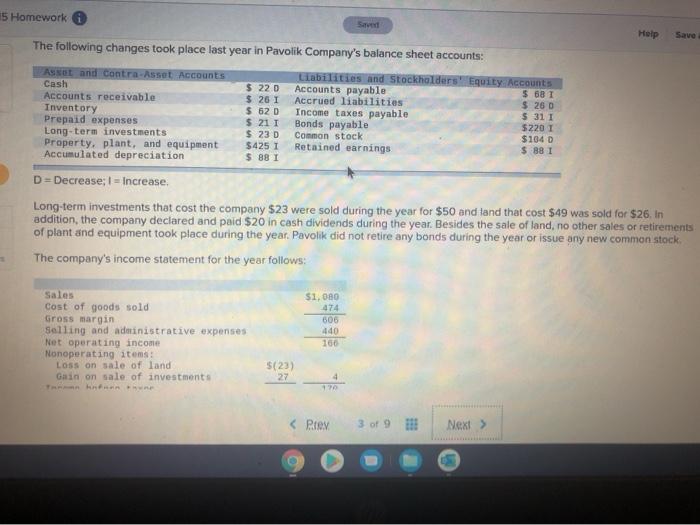

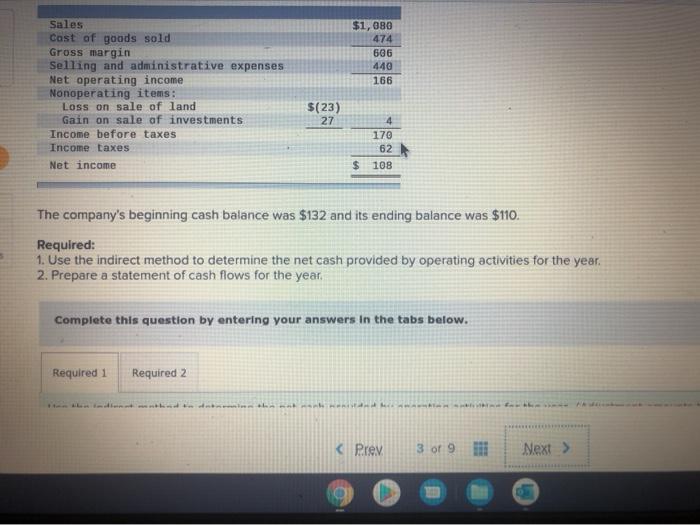

15 Homework Help Save The following changes took place last year in Pavolik Company's balance sheet accounts: ASSOL and Contra-Asset Accounts Liabilities and Stockholders' Equity Accounts Cash $ 220 Accounts payable $ 681 Accounts receivable $ 261 Accrued liabilities $ 260 Inventory $ 52 D Income taxes payable $ 31 1 Prepaid expenses $ 21 I Bonds payable 52201 Long-term investments $ 23 D Common stock $1940 Property, plant, and equipment $425 T Retained earnings $ 881 Accumulated depreciation S881 D-Decrease; I = Increase Long-term investments that cost the company $23 were sold during the year for $50 and tand that cost $49 was sold for $26. In addition, the company declared and paid $20 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock, The company's income statement for the year follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Loss on sale of land Gain on sale of investments $1,080 474 606 440 100 $(23) 27 4 17 $1,080 474 606 440 166 Sales Cast of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Loss on sale of land Gain on sale of investments Income before taxes Income taxes Net income $(23) 27 4 170 62 $ 108 The company's beginning cash balance was $132 and its ending balance was $110. Required: 1. Use the indirect method to determine the net cash provided by operating activities for the year. 2. Prepare a statement of cash flows for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 MAH Help Required 1 Required 2 Use the Indirect method to determine the net cash provided by operating activities for the year. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Pavol Company Statement of Cash Fler portion Required 2 > 3 of 9 Prepare a statement of cash flows for the year. (List any deduction in cash and canh outflows negative amounts Statement of an Flow Operating activities Investing activities Financing activities Beginning cash and cash equivalents Ending cash and cash equivalents