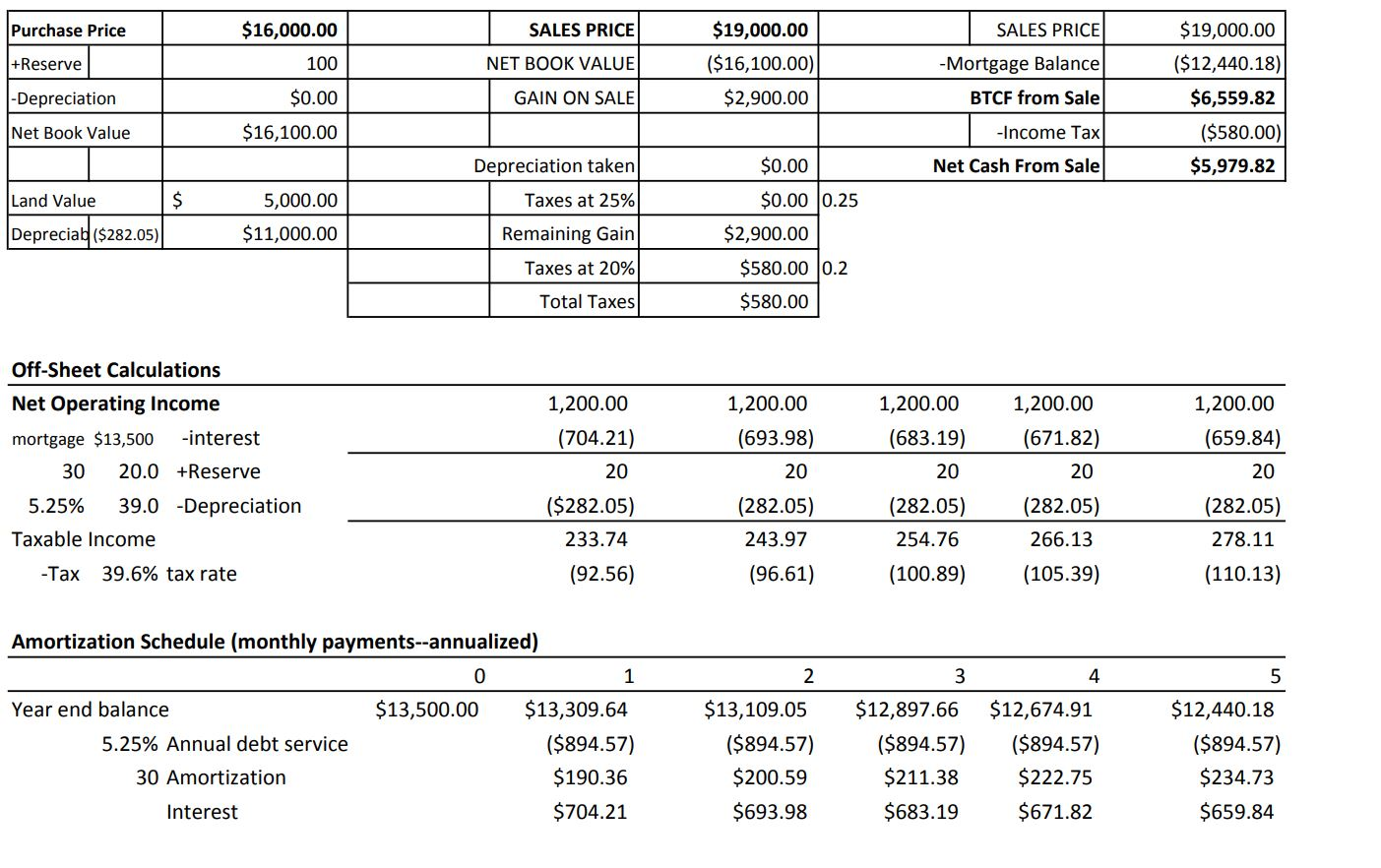

15 16 pts Return Measures in DCF Analysis Densmore-Bey Plaza Live More. Play More. Densmore. You are presenting your firm's new project to investors. The associate who prepared the following pro forma analysis forgot to calculate several key return measures, for which he was fired. Your boss, Aisha, has instructed you to calculate the missing return measures: Overall Cap Rate, Return on Equity, After-Tax IRR and the Net Present Value of the After-Tax cash flows (at a discount rate of 12%). Net proceeds from sale and off-sheet calculations are shown on the following page. Projected Cash Flow (000's) 0 1 2 3 4 5 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Assumptions NOI 3% growth -Lease Payments -Financing ($894.57) (894.57) (894.57) (894.57) (894.57) BEFORE TAX CASH FLOW -Tax Payable $305.43 ($92.56) $305.43 ($96.61) $305.43 ($100.89) $305.43 ($105.39) $305.43 ($110.13) $212.87 $208.82 $204.54 $200.04 AFTER TAX CASH FLOW -Equity in & Net Cash From Sale $195.30 $5,979.82 ($2,500.00) Total After Tax Cash Flows ($2,500.00) $212.87 $208.82 $204.54 $200.04 $6,175.12 COMBINED CASH FLOWS and RETURN MEASURES (Calculations and Answers HERE): 0 1 2 3 4 5 Project Cap Rate Ret. on Equity (ROE) After-Tax IRR NPV of After-Tax Cash Flows @ 12% Purchase Price SALES PRICE SALES PRICE $16,000.00 100 +Reserve NET BOOK VALUE $19,000.00 ($16,100.00) $2,900.00 - Mortgage Balance -Depreciation $0.00 GAIN ON SALE BTCF from Sale $19,000.00 ($12,440.18) $6,559.82 ($580.00) $5,979.82 Net Book Value $16,100.00 -Income Tax Depreciation taken $0.00 Net Cash From Sale Land Value $ Taxes at 25% 5,000.00 $11,000.00 $0.00 0.25 $2,900.00 Depreciab ($282.05) Remaining Gain Taxes at 20% $580.00 0.2 Total Taxes $580.00 1,200.00 1,200.00 (704.21) Off-Sheet Calculations Net Operating Income mortgage $13,500 -interest 30 20.0 +Reserve 5.25% 39.0 -Depreciation Taxable Income 1,200.00 (659.84) 20 20 1,200.00 (693.98) 20 (282.05) 243.97 (96.61) 1,200.00 (671.82) 20 (282.05) 266.13 (105.39) (683.19) 20 (282.05) 254.76 (100.89) ($282.05) 233.74 (92.56) (282.05) 278.11 -Tax 39.6% tax rate (110.13) Amortization Schedule (monthly payments--annualized) 0 1 2 3 4 5 Year end balance $13,500.00 5.25% Annual debt service 30 Amortization $13,309.64 ($894.57) $190.36 $704.21 $13,109.05 ($894.57) $200.59 $693.98 $12,897.66 ($894.57) $211.38 $683.19 $12,674.91 ($894.57) $222.75 $671.82 $12,440.18 ($894.57) $234.73 $659.84 Interest 15 16 pts Return Measures in DCF Analysis Densmore-Bey Plaza Live More. Play More. Densmore. You are presenting your firm's new project to investors. The associate who prepared the following pro forma analysis forgot to calculate several key return measures, for which he was fired. Your boss, Aisha, has instructed you to calculate the missing return measures: Overall Cap Rate, Return on Equity, After-Tax IRR and the Net Present Value of the After-Tax cash flows (at a discount rate of 12%). Net proceeds from sale and off-sheet calculations are shown on the following page. Projected Cash Flow (000's) 0 1 2 3 4 5 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Assumptions NOI 3% growth -Lease Payments -Financing ($894.57) (894.57) (894.57) (894.57) (894.57) BEFORE TAX CASH FLOW -Tax Payable $305.43 ($92.56) $305.43 ($96.61) $305.43 ($100.89) $305.43 ($105.39) $305.43 ($110.13) $212.87 $208.82 $204.54 $200.04 AFTER TAX CASH FLOW -Equity in & Net Cash From Sale $195.30 $5,979.82 ($2,500.00) Total After Tax Cash Flows ($2,500.00) $212.87 $208.82 $204.54 $200.04 $6,175.12 COMBINED CASH FLOWS and RETURN MEASURES (Calculations and Answers HERE): 0 1 2 3 4 5 Project Cap Rate Ret. on Equity (ROE) After-Tax IRR NPV of After-Tax Cash Flows @ 12% Purchase Price SALES PRICE SALES PRICE $16,000.00 100 +Reserve NET BOOK VALUE $19,000.00 ($16,100.00) $2,900.00 - Mortgage Balance -Depreciation $0.00 GAIN ON SALE BTCF from Sale $19,000.00 ($12,440.18) $6,559.82 ($580.00) $5,979.82 Net Book Value $16,100.00 -Income Tax Depreciation taken $0.00 Net Cash From Sale Land Value $ Taxes at 25% 5,000.00 $11,000.00 $0.00 0.25 $2,900.00 Depreciab ($282.05) Remaining Gain Taxes at 20% $580.00 0.2 Total Taxes $580.00 1,200.00 1,200.00 (704.21) Off-Sheet Calculations Net Operating Income mortgage $13,500 -interest 30 20.0 +Reserve 5.25% 39.0 -Depreciation Taxable Income 1,200.00 (659.84) 20 20 1,200.00 (693.98) 20 (282.05) 243.97 (96.61) 1,200.00 (671.82) 20 (282.05) 266.13 (105.39) (683.19) 20 (282.05) 254.76 (100.89) ($282.05) 233.74 (92.56) (282.05) 278.11 -Tax 39.6% tax rate (110.13) Amortization Schedule (monthly payments--annualized) 0 1 2 3 4 5 Year end balance $13,500.00 5.25% Annual debt service 30 Amortization $13,309.64 ($894.57) $190.36 $704.21 $13,109.05 ($894.57) $200.59 $693.98 $12,897.66 ($894.57) $211.38 $683.19 $12,674.91 ($894.57) $222.75 $671.82 $12,440.18 ($894.57) $234.73 $659.84 Interest