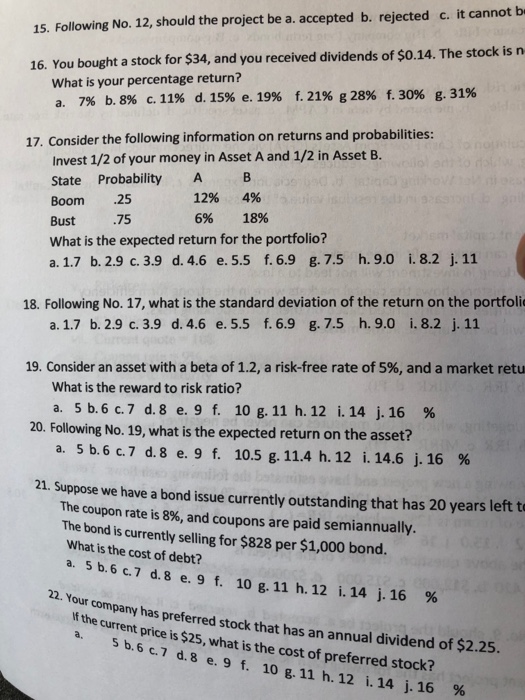

15. Following No. 12, should the project be a. accepted b. rejected c. it cannot b 16. You bought a stock for $34, and you received dividends of $0.14. The stock is n What is your percentage return? a. 7% b. 8% c. 1196 d. 15% e. 1996 f. 21% g 28% f. 30% g. 31% 17. Consider the following information on returns and probabilities: Invest 1/2 of your money in Asset A and 1/2 in Asset B. State Probability A B Boom .25 Bust 75 What is the expected return for the portfolio? a. 1.7 b. 2.9 c. 3.9 d. 4.6 e. 5.5 f. 6.9 g.7.5 h. 9.0 i.8.2 j. 11 12% 6% 4% 18% 18. Following No. 17, what is the standard deviation of the return on the portfoli 19. Consider an asset with a beta of 1.2, a risk-free rate of 5%, and a market retu What is the reward to risk ratio? a. 5b.6c. 7 d. 8 e. 9 f. 10 g. 11 h. 12 i. 14 j. 16 % 20. Following No. 19, what is the expected return on the asset? f. 5b.6 c. 7 d. 8 10.5 g. 11.4 h. 12 i. 14.6 j. 16 % a. e. 9 21. Suppose we have a bond issue currently outstanding that has 20 years left t The coupon rate is 8%, and coupons are paid semiannually. The bond is currently selling for $828 per $1,000 bond. What is the cost of debt? company has preferred stock that has an annual dividend of $2.25. If the current price is $25, what is the cost of preferred a. 5 b.6 c.7 d.8 e.9 f. 10 g. 11 h. 12 i.14 stock? 15. Following No. 12, should the project be a. accepted b. rejected c. it cannot b 16. You bought a stock for $34, and you received dividends of $0.14. The stock is n What is your percentage return? a. 7% b. 8% c. 1196 d. 15% e. 1996 f. 21% g 28% f. 30% g. 31% 17. Consider the following information on returns and probabilities: Invest 1/2 of your money in Asset A and 1/2 in Asset B. State Probability A B Boom .25 Bust 75 What is the expected return for the portfolio? a. 1.7 b. 2.9 c. 3.9 d. 4.6 e. 5.5 f. 6.9 g.7.5 h. 9.0 i.8.2 j. 11 12% 6% 4% 18% 18. Following No. 17, what is the standard deviation of the return on the portfoli 19. Consider an asset with a beta of 1.2, a risk-free rate of 5%, and a market retu What is the reward to risk ratio? a. 5b.6c. 7 d. 8 e. 9 f. 10 g. 11 h. 12 i. 14 j. 16 % 20. Following No. 19, what is the expected return on the asset? f. 5b.6 c. 7 d. 8 10.5 g. 11.4 h. 12 i. 14.6 j. 16 % a. e. 9 21. Suppose we have a bond issue currently outstanding that has 20 years left t The coupon rate is 8%, and coupons are paid semiannually. The bond is currently selling for $828 per $1,000 bond. What is the cost of debt? company has preferred stock that has an annual dividend of $2.25. If the current price is $25, what is the cost of preferred a. 5 b.6 c.7 d.8 e.9 f. 10 g. 11 h. 12 i.14 stock