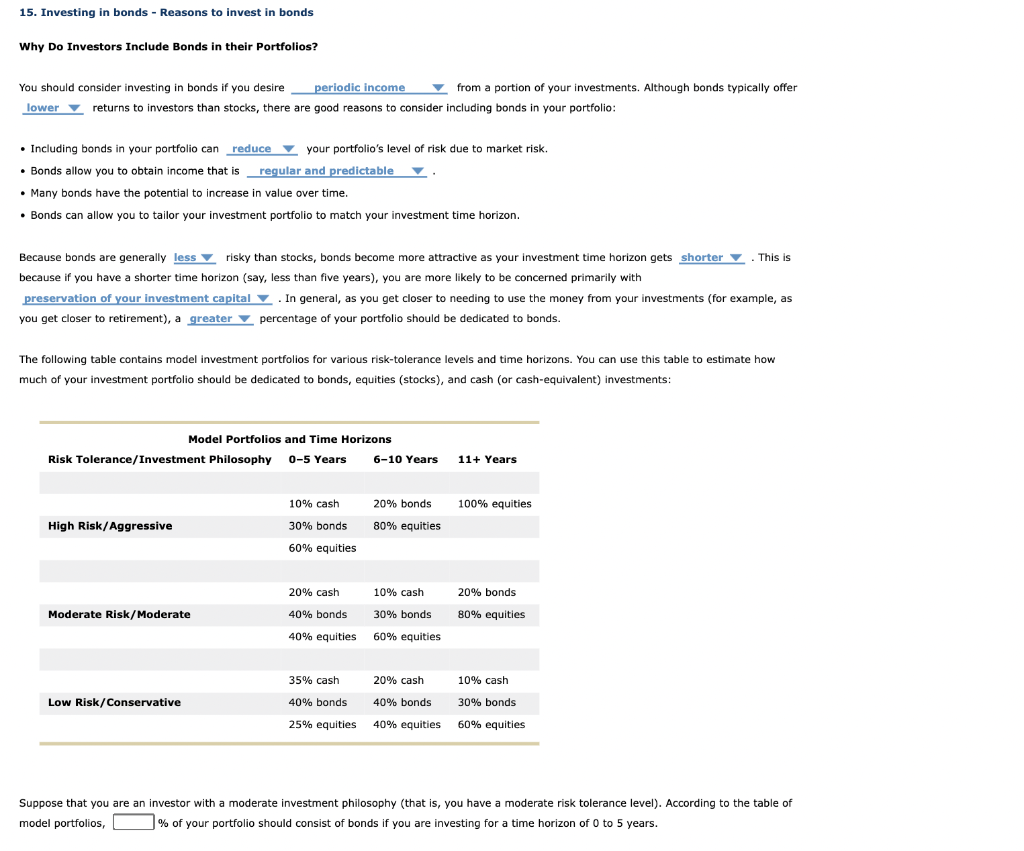

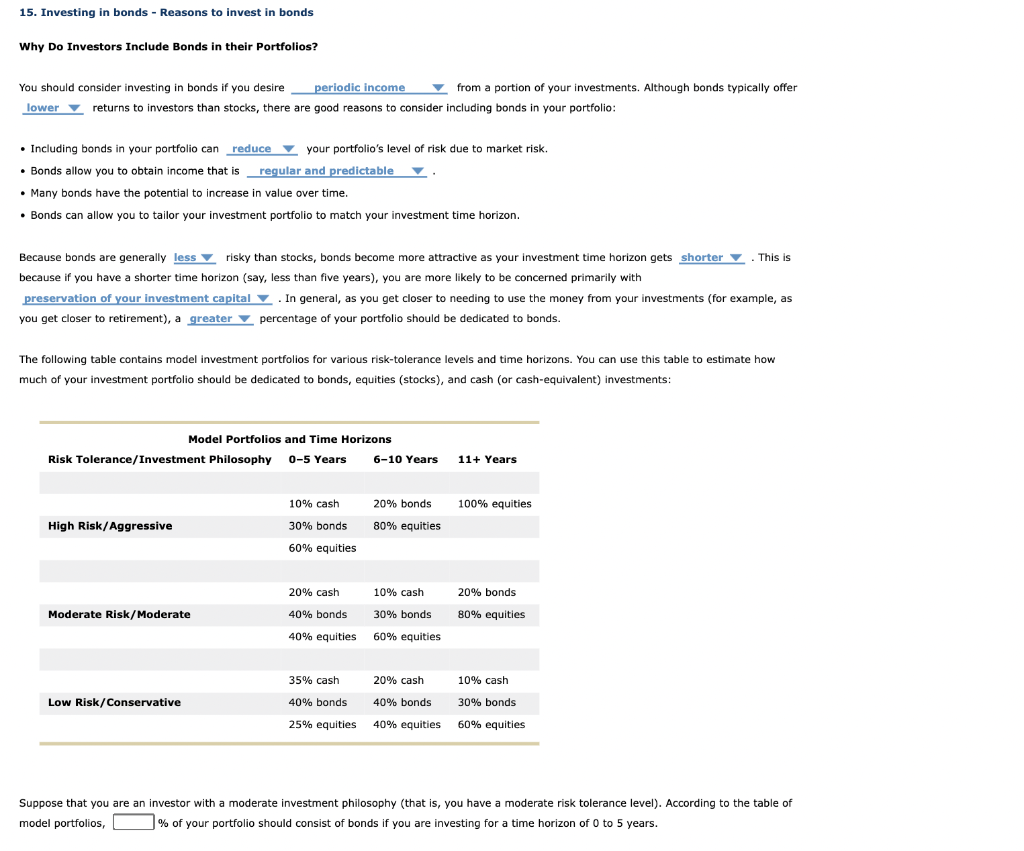

15. Investing in bonds - Reasons to invest in bonds Why Do Investors Include Bonds in their Portfolios? You should consider investing in bonds if you desire periodic income from a portion of your investments. Although bonds typically offer lower returns to investors than stocks, there are good reasons to consider including bonds in your portfolio: Including bonds in your portfolio can reduce your portfolio's level of risk due to market risk. Bonds allow you to obtain income that is regular and predictable Many bonds have the potential to increase in value over time. Bonds can allow you to tailor your investment portfolio to match your investment time horizon. Because bonds are generally less risky than stocks, bonds become more attractive as your investment time horizon gets shorter This is because if you have a shorter time horizon (say, less than five years), you are more likely to be concerned primarily with preservation of your investment capital. In general, as you get closer to needing to use the money from your investments (for example, as you get closer to retirement), a greater percentage of your portfolio should be dedicated to bonds. , The following table contains model investment portfolios for various risk-tolerance levels and time horizons. You can use this table to estimate how much of your investment portfolio should be dedicated to bonds, equities (stocks), and cash (or cash-equivalent) investments: Model Portfolios and Time Horizons Risk Tolerance/Investment Philosophy 0-5 Years / 6-10 Years 11+ Years 100% equities % 10% cash 30% bonds 60% equities % 20% bonds 80% equities High Risk/Aggressive 20% bonds Moderate Risk/Moderate / 20% cash 10% cash 40% bonds % 30% bonds % 40% equities 60% equities 80% equities Low Risk/Conservative 35% cash 20% cash 10% cash 40% bonds 40% bonds 30% bonds 25% equities 40% equities 60% equities Suppose that you are an investor with a moderate investment philosophy (that is, you have a moderate risk tolerance level). According to the table of model portfolios, % of your portfolio should consist of bonds if you are investing for a time horizon of 0 to 5 years. 