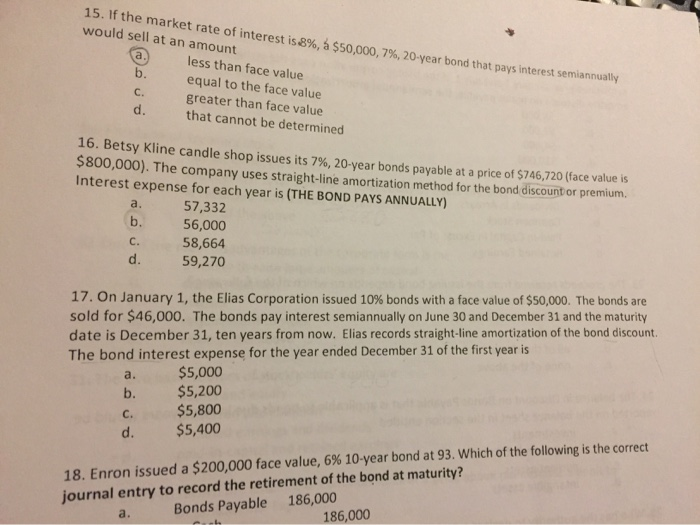

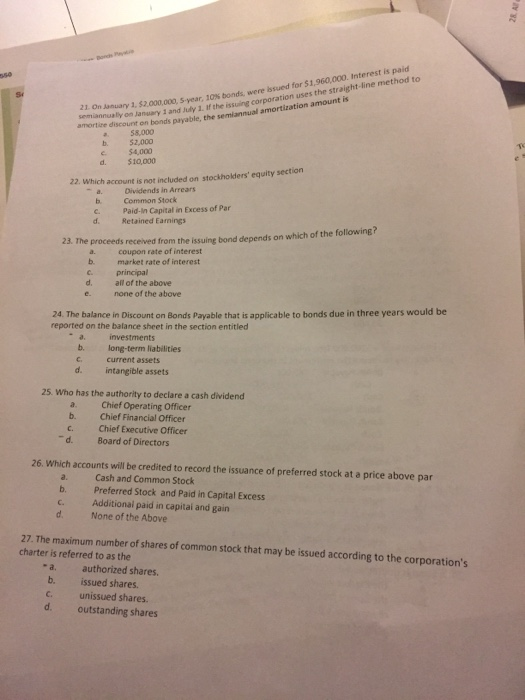

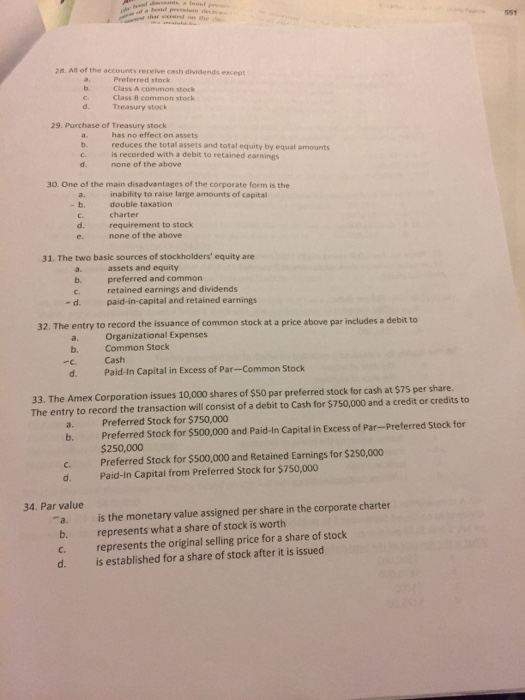

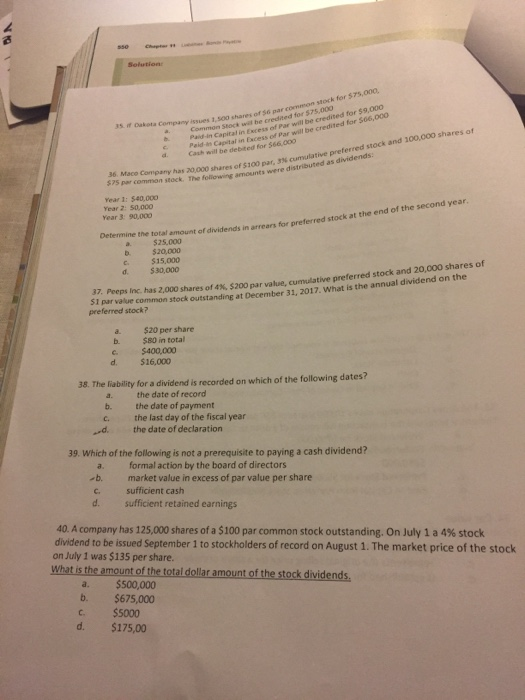

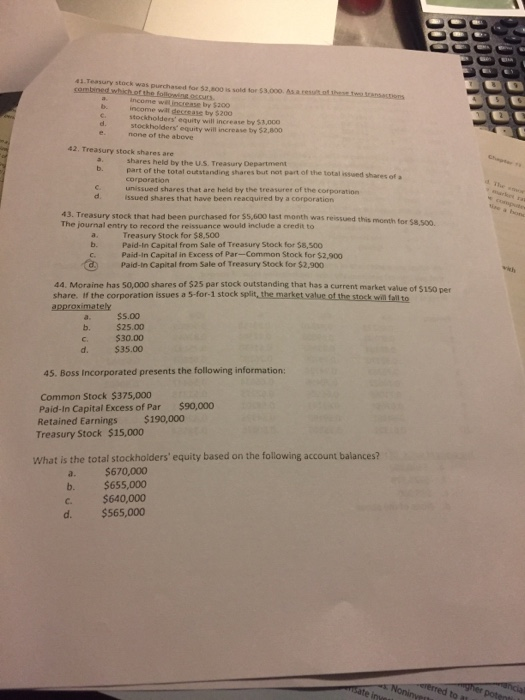

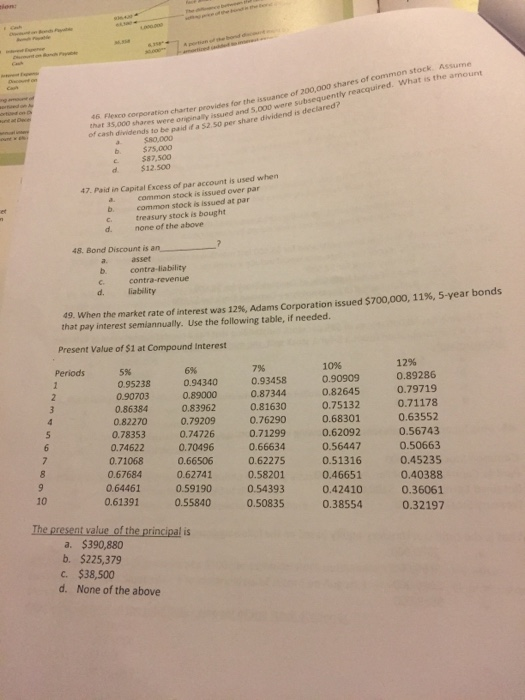

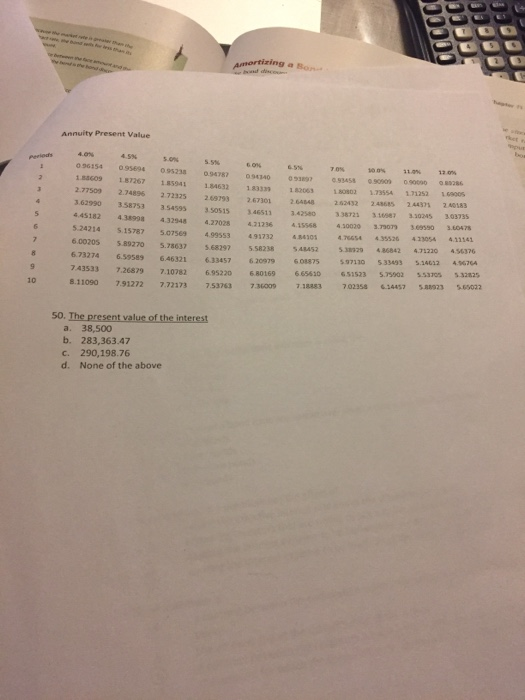

15. If the market rate of interest is 8%, $50,000, 7%, 20-year bond that pays interest semiannually would sell at an amount less than face value equal to the face value greater than face value that cannot be determined 16. Betsy Kline candle shop issues its 7%, 20-vear bonds payable at a price of $746,720 (face valve $800,000). The company uses straight-line amortization method for the bond discount or premium Interest expense for each year is (THE BOND PAYS ANNUALLY) 57,332 56,000 b. 58,664 59,270 17. On January 1, the Elias Corporation issued 10% bonds with a face value of $50,000. The bonds are sold for $46,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, ten years from now. Elias records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 of the first year is a. $5,000 $5,200 $5,800 $5,400 C. 18. Enron issued a $200,000 face value, 6% 10-year bond at 93. Which of the following is the correct journal entry to record the retirement of the bond at maturity? a. Bonds Payable 186,000 186,000 2LAR on January 12.000.000, Svear. O bonds were issued for 51,960,000. Interest is paid A yon January 1 and July 1. If the i ncorporation uses the straight-line method to orice discount on bonds payable, the semiannual amortization amounts . $2.000 $4,000 $10.000 22. Which account is not included on stockholders' equity section Dividends in Arrears Common Stock Paid in Capital in Excess of Par Retained Earnings 23. The proceeds received from the issuine band depends on which of the following coupon rate of interest market rate of interest principal all of the above none of the above 24. The balance in Discount on Bonds Payable that is applicable to bonds due in three years would be reported on the balance sheet in the section entitled investments long-term liabilities current assets intangible assets 25. Who has the authority to declare a cash dividend a. Chief Operating Officer b. Chief Financial Officer C Chief Executive Officer Board of Directors dRadle 26. Which accounts will be credited