Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Glass Attack, Ltd. provided you with the following information regarding its defined-benefit pension plan. Glass Attack Ltd. follows IFRS and it expects a return

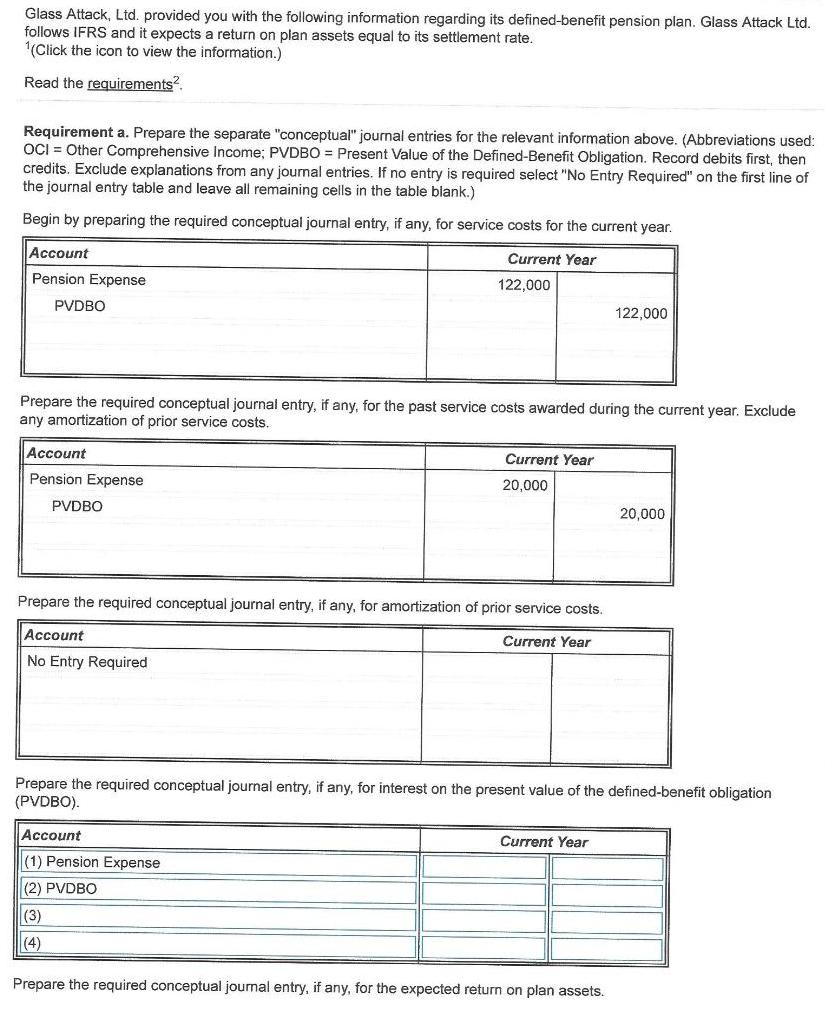

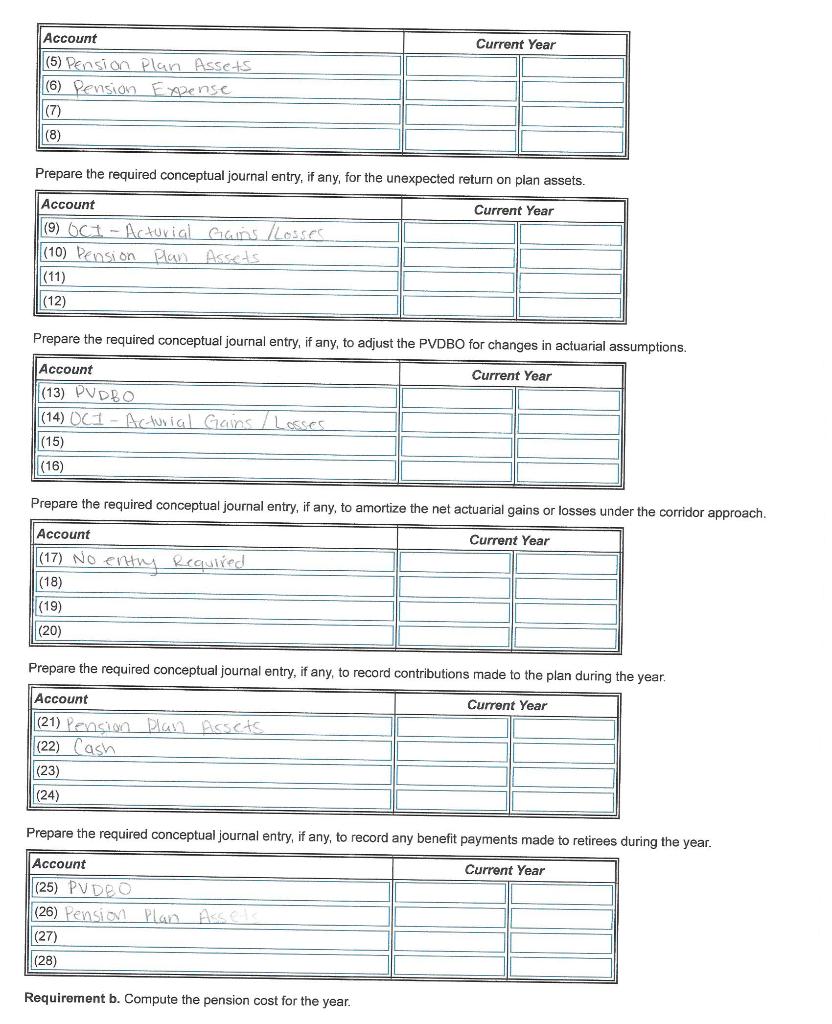

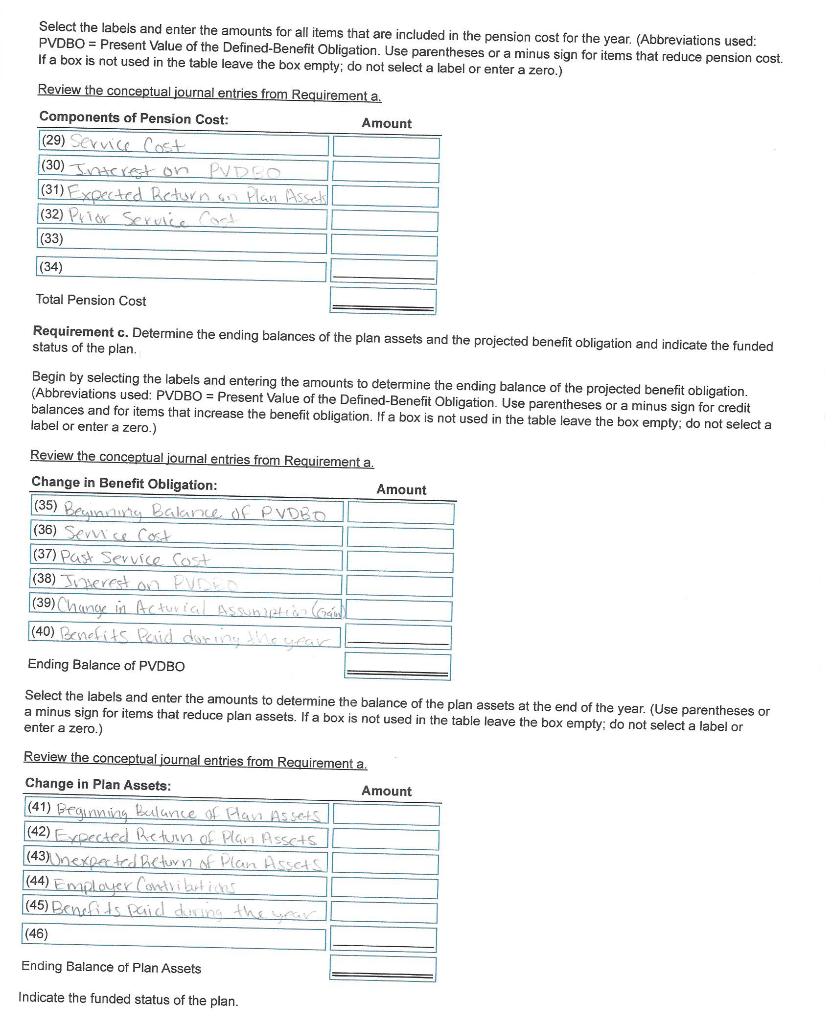

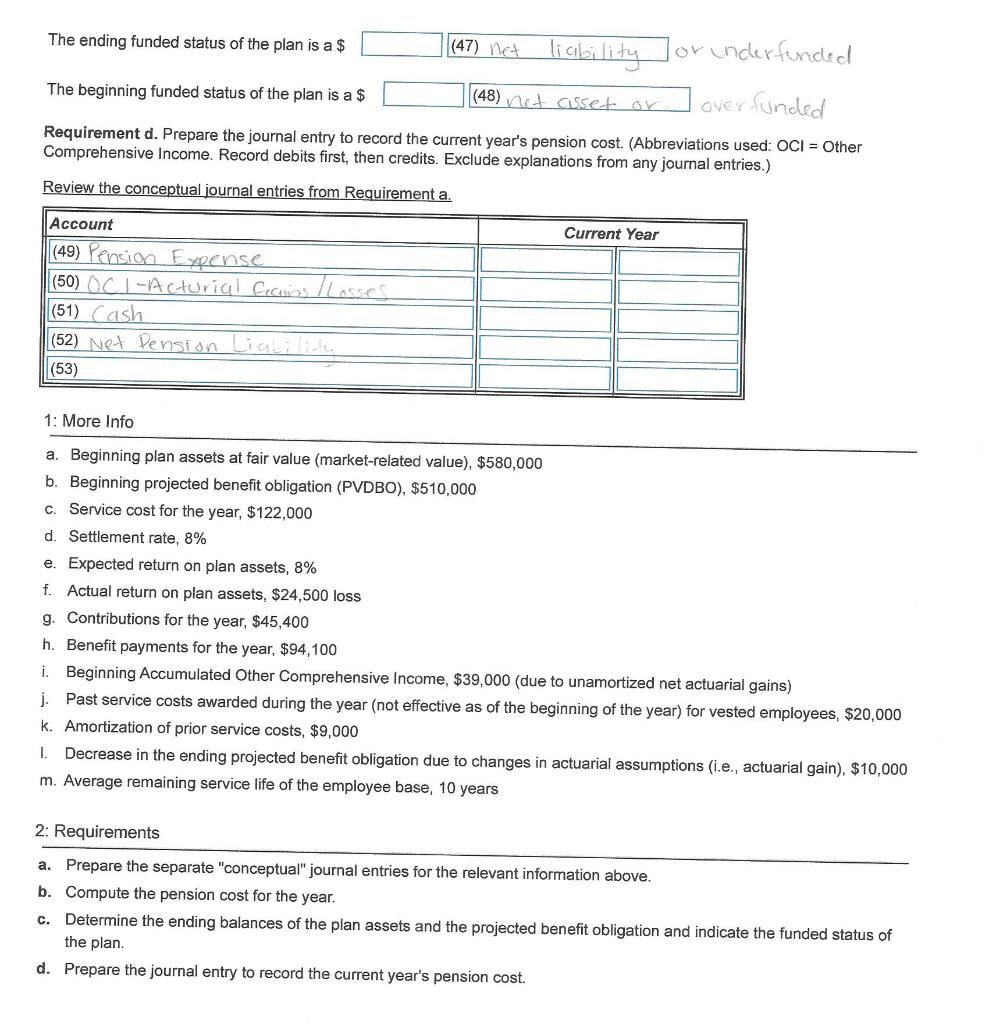

Glass Attack, Ltd. provided you with the following information regarding its defined-benefit pension plan. Glass Attack Ltd. follows IFRS and it expects a return on plan assets equal to its settlement rate. 1(Click the icon to view the information.) Read the requirements. Requirement a. Prepare the separate "conceptual" journal entries for the relevant information above. (Abbreviations used: OCI = Other Comprehensive Income; PVDBO = Present Value of the Defined-Benefit Obligation. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by preparing the required conceptual journal entry, if any, for service costs for the current year. Account Pension Expense PVDBO Account Pension Expense Current Year PVDBO 122,000 Prepare the required conceptual journal entry, if any, for the past service costs awarded during the current year. Exclude any amortization of prior service costs. Current Year 20,000 Prepare the required conceptual journal entry, if any, for amortization of prior service costs. Account Current Year No Entry Required 122,000 Current Year Prepare the required conceptual journal entry, if any, for interest on the present value of the defined-benefit obligation (PVDBO). Account (1) Pension Expense (2) PVDBO (3) (4) Prepare the required conceptual journal entry, if any, for the expected return on plan assets. 20,000 Account (5) Pension Plan Assets (6) Pension Expense (7) (8) Prepare the required conceptual journal entry, if any, for the unexpected return on plan assets. Account Current Year (9) OCI - Acturial Gains / Losses (10) Pension Plan Assets. (11) (12) Prepare the required conceptual journal entry, if any, to adjust the PVDBO for changes in actuarial assumptions. Account Current Year (13) PVDBO (14) OCI - Acturial Gains / Losses (15) (16) Current Year Prepare the required conceptual journal entry, if any, to amortize the net actuarial gains or losses under the corridor approach. Account Current Year (17) No entry Required (18) (19) (20) Prepare the required conceptual journal entry, if any, to record contributions made to the plan during the year. Current Year Account (21) Pension Plan Assets (22) Cash (23) (24) Prepare the required conceptual journal entry, if any, to record any benefit payments made to retirees during the year. Current Year Account (25) PVDBO (26) Pension Plan Assels. (27) (28) Requirement b. Compute the pension cost for the year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviations used: PVDBO Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Components of Pension Cost: Amount (29) Service Cost (30) Interest on PYDEO (31) Expected Return on Plan Assels (32) Prior Service Cart (33) (34) Total Pension Cost Requirement c. