1-5 im stuck

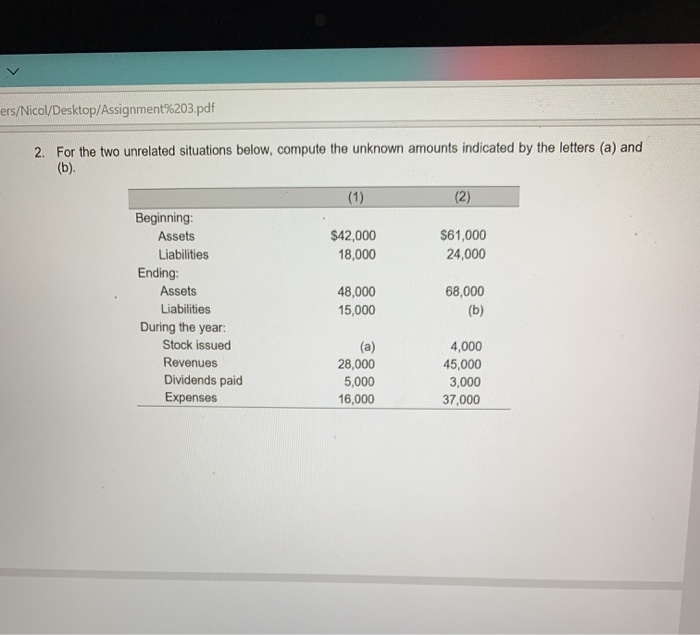

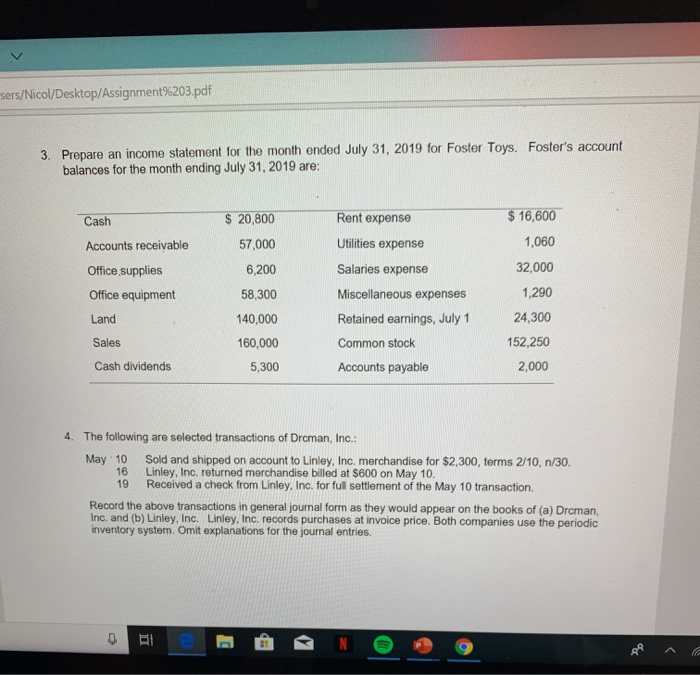

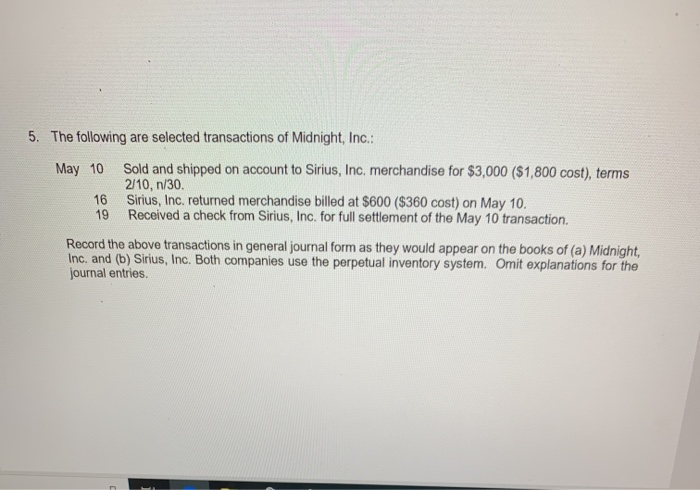

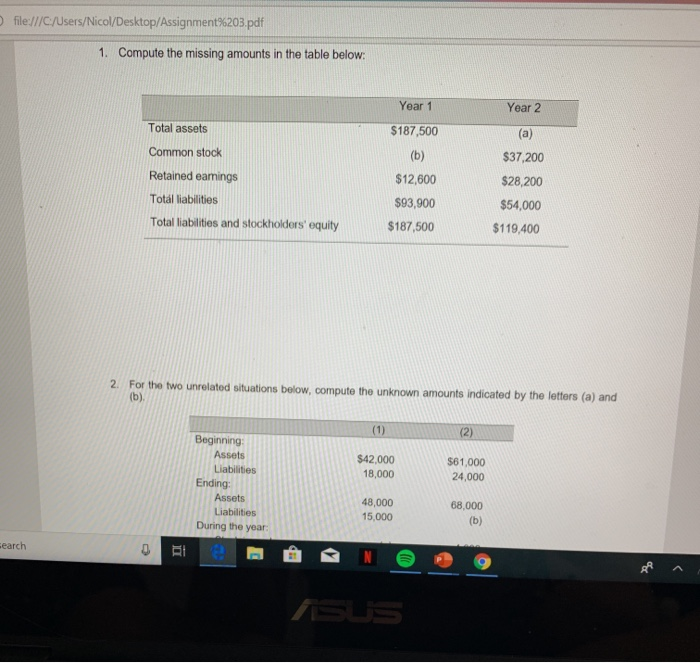

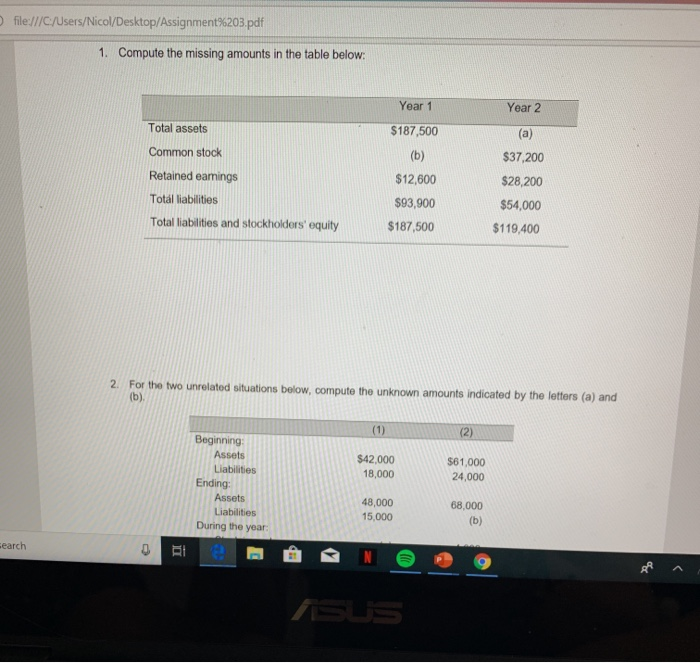

file:///C:/Users/Nicol/Desktop/Assignment%203.pdf 1. Compute the missing amounts in the table below: Year 2 Year 1 $187,500 (b) Total assets Common stock Retained earings Total liabilities Total liabilities and stockholders' equity $37,200 $28,200 $12,600 $93,900 $187,500 $54,000 $119.400 2. For the two unrelated situations below, compute the unknown amounts indicated by the letters (a) and (b). (1) (2) $42,000 18,000 Beginning Assets Liabilities Ending Assets Liabilities During the year: $61,000 24,000 48,000 15,000 68,000 (b) Fearch ers/Nicol/Desktop/Assignment%203.pdf 2. For the two unrelated situations below, compute the unknown amounts indicated by the letters (a) and (1) (2) $42,000 18,000 $61,000 24,000 68,000 Beginning: Assets Liabilities Ending: Assets Liabilities During the year: Stock issued Revenues Dividends paid Expenses 48,000 15,000 (b) (a) 28,000 5,000 16,000 4,000 45,000 3,000 37,000 sers/Nicol/Desktop/Assignment%203.pdf 3. Prepare an income statement for the month ended July 31, 2019 for Foster Toys. Foster's account balances for the month ending July 31, 2019 are: $ 20,800 Rent expense $ 16,600 Utilities expense Cash Accounts