to record the issuance of preferred stock at a price above par Cash and Common Stock Preferred Stock and Paid in Capital Excess Additional paid in capital and gain None of the Above d. 27. The maximum number of shares of common stock that may be issued according to the corporation's charter is referred to as the - a. authorized shares. b. issued shares. unissued shares. d. outstanding shares 2. All of the accounts receive cash dividends except Class A common stock Class B common stock Treasury stock 29. Purchase of Treasury stock has no effect on assets reduces the total assets and total equity by equal amounts is recorded with a debit to retained earnings none of the above 30. One of the main disadvantages of the corporate form is the inability to raise large amounts of capital double taxation charter requirement to stock none of the above 31. The two basic sources of stockholders' equity are assets and equity b. preferred and common retained earnings and dividends d. paid-in-capital and retained earnings 32. The entry to record the issuance of common stock at a price above par includes a debit to Organizational Expenses Common Stock Cash d. Paid-In Capital in Excess of Par-Common Stock 33. The Amex Corporation issues 10,000 shares of $50 par preferred stock for cash at $75 per share. The entry to record the transaction will consist of a debit to Cash for $750,000 and a credit or credits to Preferred Stock for $750,000 b. Preferred Stock for $500,000 and Paid-In Capital in Excess of Par-Preferred Stock for $250,000 C. Preferred Stock for $500,000 and Retained Earnings for $250,000 Paid-In Capital from Preferred Stock for $750,000 34. Par value b. is the monetary value assigned per share in the corporate charter represents what a share of stock is worth represents the original selling price for a share of stock is established for a share of stock after it is issued c. d. Solution 5. Data company issues 1.500 shares of 56 Common stock will be created So shares of sonar common stock for $75.000 575.000 - Capital in res of Paribe credited for $9.000 Paid Capital Fress of Par will be credited for $6,000 Casill be debited for 566.000 000 shares of $100 par cumulative preferred stock and 100.000 shares of Hack The following amounts were distributed as dividends. 