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. Begin by selecting the labels and entering the amounts to determine the ending balance of the projected benefit obligation. (Abbreviations used: PVDBO = Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for credit balances and for items that increase the benefit obligation. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Change in Benefit Obligation: (35) Beginning Balance of PVD BO (36) Service Cost (37) Past Service Cost (38) Interest on PUDEO (39) Change in Acturial Assumption (Gran)) (40) Benefits Paid during the year Ending Balance of PVDBO Select the labels and enter the amounts to determine the balance of the plan assets at the end of the year. (Use parentheses or a minus sign for items that reduce plan assets. If a box is not used in the table leave the box empty; do not selecta enter a zero.) label or Review the conceptual journal entries from Requirement a Change in Plan Assets: (41) Beginning Balance of Plan Assets (42) Expected Return of Plan Assets (43)Unexpected Return of Plan Assets Amount (44) Employer Contributions (45) Benefits paid during the year (46) Ending Balance of Plan Assets Indicate the funded status of the plan. Amount The ending funded status of the plan is a $ (47) net liability or underfunded over funded (48) not cisset or The beginning funded status of the plan is a $ Requirement d. Prepare the journal entry to record the current year's pension cost. (Abbreviations used: OCI = Other Comprehensive Income. Record debits first, then credits. Exclude explanations from any journal entries.) Review the conceptual journal entries from Requirement a. Account (49) Pension Expense (50) (C1-Acturial Grains / Lasses (51) Cash (52) Net Pension Liability (53) 1: More Info a. Beginning plan assets at fair value (market-related value), $580,000 b. Beginning projected benefit obligation (PVDBO), $510,000 c. Service cost for the year, $122,000 d. Settlement rate, 8% e. Expected return on plan assets, 8% f. Actual return on plan assets, $24,500 loss Current Year g. Contributions for the year, $45,400 h. Benefit payments for the year, $94,100 i. Beginning Accumulated Other Comprehensive Income, $39,000 (due to unamortized net actuarial gains) j. Past service costs awarded during the year (not effective as of the beginning of the year) for vested employees, $20,000 k. Amortization of prior service costs, $9,000 1. Decrease in the ending projected benefit obligation due to changes in actuarial assumptions (i.e., actuarial gain), $10,000 m. Average remaining service life of the employee base, 10 years 2: Requirements a. Prepare the separate "conceptual" journal entries for the relevant information above. b. Compute the pension cost for the year. C. