15 Dec A credit note to the amount of R17 298, was issued to Receivable Croock in respect of goods returned by Receivable Croock.

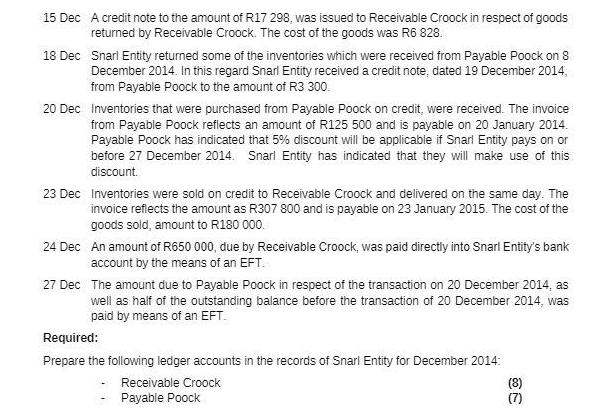

15 Dec A credit note to the amount of R17 298, was issued to Receivable Croock in respect of goods returned by Receivable Croock. The cost of the goods was R6 828. 18 Dec Snarl Entity returned some of the inventories which were received from Payable Poock on 8 December 2014. In this regard Snarl Entity received a credit note, dated 19 December 2014, from Payable Poock to the amount of R3 300. 20 Dec Inventories that were purchased from Payable Poock on credit, were received. The invoice from Payable Poock reflects an amount of R125 500 and is payable on 20 January 2014. Payable Poock has indicated that 5% discount will be applicable if Snarl Entity pays on or before 27 December 2014. Snarl Entity has indicated that they will make use of this discount. 23 Dec Inventories were sold on credit to Receivable Croock and delivered on the same day. The invoice reflects the amount as R307 800 and is payable on 23 January 2015. The cost of the goods sold, amount to R180 000. 24 Dec An amount of R650 000, due by Receivable Croock, was paid directly into Snarl Entity's bank account by the means of an EFT. 27 Dec The amount due to Payable Poock in respect of the transaction on 20 December 2014, as well as half of the outstanding balance before the transaction of 20 December 2014, was paid by means of an EFT. Required: Prepare the following ledger accounts in the records of Snarl Entity for December 2014: Receivable Croock Payable Poock (8) (7) 33

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Receivable Croock Dec 15 Accounts Receivable17298114 15174 Input VAT15174...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started