36. Mace company has 20,000 shares of 10 $75 par common stock The Year 1500.000 Year: 50.000 Year 3 90,000 total amount of dividends in arrears for preferred stock at the end of the second year Determine the total amount of divide $25.000 $20,000 $15,000 $ 30,000 Peeps Inc. has 2,000 shares of 4 $200 par value cumulative preferred stock and 20,000 shares of par le common stock outstanding at December 31, 2017. What is the annual dividend on the preferred stock? $20 per share $80 in total $400,000 $16.000 38. The liability for a dividend is recorded on which of the following dates? the date of record the date of payment the last day of the fiscal year d the date of declaration 39. Which of the following is not a prerequisite to paying a cash dividend? formal action by the board of directors market value in excess of par value per share c. sufficient cash d. sufficient retained earnings 40. A company has 125,000 shares of a $100 par common stock outstanding. On July 1 a 4% stock dividend to be issued September 1 to stockholders of record on August 1. The market price of the stock on July 1 was $135 per share. What is the amount of the total dollar amount of the stock dividends. a. $500,000 b. $675,000 $5000 d. $175,00 Teasury stack was purchased $2.500 53.000 income will cree by $100 income will decrease by $200 stockholders' equity will increase by $3000 stockholders' equity will increase by 52.800 none of the above 42. Treasury stock shares are shares held by the US Treasury Department part of the total outstanding shares but not part of the total issued shares of corporation unissued shares that are held by the treasurer of the corporation issued shares that have been reacquired by a corporation 43. Treasury stock that had been purchased for $5,600 last month was reissued this month The journal entry to record the reissuance would include a credit to Treasury Stock for $8,500 Paid-in Capital from Sale of Treasury Stock for $8.500 Paid-in Capital in Excess of Par-Common Stock for $2.900 Paid-in Capital from Sale of Treasury Stock for $2.900 44. Moraine has 50,000 shares of $25 par stock outstanding that has a current market value of Sie share. If the corporation issues a 5-for-1 stock split, the market value of the stock will fall to approximately $5.00 b. $25.00 c. $30.00 $35.00 45. Boss