receivable Office supplies Office equipment Salaries expense 1,060 32,000 1,290 57.000 6,200 58,300 140,000 160,000 5,300 Land 24,300 Miscellaneous expenses Retained earnings, July 1 Common stock Accounts payable Sales 152,250 Cash dividends 2,000 4. The following are selected transactions of Droman, Inc.: May 10 Sold and shipped on account to Linley, Inc, merchandise for $2,300, terms 2/10, n/30. 16 Linley, Inc. returned merchandise billed at $600 on May 10. 19 Received a check from Linley, Inc. for ful settlement of the May 10 transaction. Record the above transactions in general journal form as they would appear on the books of (a) Droman. Inc. and (b) Linley, Inc. Linley, Inc. records purchases at invoice price. Both companies use the periodic inventory system. Omit explanations for the journal entries. 5. The following are selected transactions of Midnight, Inc.: May 10 Sold and shipped on account to Sirius, Inc. merchandise for $3,000 ($1,800 cost), terms 2/10, n/30. 16 Sirius, Inc. returned merchandise billed at $600 ($360 cost) on May 10. 19 Received a check from Sirius, Inc. for full settlement of the May 10 transaction. Record the above transactions in general journal form as they would appear on the books of (a) Midnight, Inc. and (b) Sirius, Inc. Both companies use the perpetual inventory system. Omit explanations for the journal entries

1-5 im stuck

1-5 im stuck