Answered step by step

Verified Expert Solution

Question

1 Approved Answer

# 15 its two answers B is correct what is the other one 16 82/take Operating Expenses 750,000 Interest 100,000 Tax on Profits 90,000 It

# 15 its two answers

B is correct what is the other one

16

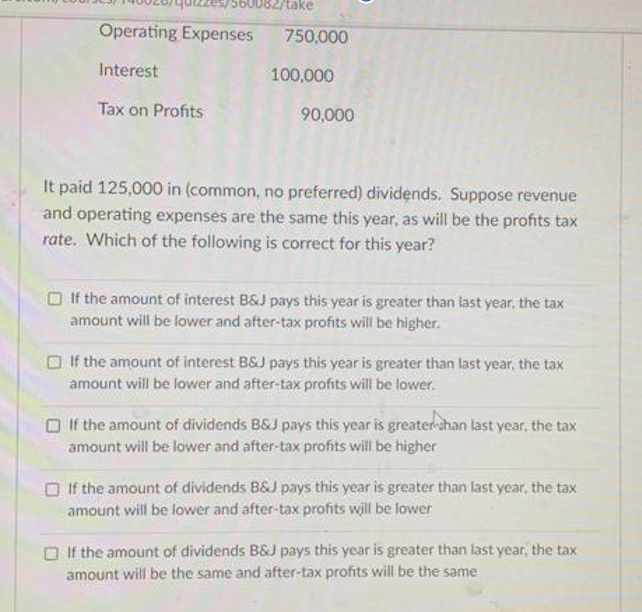

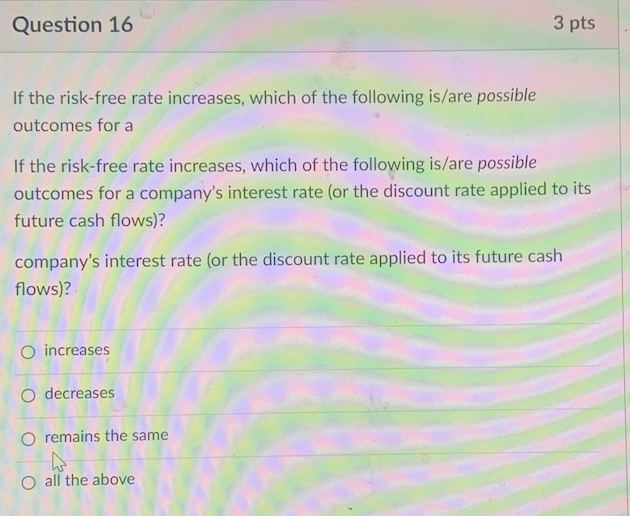

82/take Operating Expenses 750,000 Interest 100,000 Tax on Profits 90,000 It paid 125,000 in (common, no preferred) dividends. Suppose revenue and operating expenses are the same this year, as will be the profits tax rate. Which of the following is correct for this year? If the amount of interest B&J pays this year is greater than last year, the tax amount will be lower and after-tax profits will be higher. If the amount of interest B&J pays this year is greater than last year, the tax amount will be lower and after-tax profits will be lower. If the amount of dividends B&J pays this year is greaterlhan last year, the tax amount will be lower and after-tax prohts will be higher If the amount of dividends B&J pays this year is greater than last year, the tax amount will be lower and after-tax profits will be lower If the amount of dividends B&J pays this year is greater than last year, the tax amount will be the same and after-tax profits will be the same Question 16 3 pts If the risk-free rate increases, which of the following is/are possible outcomes for a If the risk-free rate increases, which of the following is/are possible outcomes for a company's interest rate (or the discount rate applied to its future cash flows)? company's interest rate (or the discount rate applied to its future cash flows)? o increases O decreases O remains the same O all the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started