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. d. Prepare the journal entry to record the current year's pension cost. Glass Attack, Ltd. provided you with the following information regarding its defined-benefit pension plan. Glass Attack Ltd. follows IFRS and it expects a return on plan assets equal to its settlement rate. 1(Click the icon to view the information.) Read the requirements. Requirement a. Prepare the separate "conceptual" journal entries for the relevant information above. (Abbreviations used: OCI = Other Comprehensive Income; PVDBO = Present Value of the Defined-Benefit Obligation. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by preparing the required conceptual journal entry, if any, for service costs for the current year. Account Pension Expense PVDBO Account Pension Expense Current Year PVDBO 122,000 Prepare the required conceptual journal entry, if any, for the past service costs awarded during the current year. Exclude any amortization of prior service costs. Current Year 20,000 Prepare the required conceptual journal entry, if any, for amortization of prior service costs. Account Current Year No Entry Required 122,000 Current Year Prepare the required conceptual journal entry, if any, for interest on the present value of the defined-benefit obligation (PVDBO). Account (1) Pension Expense (2) PVDBO (3) (4) Prepare the required conceptual journal entry, if any, for the expected return on plan assets. 20,000 Account (5) Pension Plan Assets (6) Pension Expense (7) (8) Prepare the required conceptual journal entry, if any, for the unexpected return on plan assets. Account Current Year (9) OCI - Acturial Gains / Losses (10) Pension Plan Assets. (11) (12) Prepare the required conceptual journal entry, if any, to adjust the PVDBO for changes in actuarial assumptions. Account Current Year (13) PVDBO (14) OCI - Acturial Gains / Losses (15) (16) Current Year Prepare the required conceptual journal entry, if any, to amortize the net actuarial gains or losses under the corridor approach. Account Current Year (17) No entry Required (18) (19) (20) Prepare the required conceptual journal entry, if any, to record contributions made to the plan during the year. Current Year Account (21) Pension Plan Assets (22) Cash (23) (24) Prepare the required conceptual journal entry, if any, to record any benefit payments made to retirees during the year. Current Year Account (25) PVDBO (26) Pension Plan Assels. (27) (28) Requirement b. Compute the pension cost for the year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviations used: PVDBO Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Components of Pension Cost: Amount (29) Service Cost (30) Interest on PYDEO (31) Expected Return on Plan Assels (32) Prior Service Cart (33) (34) Total Pension Cost Requirement c. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. Begin by selecting the labels and entering the amounts to determine the ending balance of the projected benefit obligation. (Abbreviations used: PVDBO = Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for credit balances and for items that increase the benefit obligation. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Change in Benefit Obligation: (35) Beginning Balance of PVD BO (36) Service Cost (37) Past Service Cost (38) Interest on PUDEO (39) Change in Acturial Assumption (Gran)) (40) Benefits Paid during the year Ending Balance of PVDBO Select the labels and enter the amounts to determine the balance of the plan assets at the end of the year. (Use parentheses or a minus sign for items that reduce plan assets. If a box is not used in the table leave the box empty; do not selecta enter a zero.) label or Review the conceptual journal entries from Requirement a Change in Plan Assets: (41) Beginning Balance of Plan Assets (42) Expected Return of Plan Assets (43)Unexpected Return of Plan Assets Amount (44) Employer Contributions (45) Benefits paid during the year (46) Ending Balance of Plan Assets Indicate the funded status of the plan. Amount The ending funded status of the plan is a $ (47) net liability or underfunded over funded (48) not cisset or The beginning funded status of the plan is a $ Requirement d. Prepare the journal entry to record the current year's pension cost. (Abbreviations used: OCI = Other Comprehensive Income. Record debits first, then credits. Exclude explanations from any journal entries.) Review the conceptual journal entries from Requirement a. Account (49) Pension Expense (50) (C1-Acturial Grains / Lasses (51) Cash (52) Net Pension Liability (53) 1: More Info a. Beginning plan assets at fair value (market-related value), $580,000 b. Beginning projected benefit obligation (PVDBO), $510,000 c. Service cost for the year, $122,000 d. Settlement rate, 8% e. Expected return on plan assets, 8% f. Actual return on plan assets, $24,500 loss Current Year g. Contributions for the year, $45,400 h. Benefit payments for the year, $94,100 i. Beginning Accumulated Other Comprehensive Income, $39,000 (due to unamortized net actuarial gains) j. Past service costs awarded during the year (not effective as of the beginning of the year) for vested employees, $20,000 k. Amortization of prior service costs, $9,000 1. Decrease in the ending projected benefit obligation due to changes in actuarial assumptions (i.e., actuarial gain), $10,000 m. Average remaining service life of the employee base, 10 years 2: Requirements a. Prepare the separate "conceptual" journal entries for the relevant information above. b. Compute the pension cost for the year. C. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. d. Prepare the journal entry to record the current year's pension cost. Glass Attack, Ltd. provided you with the following information regarding its defined-benefit pension plan. Glass Attack Ltd. follows IFRS and it expects a return on plan assets equal to its settlement rate. 1(Click the icon to view the information.) Read the requirements. Requirement a. Prepare the separate "conceptual" journal entries for the relevant information above. (Abbreviations used: OCI = Other Comprehensive Income; PVDBO = Present Value of the Defined-Benefit Obligation. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by preparing the required conceptual journal entry, if any, for service costs for the current year. Account Pension Expense PVDBO Account Pension Expense Current Year PVDBO 122,000 Prepare the required conceptual journal entry, if any, for the past service costs awarded during the current year. Exclude any amortization of prior service costs. Current Year 20,000 Prepare the required conceptual journal entry, if any, for amortization of prior service costs. Account Current Year No Entry Required 122,000 Current Year Prepare the required conceptual journal entry, if any, for interest on the present value of the defined-benefit obligation (PVDBO). Account (1) Pension Expense (2) PVDBO (3) (4) Prepare the required conceptual journal entry, if any, for the expected return on plan assets. 20,000 Account (5) Pension Plan Assets (6) Pension Expense (7) (8) Prepare the required conceptual journal entry, if any, for the unexpected return on plan assets. Account Current Year (9) OCI - Acturial Gains / Losses (10) Pension Plan Assets. (11) (12) Prepare the required conceptual journal entry, if any, to adjust the PVDBO for changes in actuarial assumptions. Account Current Year (13) PVDBO (14) OCI - Acturial Gains / Losses (15) (16) Current Year Prepare the required conceptual journal entry, if any, to amortize the net actuarial gains or losses under the corridor approach. Account Current Year (17) No entry Required (18) (19) (20) Prepare the required conceptual journal entry, if any, to record contributions made to the plan during the year. Current Year Account (21) Pension Plan Assets (22) Cash (23) (24) Prepare the required conceptual journal entry, if any, to record any benefit payments made to retirees during the year. Current Year Account (25) PVDBO (26) Pension Plan Assels. (27) (28) Requirement b. Compute the pension cost for the year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviations used: PVDBO Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Components of Pension Cost: Amount (29) Service Cost (30) Interest on PYDEO (31) Expected Return on Plan Assels (32) Prior Service Cart (33) (34) Total Pension Cost Requirement c. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. Begin by selecting the labels and entering the amounts to determine the ending balance of the projected benefit obligation. (Abbreviations used: PVDBO = Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for credit balances and for items that increase the benefit obligation. