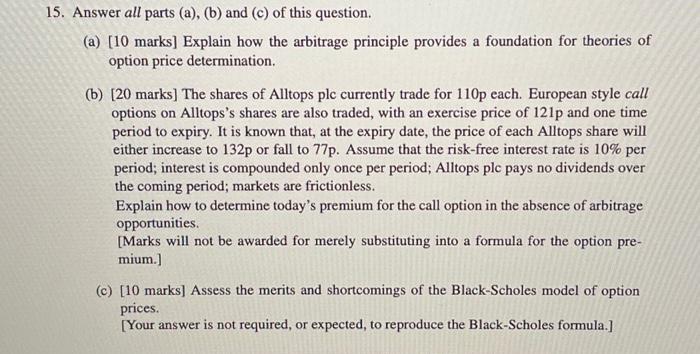

15. Answer all parts (a), (b) and (c) of this question. (a) [10 marks] Explain how the arbitrage principle provides a foundation for theories of option price determination. (b) [20 marks] The shares of Alltops plc currently trade for 110p each. European style call options on Alltops's shares are also traded, with an exercise price of 121p and one time period to expiry. It is known that, at the expiry date, the price of each Alltops share will either increase to 132p or fall to 77p. Assume that the risk-free interest rate is 10% per period; interest is compounded only once per period; Alltops plc pays no dividends over the coming period; markets are frictionless. Explain how to determine today's premium for the call option in the absence of arbitrage opportunities. [Marks will not be awarded for merely substituting into a formula for the option pre- mium.] (c) [10 marks] Assess the merits and shortcomings of the Black-Scholes model of option prices. [Your answer is not required, or expected, to reproduce the Black-Scholes formula.] 15. Answer all parts (a), (b) and (c) of this question. (a) [10 marks] Explain how the arbitrage principle provides a foundation for theories of option price determination. (b) [20 marks] The shares of Alltops plc currently trade for 110p each. European style call options on Alltops's shares are also traded, with an exercise price of 121p and one time period to expiry. It is known that, at the expiry date, the price of each Alltops share will either increase to 132p or fall to 77p. Assume that the risk-free interest rate is 10% per period; interest is compounded only once per period; Alltops plc pays no dividends over the coming period; markets are frictionless. Explain how to determine today's premium for the call option in the absence of arbitrage opportunities. [Marks will not be awarded for merely substituting into a formula for the option pre- mium.] (c) [10 marks] Assess the merits and shortcomings of the Black-Scholes model of option prices. [Your answer is not required, or expected, to reproduce the Black-Scholes formula.]