Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. David's Delicatessen flies in Hebrew National salamis regularly to satisfy a grow- ing demand for the salamis in Silicon Valley. The owner, David Gold,

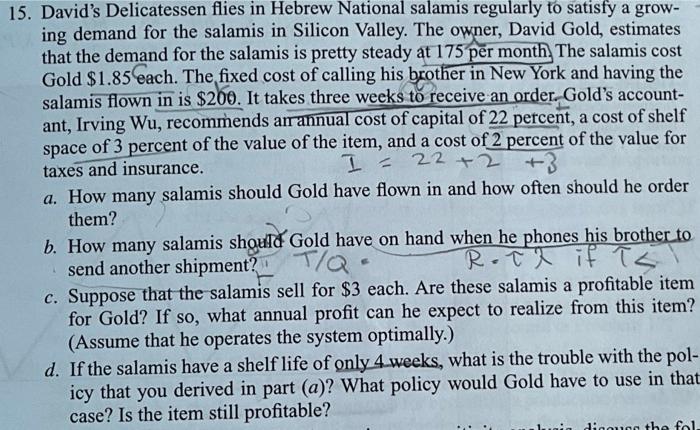

15. David's Delicatessen flies in Hebrew National salamis regularly to satisfy a grow- ing demand for the salamis in Silicon Valley. The owner, David Gold, estimates that the demand for the salamis is pretty steady at 175 per month The salamis cost Gold $1.85 each. The fixed cost of calling his brother in New York and having the salamis flown in is $200. It takes three weeks to receive an order. Gold's account- ant, Irving Wu, recommends an annual cost of capital of 22 percent, a cost of shelf space of 3 percent of the value of the item, and a cost of 2 percent of the value for I = 22 +2 +3 taxes and insurance. a. How many salamis should Gold have flown in and how often should he order them? b. How many salamis should Gold have on hand when he phones his brother to send another shipment? T/Q R=TR if TST c. Suppose that the salamis sell for $3 each. Are these salamis a profitable item for Gold? If so, what annual profit can he expect to realize from this item? (Assume that he operates the system optimally.) d. If the salamis have a shelf life of only 4 weeks, what is the trouble with the pol- icy that you derived in part (a)? What policy would Gold have to use in that case? Is the item still profitable? gia digougs the fol-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started