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Change in Benefit Obligation: (35) Beginning Balance of PVD BO (36) Service Cost (37) Past Service Cost (38) Interest on PUDEO (39) Change in Acturial Assumption (Gran)) (40) Benefits Paid during the year Ending Balance of PVDBO Select the labels and enter the amounts to determine the balance of the plan assets at the end of the year. (Use parentheses or a minus sign for items that reduce plan assets. If a box is not used in the table leave the box empty; do not selecta enter a zero.) label or Review the conceptual journal entries from Requirement a Change in Plan Assets: (41) Beginning Balance of Plan Assets (42) Expected Return of Plan Assets (43)Unexpected Return of Plan Assets Amount (44) Employer Contributions (45) Benefits paid during the year (46) Ending Balance of Plan Assets Indicate the funded status of the plan. Amount The ending funded status of the plan is a $ (47) net liability or underfunded over funded (48) not cisset or The beginning funded status of the plan is a $ Requirement d. Prepare the journal entry to record the current year's pension cost. (Abbreviations used: OCI = Other Comprehensive Income. Record debits first, then credits. Exclude explanations from any journal entries.) Review the conceptual journal entries from Requirement a. Account (49) Pension Expense (50) (C1-Acturial Grains / Lasses (51) Cash (52) Net Pension Liability (53) 1: More Info a. Beginning plan assets at fair value (market-related value), $580,000 b. Beginning projected benefit obligation (PVDBO), $510,000 c. Service cost for the year, $122,000 d. Settlement rate, 8% e. Expected return on plan assets, 8% f. Actual return on plan assets, $24,500 loss Current Year g. Contributions for the year, $45,400 h. Benefit payments for the year, $94,100 i. Beginning Accumulated Other Comprehensive Income, $39,000 (due to unamortized net actuarial gains) j. Past service costs awarded during the year (not effective as of the beginning of the year) for vested employees, $20,000 k. Amortization of prior service costs, $9,000 1. Decrease in the ending projected benefit obligation due to changes in actuarial assumptions (i.e., actuarial gain), $10,000 m. Average remaining service life of the employee base, 10 years 2: Requirements a. Prepare the separate "conceptual" journal entries for the relevant information above. b. Compute the pension cost for the year. C. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. d. Prepare the journal entry to record the current year's pension cost. Glass Attack, Ltd. provided you with the following information regarding its defined-benefit pension plan. Glass Attack Ltd. follows IFRS and it expects a return on plan assets equal to its settlement rate. 1(Click the icon to view the information.) Read the requirements. Requirement a. Prepare the separate "conceptual" journal entries for the relevant information above. (Abbreviations used: OCI = Other Comprehensive Income; PVDBO = Present Value of the Defined-Benefit Obligation. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by preparing the required conceptual journal entry, if any, for service costs for the current year. Account Pension Expense PVDBO Account Pension Expense Current Year PVDBO 122,000 Prepare the required conceptual journal entry, if any, for the past service costs awarded during the current year. Exclude any amortization of prior service costs. Current Year 20,000 Prepare the required conceptual journal entry, if any, for amortization of prior service costs. Account Current Year No Entry Required 122,000 Current Year Prepare the required conceptual journal entry, if any, for interest on the present value of the defined-benefit obligation (PVDBO). Account (1) Pension Expense (2) PVDBO (3) (4) Prepare the required conceptual journal entry, if any, for the expected return on plan assets. 20,000 Account (5) Pension Plan Assets (6) Pension Expense (7) (8) Prepare the required conceptual journal entry, if any, for the unexpected return on plan assets. Account Current Year (9) OCI - Acturial Gains / Losses (10) Pension Plan Assets. (11) (12) Prepare the required conceptual journal entry, if any, to adjust the PVDBO for changes in actuarial assumptions. Account Current Year (13) PVDBO (14) OCI - Acturial Gains / Losses (15) (16) Current Year Prepare the required conceptual journal entry, if any, to amortize the net actuarial gains or losses under the corridor approach. Account Current Year (17) No entry Required (18) (19) (20) Prepare the required conceptual journal entry, if any, to record contributions made to the plan during the year. Current Year Account (21) Pension Plan Assets (22) Cash (23) (24) Prepare the required conceptual journal entry, if any, to record any benefit payments made to retirees during the year. Current Year Account (25) PVDBO (26) Pension Plan Assels. (27) (28) Requirement b. Compute the pension cost for the year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviations used: PVDBO Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Components of Pension Cost: Amount (29) Service Cost (30) Interest on PYDEO (31) Expected Return on Plan Assels (32) Prior Service Cart (33) (34) Total Pension Cost Requirement c. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. Begin by selecting the labels and entering the amounts to determine the ending balance of the projected benefit obligation. (Abbreviations used: PVDBO = Present Value of the Defined-Benefit Obligation. Use parentheses or a minus sign for credit balances and for items that increase the benefit obligation. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Review the conceptual journal entries from Requirement a. Change in Benefit Obligation: (35) Beginning Balance of PVD BO (36) Service Cost (37) Past Service Cost (38) Interest on PUDEO (39) Change in Acturial Assumption (Gran)) (40) Benefits Paid during the year Ending Balance of PVDBO Select the labels and enter the amounts to determine the balance of the plan assets at the end of the year. (Use parentheses or a minus sign for items that reduce plan assets. If a box is not used in the table leave the box empty; do not selecta enter a zero.) label or Review the conceptual journal entries from Requirement a Change in Plan Assets: (41) Beginning Balance of Plan Assets (42) Expected Return of Plan Assets (43)Unexpected Return of Plan Assets Amount (44) Employer Contributions (45) Benefits paid during the year (46) Ending Balance of Plan Assets Indicate the funded status of the plan. Amount The ending funded status of the plan is a $ (47) net liability or underfunded over funded (48) not cisset or The beginning funded status of the plan is a $ Requirement d. Prepare the journal entry to record the current year's pension cost. (Abbreviations used: OCI = Other Comprehensive Income. Record debits first, then credits. Exclude explanations from any journal entries.) Review the conceptual journal entries from Requirement a. Account (49) Pension Expense (50) (C1-Acturial Grains / Lasses (51) Cash (52) Net Pension Liability (53) 1: More Info a. Beginning plan assets at fair value (market-related value), $580,000 b. Beginning projected benefit obligation (PVDBO), $510,000 c. Service cost for the year, $122,000 d. Settlement rate, 8% e. Expected return on plan assets, 8% f. Actual return on plan assets, $24,500 loss Current Year g. Contributions for the year, $45,400 h. Benefit payments for the year, $94,100 i. Beginning Accumulated Other Comprehensive Income, $39,000 (due to unamortized net actuarial gains) j. Past service costs awarded during the year (not effective as of the beginning of the year) for vested employees, $20,000 k. Amortization of prior service costs, $9,000 1. Decrease in the ending projected benefit obligation due to changes in actuarial assumptions (i.e., actuarial gain), $10,000 m. Average remaining service life of the employee base, 10 years 2: Requirements a. Prepare the separate "conceptual" journal entries for the relevant information above. b. Compute the pension cost for the year. C. Determine the ending balances of the plan assets and the projected benefit obligation and indicate the funded status of the plan. d. Prepare the journal entry to record the current year's pension cost.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Pension Work Sheet Negative sign indicates Credits Positive Sign Indicates Debits Items Balance Jan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started