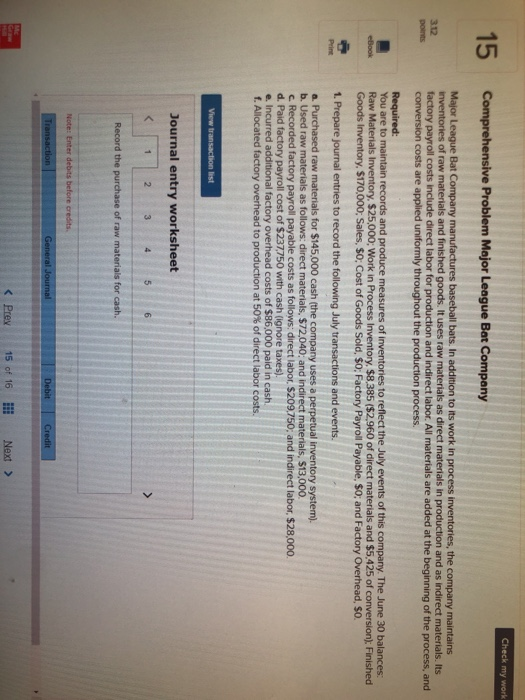

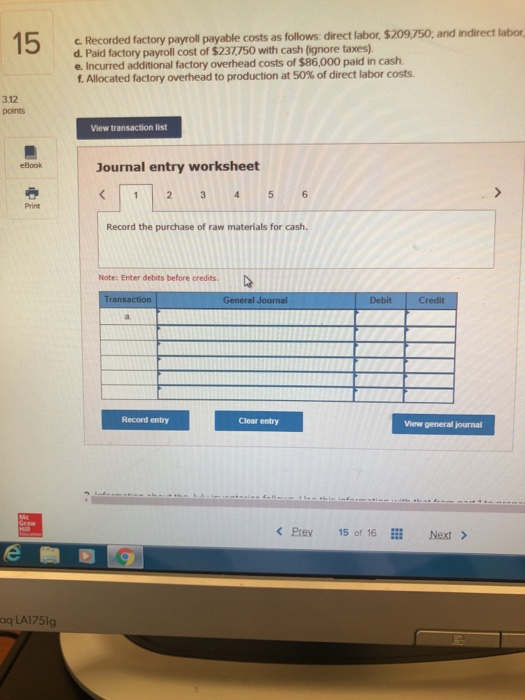

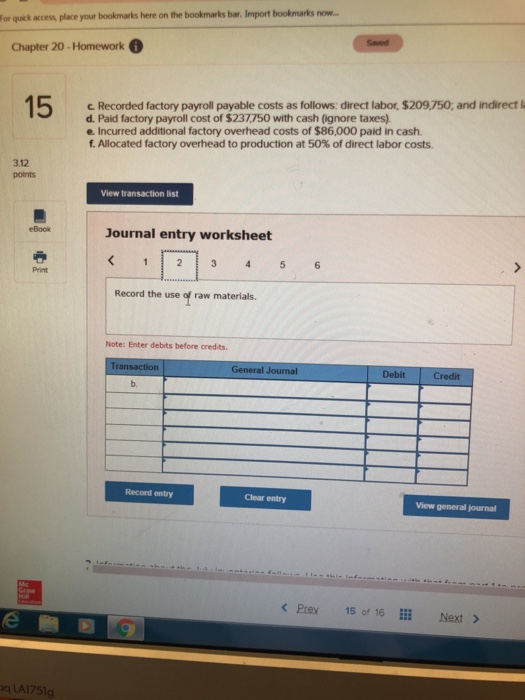

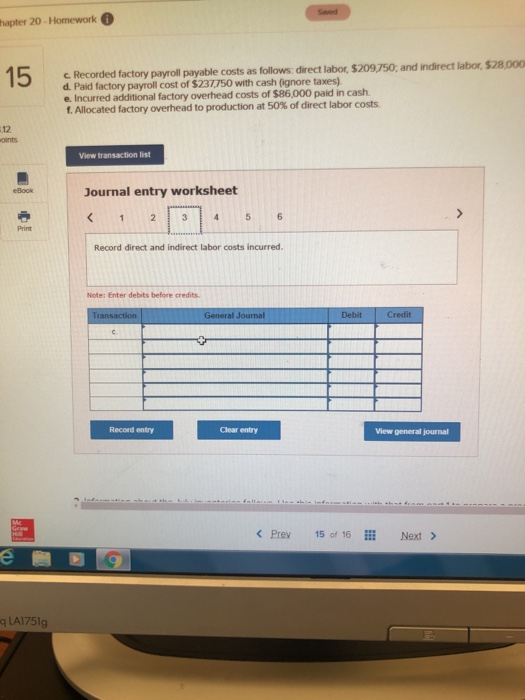

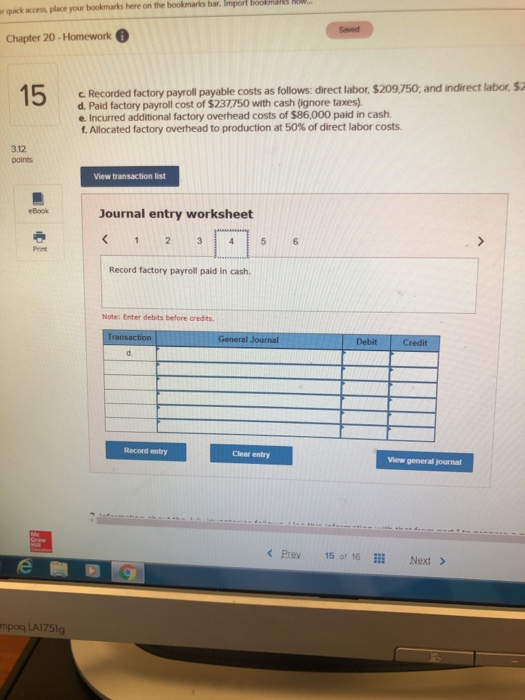

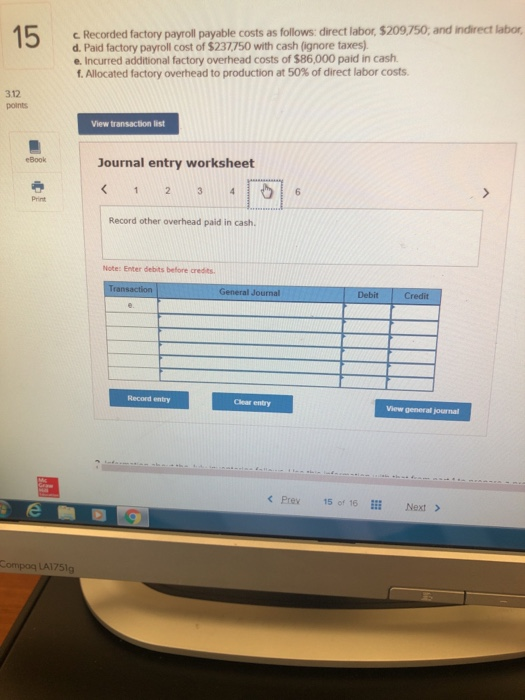

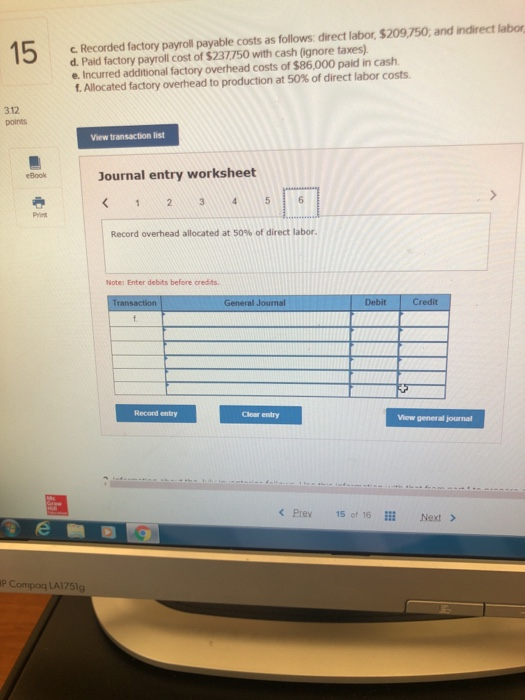

15 Comprehensive Problem Mojor League Bat Company Major League Bat Company manufactures inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and company maintains 312 points You are to maintain records and produce measures of inventories to reflect the July events of this company. The June 30 balances: y, $8.385 ($2,960 of direct materials and $5.425 of conversion): Finished in Process Invent Goods Inventory, $170,000; Sales, $0: Cost of Goods Sold, $0; Factory Payroll Payable, $0; and Factory S0. 1. Prepare journal entries to record the following July transactions and events. a Purchased raw materials for $145,000 cash (the company uses a perpetual inventory system) b. Used raw materials as follows: direct materials, $72,040; and indirect materials, $13,000 factory payroll payable costs as follows: direct labor. $209,750, and indirect labor, $28,000 d. Paid factory payroll cost of $237,750 with cash (ignore taxes). e. Incurred additional factory overhead costs of $86,000 paid in cash. f. Allocated factory overhead to p at 50% of direct labor costs. Journal entry worksheet Record the purchase of raw materials for cash c Recorded factory payroll payable costs as follows direct labor, $209,750, and indirect labor d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e. Incurred additional factory overhead costs of $86,000 paid in cash. f. Allocated factory overhead to production at 50% of direct labor costs. 