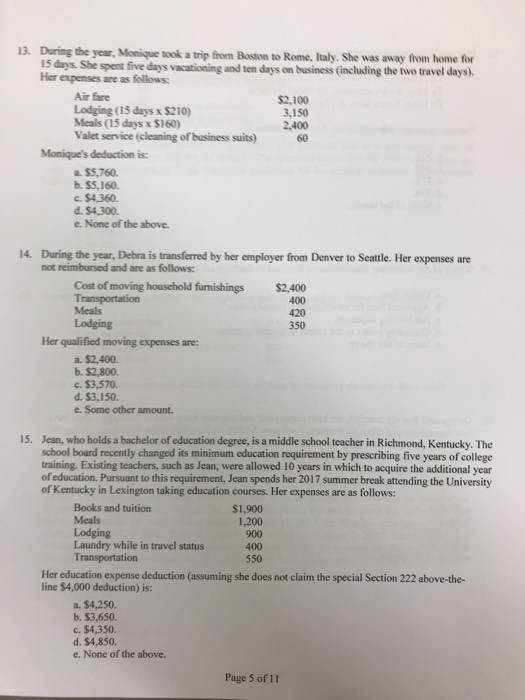

15 days. She Her expenses are as follows: spent five days vacationing and ten days on business (including the two travel days). Air fare Lodging (15 days x $210) Meals (15 days x $160) Valet service (cleaning of business suits) $2.100 3,150 2,400 60 Monique's deduction is a. $5,760. b. $5,160. c. $4,360 d. $4,300. e. None of the above. 14. During the year, Debra is transferred by her employer from Denver to Seattle. Her expenses are not reimbursed and are as follows: Cost of moving household furnishings Transportation Meals Lodging $2,400 400 420 350 Her qualified moving expenses are: a. $2,400. b. $2,800. c. $3,570. d. $3,150. e. Some other amount. 15. Jean, who holds a bachelor of education degree, is a middle school teacher in Richmond, Kentucky. The school board recently changed its minimum education requirement by prescribing five years of college training. Existing teachers, such as Jean, were allowed 10 years in which to acquire the additional year of education. Pursuant to this requirement, Jean spends her 2017 summer break attending the University of Kentucky in Lexington taking education courses. Her expenses are as follows: Books and tuition Meals Lodging Laundry while in travel status Transportation $1,900 1,200 900 400 550 Her education expense deduction (assuming she does not claim the special Section 222 above-the- line $4,000 deduction) is: a. $4,250. b. $3,650 c. $4,350. d. $4,850. e. None of the above. Page 5 of 11 15 days. She Her expenses are as follows: spent five days vacationing and ten days on business (including the two travel days). Air fare Lodging (15 days x $210) Meals (15 days x $160) Valet service (cleaning of business suits) $2.100 3,150 2,400 60 Monique's deduction is a. $5,760. b. $5,160. c. $4,360 d. $4,300. e. None of the above. 14. During the year, Debra is transferred by her employer from Denver to Seattle. Her expenses are not reimbursed and are as follows: Cost of moving household furnishings Transportation Meals Lodging $2,400 400 420 350 Her qualified moving expenses are: a. $2,400. b. $2,800. c. $3,570. d. $3,150. e. Some other amount. 15. Jean, who holds a bachelor of education degree, is a middle school teacher in Richmond, Kentucky. The school board recently changed its minimum education requirement by prescribing five years of college training. Existing teachers, such as Jean, were allowed 10 years in which to acquire the additional year of education. Pursuant to this requirement, Jean spends her 2017 summer break attending the University of Kentucky in Lexington taking education courses. Her expenses are as follows: Books and tuition Meals Lodging Laundry while in travel status Transportation $1,900 1,200 900 400 550 Her education expense deduction (assuming she does not claim the special Section 222 above-the- line $4,000 deduction) is: a. $4,250. b. $3,650 c. $4,350. d. $4,850. e. None of the above. Page 5 of 11