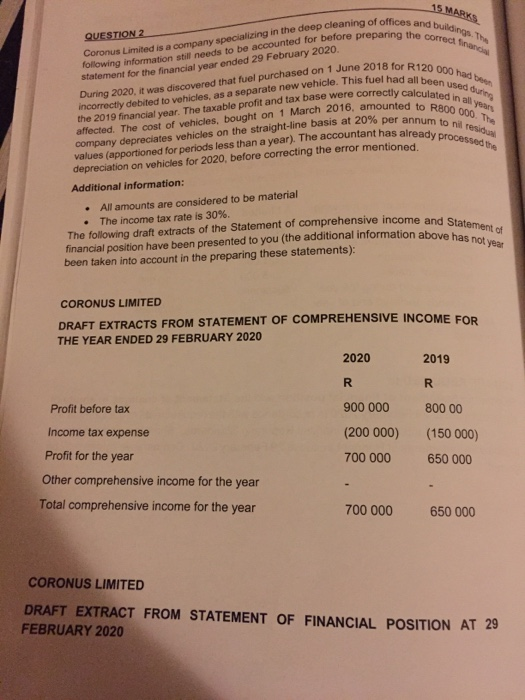

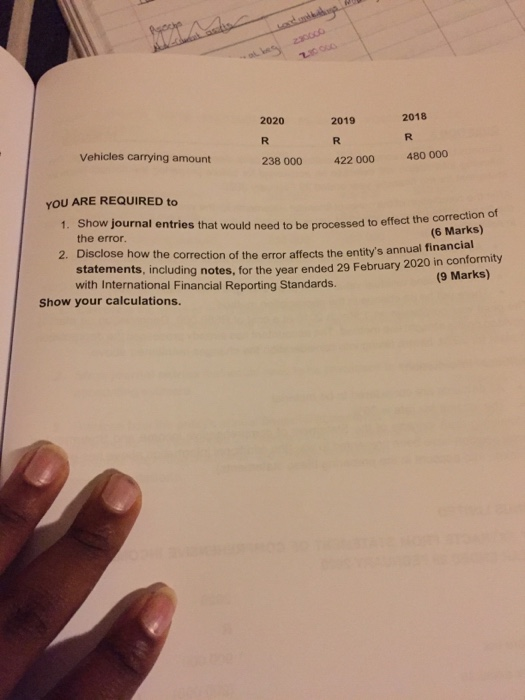

15 MARKS QUESTION 2 statement for the financial year ended 29 February 2020 Coronus Limited is a company specializing in the deep cleaning of offices and buildings. The following information still needs to be accounted for before preparing the correction incorrectly debited to vehicles, as a separate new vehicle. This fuel had all been used during During 2020, it was discovered that fuel purchased on 1 June 2018 for R120 000 had been the 2019 financial year. The taxable profit and tax base were correctly calculated in all your company depreciates vehicles on the straight-line basis at 20% per annum to ni residual affected. The cost of vehicles, bought on 1 March 2016, amounted to R800 000. The values (apportioned for periods less than a year). The accountant has already processed the The following draft extracts of the Statement of comprehensive income and Statement of financial position have been presented to you (the additional information above has not year . depreciation on vehicles for 2020, before correcting the error mentioned Additional information: All amounts are considered to be material The income tax rate is 30%. been taken into account in the preparing these statements): CORONUS LIMITED DRAFT EXTRACTS FROM STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 29 FEBRUARY 2020 2020 2019 R R Profit before tax 900 000 800 00 (200 000) (150 000) 650 000 700 000 Income tax expense Profit for the year Other comprehensive income for the year Total comprehensive income for the year 700 000 650 000 CORONUS LIMITED DRAFT EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 29 FEBRUARY 2020 2 2020 2019 2018 R R R Vehicles carrying amount 238 000 422 000 480 000 YOU ARE REQUIRED to 1. Show journal entries that would need to be processed to effect the correction of the error. (6 Marks) 2. Disclose how the correction of the error affects the entity's annual financial statements, including notes, for the year ended 29 February 2020 in conformity with International Financial Reporting Standards. (9 Marks) Show your calculations. 15 MARKS QUESTION 2 statement for the financial year ended 29 February 2020 Coronus Limited is a company specializing in the deep cleaning of offices and buildings. The following information still needs to be accounted for before preparing the correction incorrectly debited to vehicles, as a separate new vehicle. This fuel had all been used during During 2020, it was discovered that fuel purchased on 1 June 2018 for R120 000 had been the 2019 financial year. The taxable profit and tax base were correctly calculated in all your company depreciates vehicles on the straight-line basis at 20% per annum to ni residual affected. The cost of vehicles, bought on 1 March 2016, amounted to R800 000. The values (apportioned for periods less than a year). The accountant has already processed the The following draft extracts of the Statement of comprehensive income and Statement of financial position have been presented to you (the additional information above has not year . depreciation on vehicles for 2020, before correcting the error mentioned Additional information: All amounts are considered to be material The income tax rate is 30%. been taken into account in the preparing these statements): CORONUS LIMITED DRAFT EXTRACTS FROM STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 29 FEBRUARY 2020 2020 2019 R R Profit before tax 900 000 800 00 (200 000) (150 000) 650 000 700 000 Income tax expense Profit for the year Other comprehensive income for the year Total comprehensive income for the year 700 000 650 000 CORONUS LIMITED DRAFT EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 29 FEBRUARY 2020 2 2020 2019 2018 R R R Vehicles carrying amount 238 000 422 000 480 000 YOU ARE REQUIRED to 1. Show journal entries that would need to be processed to effect the correction of the error. (6 Marks) 2. Disclose how the correction of the error affects the entity's annual financial statements, including notes, for the year ended 29 February 2020 in conformity with International Financial Reporting Standards. (9 Marks) Show your calculations