3.12 points View transaction list Journal entry worksheet eBook Print Record the purchase of raw materials for cash. Note: Enter debitsbefore credits. Record entry Clear entry View general journal aq LA1751g For quick access, place your bookmarks here on the bookmarks bar. Import bookmarks now Chapter 20-Homework c Recorded factory payroll payable costs as follows: direct labor, $209,750, and indirect l d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e. Incurred additional factory overhead costs of $86,000 paid in cash. f. Allocated factory overhead to production at 50% of direct labor costs. 3.12 points View transaction list eBook Journal entry worksheet Print Record the use of raw materials. Note: Enter debits before credits. General Journal Debit Credit b. Record entry Clear entry View general journal q LA1751g hapter 20- Homework c Recorded factory payroll payable costs as follows: direct labor, $209750, and indirect labor, $28000 d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e. Incurred additional factory overhead costs of $86,000 paid in cash f. Allocated factory overhead to production at 50% of direct labor costs. 12 oints View transaction list Journal entry worksheet Print Record direct and indirect labor costs incurred Note: Enter debits before credits General Journal Cr Record entry Clear entry View general journal q LA1751g bar. Import r quick access, place your bookmarks here on the bookmarks Chapter 20-Homework c Recorded factory payroll payable costs as follows: direct labor, $209,750; and indirect labor s d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e. Incurred additional factory overhead costs of $86,000 paid in cash. f. Allocated factory overhead to production at 50% of direct labor costs. 3.12 points View transaction list eBook Journal entry worksheet Print Record factory payroll paid in cash Note: Enter debits before credts. General Journal Record entry Clear entry View general journal mpaq LA175lg c Recorded factory payroll payable costs as follows: direct labor, $209,750, and indirect labor d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e Incurred additional factory overhead costs of $86,000 paid in cash f. Allocated factory overhead to production at 50% of direct labor costs. 312 oints View transaction list Book Journal entry worksheet Print Record other overhead paid in cash. Note: Enter debits before credits Debit Credit Record entry Clear entry View general journal Compog LA1751g c. Recorded factory payroll payable costs as follows: direct labor, $209,750, and indirect labor d. Paid factory payroll cost of $237,750 with cash (ignore taxes) e. Incurred additional factory overhead costs of $86,000 paid in cash f. Allocated factory overhead to production at 50% of direct labor costs. 3.12 points View transaction list Journal entry worksheet eBook Print Record overhead allocated at 50% of direct labor Note: Enter debits before credits Record entry Clear entry View general journal P Compoq LA1751g