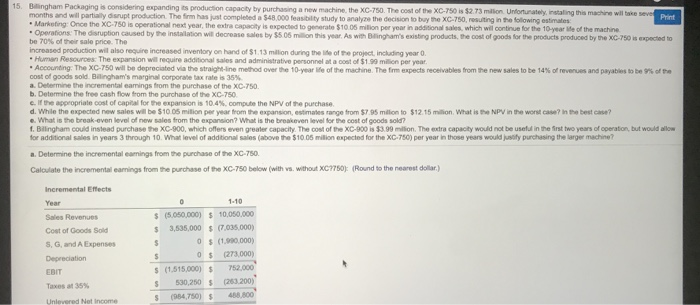

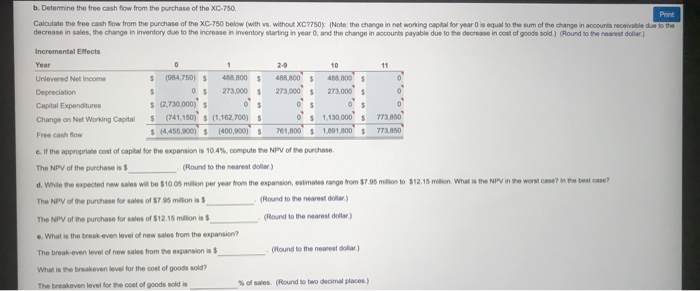

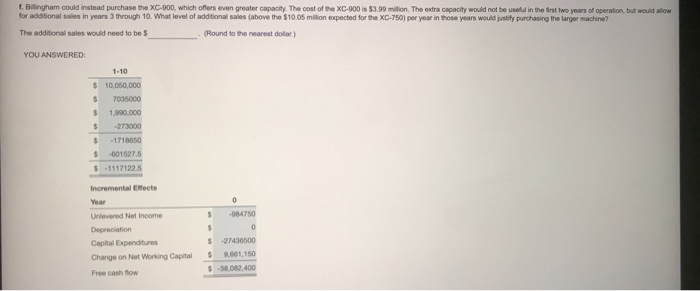

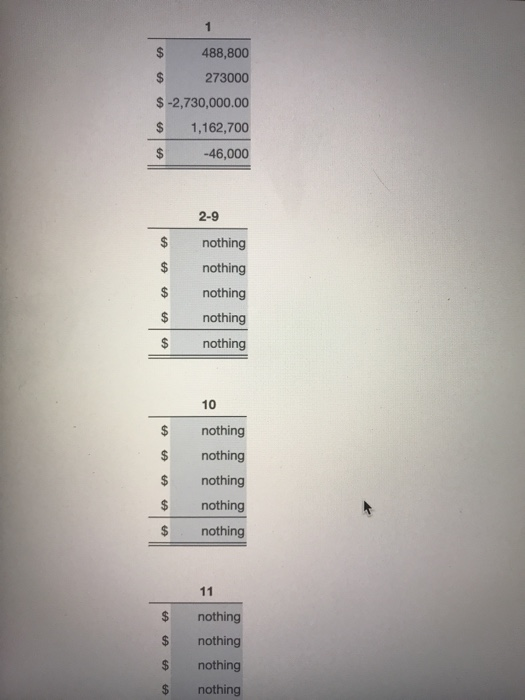

15. Bingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.73 million Unfortunately, installing this machine will take seve months and will partially disrupt production. The firm has just completed a $48.000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales which will continue for the 10 year of the machine Operations. The disruption caused by the installation will decrease sales by 55 05 million this year. As with Blingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The increased production will also require increased inventory on hand of $1.13 milion during the le of project, including year. Human Resources: The expansion will require additional sales and administrative personnel at a cost of $10 million per year. Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year of the machine. The firm expects receivables from the new sales to be 14% of revenues and payable to be of the cost of goods sold. Bilingham's marginal corporate tax rate is 35% a. Determine the incremental camnings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of the XC-750 er the appropriate cost of capital for the expansion is 10.4% compute the NPV of the purchase d. While the expected new sales will be $1005 million per year from the expansion, estimates range from $7.95 milion to $12.15 million What is the NPV in the worst case in the best case? e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? 1. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-000 is $3.90 milion. The extra capacity would not be useful in the first two years of operation, but would allow for additional sales in years 3 through 10. What level of additional sales (above the $10.05 million expected for the XC-750) per year in those years would justify purchasing the larger machine? a. Determine the incremental camnings from the purchase of the XC-750 Calculate the incrementaleanings from the purchase of the XC-750 below (with vs without XC7750)(Round to the nearest dollar) Incremental Effects Sales Revenues Cost of Goods Sold S. G. and A Expenses Depreciation EBIT Taxes at 35% (5.050,000) $ 10,050,000 $ 3,635,000 $ 17.035.000) 0$ (1.900,000) 05 273.000) $ (1.515,000) $ 752.000 $ 530,250 $ (263.200) S (954750) 468.000 Unlevered Net Income b. Determine the free how from the purchase of the XC-750 Print Calculate the tree cash flow from the purchase of the XC-750 below with vs without XC7750 Note the change in networking capital for year is equal to the sum of the change in accounts receivable due to the decrease in the change in inventory due to the increase in inventory starting in year and the change in accounts payable due to the decease in cost of goods sold ) Round to the nearest dollar Hects Incrementa Year 0 Univered Net Income Depreciation Capital Expenditures Change on Not Working Capital Free cash flow (64,750) 466.800 0 $ 273.000 $ $ 2,730,000) s os (741,150) S (1,162.700) $ $14.456.000) (400,000) 468.800 5 273,000 S 273,000 $ o s os 0 $1,130.000 761,800 1.801.800 7730 773.850 e. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase The NPV of the purchase is (Round to the nearest dollar) d. While the expected new sales will be 100 milion per year from the expansion estimates range from $7.95 million to $12.15 milion. What is the NPV in the worst The NPV of the purchase for sales of $75 mon iss Round to the nearest ) in the case The NPV of the purchase for sales of $12.15 milionis Round to the nearest dollar) . What is the break even level of new les from the expansion? Round to the nearest dollar) The break even level of news from the expansion is What is the braven level for the cost of goods sold? The breskeverve for the cost of good s of Roundwo decimal places) L t ing go for additional adurch XC 600 which anthrough 10. What level of even greater capacity. The cost of the XC-900 is $39 million. There w ere ston e above the $10.05 milion expected for the XC-750 per year in the years would the two years of operation but would allow purchasing the larger machine? The additional sales would need to be Round to the nearest do YOU ANSWERED $ 10,050,000 7035000 1.990.000 273000 -17100 -001527,5 $ 1171225 Incrementalets -004750 Univered Net Income Deprecation Capital Expenditures Change on Net Worting Capital 21436500 5 .661.150 S300400 $ 488,800 $ 273000 $ -2,730,000.00 $ 1,162,700 $ 46,000 2-9 nothing nothing nothing nothing nothing $ 10 nothing nothing nothing nothing nothing $ 11 nothing nothing nothing nothing 15. Bingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.73 million Unfortunately, installing this machine will take seve months and will partially disrupt production. The firm has just completed a $48.000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales which will continue for the 10 year of the machine Operations. The disruption caused by the installation will decrease sales by 55 05 million this year. As with Blingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The increased production will also require increased inventory on hand of $1.13 milion during the le of project, including year. Human Resources: The expansion will require additional sales and administrative personnel at a cost of $10 million per year. Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year of the machine. The firm expects receivables from the new sales to be 14% of revenues and payable to be of the cost of goods sold. Bilingham's marginal corporate tax rate is 35% a. Determine the incremental camnings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of the XC-750 er the appropriate cost of capital for the expansion is 10.4% compute the NPV of the purchase d. While the expected new sales will be $1005 million per year from the expansion, estimates range from $7.95 milion to $12.15 million What is the NPV in the worst case in the best case? e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? 1. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-000 is $3.90 milion. The extra capacity would not be useful in the first two years of operation, but would allow for additional sales in years 3 through 10. What level of additional sales (above the $10.05 million expected for the XC-750) per year in those years would justify purchasing the larger machine? a. Determine the incremental camnings from the purchase of the XC-750 Calculate the incrementaleanings from the purchase of the XC-750 below (with vs without XC7750)(Round to the nearest dollar) Incremental Effects Sales Revenues Cost of Goods Sold S. G. and A Expenses Depreciation EBIT Taxes at 35% (5.050,000) $ 10,050,000 $ 3,635,000 $ 17.035.000) 0$ (1.900,000) 05 273.000) $ (1.515,000) $ 752.000 $ 530,250 $ (263.200) S (954750) 468.000 Unlevered Net Income b. Determine the free how from the purchase of the XC-750 Print Calculate the tree cash flow from the purchase of the XC-750 below with vs without XC7750 Note the change in networking capital for year is equal to the sum of the change in accounts receivable due to the decrease in the change in inventory due to the increase in inventory starting in year and the change in accounts payable due to the decease in cost of goods sold ) Round to the nearest dollar Hects Incrementa Year 0 Univered Net Income Depreciation Capital Expenditures Change on Not Working Capital Free cash flow (64,750) 466.800 0 $ 273.000 $ $ 2,730,000) s os (741,150) S (1,162.700) $ $14.456.000) (400,000) 468.800 5 273,000 S 273,000 $ o s os 0 $1,130.000 761,800 1.801.800 7730 773.850 e. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase The NPV of the purchase is (Round to the nearest dollar) d. While the expected new sales will be 100 milion per year from the expansion estimates range from $7.95 million to $12.15 milion. What is the NPV in the worst The NPV of the purchase for sales of $75 mon iss Round to the nearest ) in the case The NPV of the purchase for sales of $12.15 milionis Round to the nearest dollar) . What is the break even level of new les from the expansion? Round to the nearest dollar) The break even level of news from the expansion is What is the braven level for the cost of goods sold? The breskeverve for the cost of good s of Roundwo decimal places) L t ing go for additional adurch XC 600 which anthrough 10. What level of even greater capacity. The cost of the XC-900 is $39 million. There w ere ston e above the $10.05 milion expected for the XC-750 per year in the years would the two years of operation but would allow purchasing the larger machine? The additional sales would need to be Round to the nearest do YOU ANSWERED $ 10,050,000 7035000 1.990.000 273000 -17100 -001527,5 $ 1171225 Incrementalets -004750 Univered Net Income Deprecation Capital Expenditures Change on Net Worting Capital 21436500 5 .661.150 S300400 $ 488,800 $ 273000 $ -2,730,000.00 $ 1,162,700 $ 46,000 2-9 nothing nothing nothing nothing nothing $ 10 nothing nothing nothing nothing nothing $ 11 nothing nothing nothing nothing