Incorporated presents the following information: Common Stock $375,000 Paid-in Capital Excess of Par $90,000 Retained Earnings $190,000 Treasury Stock $15,000 What is the total stockholders' equity based on the following account balances? $670,000 $655,000 $640,000 $565,000 d. crerred to Noninven Tsate in grer poten mancial 16 F o corporation charte that of cash charter provides for the issuance of 200,000 shares of common stock. Assum were only issued and 5.000 were subsequently reacquired. What is the amount Us to be paid ifas per share dividend is declared? CRO.000 $75.000 $87.500 $12.500 47. Paid in Capital Excess of par account is used when common stock is issued over par common stock is issued at par treasury stock is bought none of the above 48. Bond Discount is an asset contra-liability contra revenue liability 49. When the market rate of interest was 12%, Adams Corporation issued $700,000, 11%, 5-year bonds that pay interest semiannually. Use the following table, if needed. Present Value of $1 at Compound Interest Periods 5% 6% 0.95238 0.90703 0.86384 0.82270 0.78353 0.74622 0.71068 0.67684 0.64461 0.61391 0.94340 0.89000 0.83962 0.79209 0.74726 0.70496 0.66506 0.62741 0.59190 0.55840 7% 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 0.54393 0.50835 10% 0.90909 0.82645 0.75132 0.68301 0.62092 0.56447 0.51316 0.46651 0.42410 0.38554 12% 0.89286 0.79719 0.71178 0.63552 0.56743 0.50663 0.45235 0.40388 0.36061 0.32197 The present value of the principal is a. $390,880 b. $225,379 C. $38,500 d. None of the above 10 mortizing Annuity Present Value 4.0% 1 9 2.77509 3.62990 5.24214 6.00205 6.73274 7.43533 8.11090 137267 1841 1.84632 2.748963725 2.69793 3.58753 35455 3.50515 4.22028 S15787 5.07569 4.99553 S29270 5.78637 5.68297 6.5959 6.46321 633457 7.26879 7.1073) 695220 7.91272 772173753761 6 ON 040 1 12 2.67301 346511 4,21236 491732 5.58238 6 20979 6 0169 76009 6.5 7.0 0 1 13.0 000 12063 1 O 1.73554 171252 SOOS 2.6414 26242 243 244 240183 1.450 338721 1 7 3.10245 303735 4.15568 4.10020 3.79079 3.60478 4 4.766 35526 413054 4.11141 SALAS 5329 436842 4.7120456376 608875 5.97110 533493 5.14612 4.9676A 6.65630 6.51523 5.7903 553105 5:32625 1 3 7.02358 6.14457 51923 5.69022 50. The present value of the interest a. 38,500 b. 283,363.47 c. 290,198.76 d. None of the above