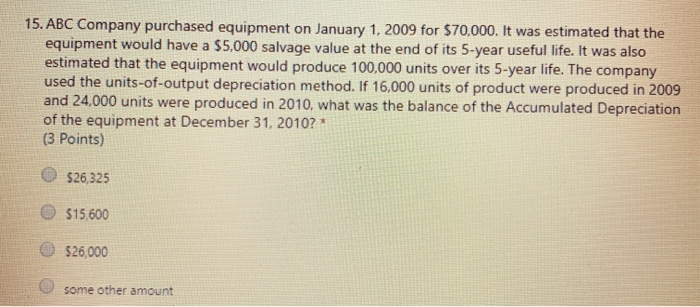

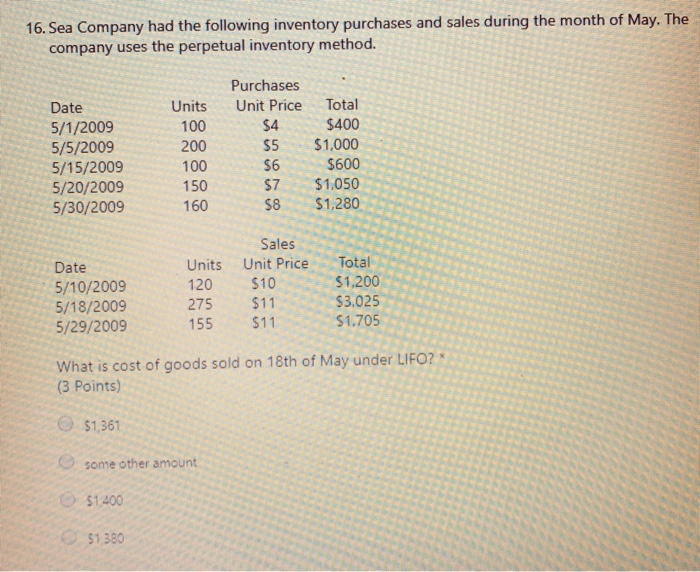

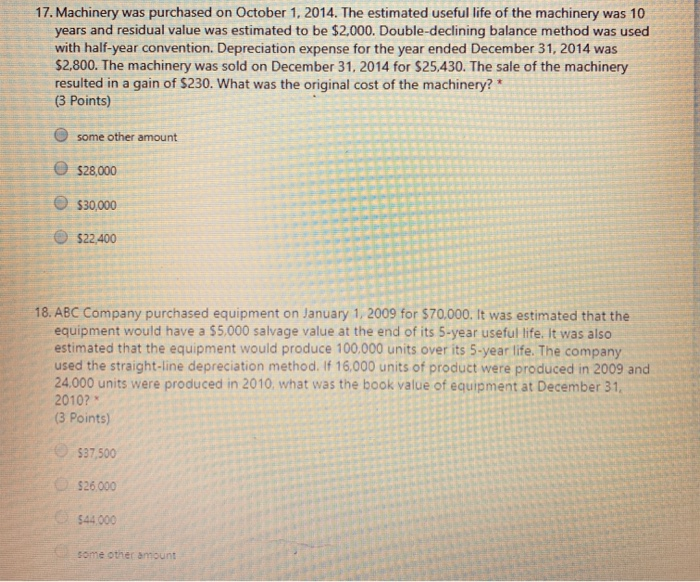

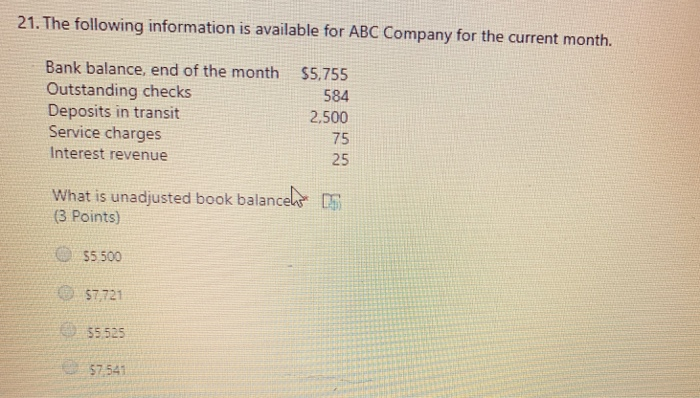

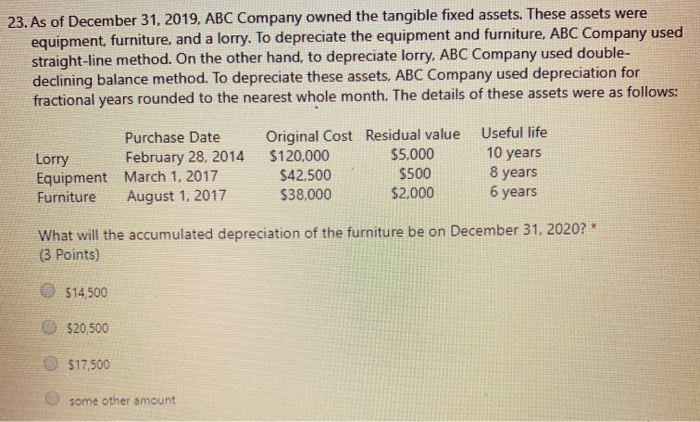

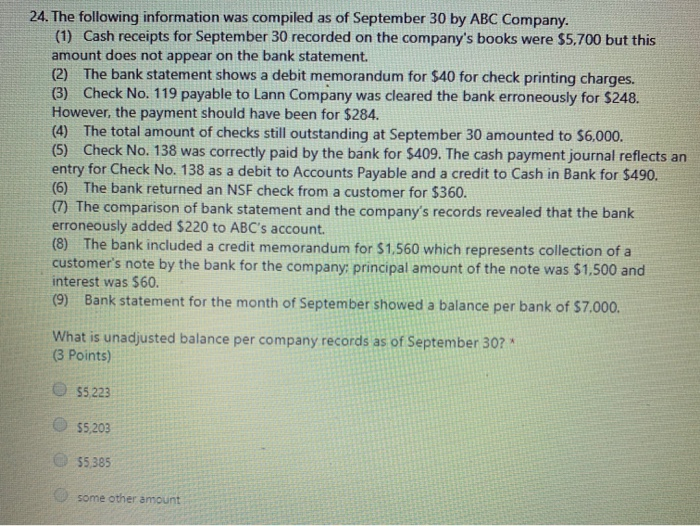

15. ABC Company purchased equipment on January 1, 2009 for $70,000. It was estimated that the equipment would have a $5,000 salvage value at the end of its 5-year useful life. It was also estimated that the equipment would produce 100,000 units over its 5-year life. The company used the units-of-output depreciation method. If 16,000 units of product were produced in 2009 and 24,000 units were produced in 2010, what was the balance of the Accumulated Depreciation of the equipment at December 31, 2010?* (3 Points) $26,325 $15,600 526,000 some other amount 16. Sea Company had the following inventory purchases and sales during the month of May. The company uses the perpetual inventory method. Date 5/1/2009 5/5/2009 5/15/2009 5/20/2009 5/30/2009 Units 100 200 100 150 160 Purchases Unit Price $4 $5 $6 $7 Total $400 $1,000 $600 $1,050 $1,280 58 Date 5/10/2009 5/18/2009 5/29/2009 Units 120 275 155 Sales Unit Price $10 $11 $11 Total $1,200 $3.025 $1.705 What is cost of goods sold on 18th of May under LIFO? (3 Points) $1,361 some other amount $1.400 51380 17. Machinery was purchased on October 1, 2014. The estimated useful life of the machinery was 10 years and residual value was estimated to be $2,000. Double-declining balance method was used with half-year convention. Depreciation expense for the year ended December 31, 2014 was $2,800. The machinery was sold on December 31, 2014 for $25,430. The sale of the machinery resulted in a gain of $230. What was the original cost of the machinery? * (3 Points) some other amount $28,000 O $30,000 $22.400 18. ABC Company purchased equipment on January 1, 2009 for $70,000. It was estimated that the equipment would have a $5,000 salvage value at the end of its 5-year useful life. It was also estimated that the equipment would produce 100,000 units over its 5-year life. The company used the straight-line depreciation method. If 16,000 units of product were produced in 2009 and 24.000 units were produced in 2010, what was the book value of equipment at December 31 2010? (3 Points) 537,500 $26.000 $44.000 some other amount 21. The