15. Investing in bonds - Reasons to invest in bonds Why Do Investors Include Bonds in their Portfolios? You should consider investing in bonds if you desire periodic income from a portion of your investments. Although bonds typically offer lower returns to investors than stocks, there are good reasons to consider including bonds in your portfolio: Including bonds in your portfolio can reduce your portfolio's level of risk due to market risk. Bonds allow you to obtain income that is regular and predictable Many bonds have the potential to increase in value over time. Bonds can allow you to tailor your investment portfolio to match your investment time horizon. Because bonds are generally less risky than stocks, bonds become more attractive as your investment time horizon gets shorter This is because if you have a shorter time horizon (say, less than five years), you are more likely to be concerned primarily with preservation of your investment capital. In general, as you get closer to needing to use the money from your investments (for example, as you get closer to retirement), a greater percentage of your portfolio should be dedicated to bonds. , The following table contains model investment portfolios for various risk-tolerance levels and time horizons. You can use this table to estimate how much of your investment portfolio should be dedicated to bonds, equities (stocks), and cash (or cash-equivalent) investments: Model Portfolios and Time Horizons Risk Tolerance/Investment Philosophy 0-5 Years / 6-10 Years 11+ Years 100% equities % 10% cash 30% bonds 60% equities % 20% bonds 80% equities High Risk/Aggressive 20% bonds Moderate Risk/Moderate / 20% cash 10% cash 40% bonds % 30% bonds % 40% equities 60% equities 80% equities Low Risk/Conservative 35% cash 20% cash 10% cash 40% bonds 40% bonds 30% bonds 25% equities 40% equities 60% equities Suppose that you are an investor with a moderate investment philosophy (that is, you have a moderate risk tolerance level). According to the table of model portfolios, % of your portfolio should consist of bonds if you are investing for a time horizon of 0 to 5 years