following information is available for ABC Company for the current month. Bank balance, end of the month Outstanding checks Deposits in transit Service charges Interest revenue $5.755 584 2.500 75 25 What is unadjusted book balanceh (3 Points) 55 500 $7,721 55525 $7541 23. As of December 31, 2019, ABC Company owned the tangible fixed assets. These assets were equipment furniture, and a lorry. To depreciate the equipment and furniture, ABC Company used straight-line method. On the other hand, to depreciate lorry, ABC Company used double- declining balance method. To depreciate these assets, ABC Company used depreciation for fractional years rounded to the nearest whole month. The details of these assets were as follows: Purchase Date Lorry February 28, 2014 Equipment March 1, 2017 Furniture August 1, 2017 Original Cost Residual value $120,000 $5,000 $42.500 $500 $38,000 $2.000 Useful life 10 years 8 years 6 years What will the accumulated depreciation of the furniture be on December 31, 2020?* (3 Points) $14,500 $20,500 $17.500 some other amount 24. The following information was compiled as of September 30 by ABC Company. (1) Cash receipts for September 30 recorded on the company's books were $5,700 but this amount does not appear on the bank statement. (2) The bank statement shows a debit memorandum for $40 for check printing charges. (3) Check No. 119 payable to Lann Company was cleared the bank erroneously for $248. However, the payment should have been for $284. (4) The total amount of checks still outstanding at September 30 amounted to $6,000. (5) Check No. 138 was correctly paid by the bank for $409. The cash payment journal reflects an entry for Check No. 138 as a debit to Accounts Payable and a credit to Cash in Bank for $490. (6) The bank returned an NSF check from a customer for $360. (7) The comparison of bank statement and the company's records revealed that the bank erroneously added $220 to ABC's account. (8) The bank included a credit memorandum for $1.560 which represents collection of a customer's note by the bank for the company; principal amount of the note was $1,500 and interest was $60. (9) Bank statement for the month of September showed a balance per bank of $7.000. What is unadjusted balance per company records as of September 30? (3 Points) $5,223 $5,203 55385 some other amount