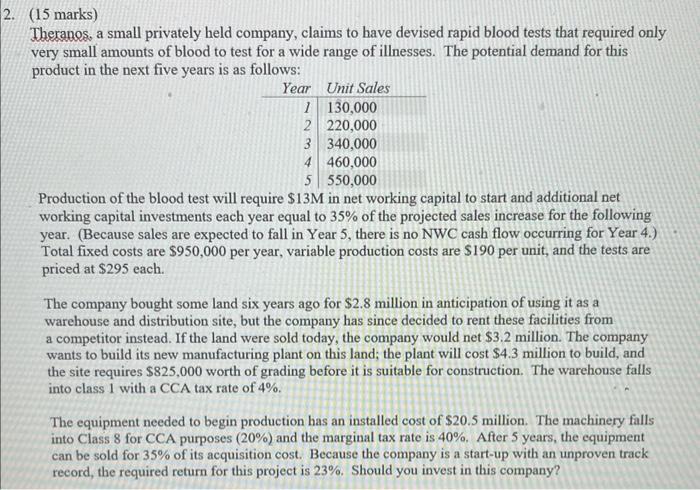

(15 marks) Theranes, a small privately held company, claims to have devised rapid blood tests that required only very small amounts of blood to test for a wide range of illnesses. The potential demand for this product in the next five years is as follows: Production of the blood test will require $13M in net working capital to start and additional net working capital investments each year equal to 35% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5 , there is no NWC cash flow occurring for Year 4.) Total fixed costs are $950,000 per year, variable production costs are $190 per unit, and the tests are priced at $295 each. The company bought some land six years ago for $2.8 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $3.2 million. The company wants to build its new manufacturing plant on this land; the plant will cost $4.3 million to build, and the site requires $825,000 worth of grading before it is suitable for construction. The warehouse falls into class 1 with a CCA tax rate of 4%. The equipment needed to begin production has an installed cost of $20.5 million. The machinery falls into Class 8 for CCA purposes (20%) and the marginal tax rate is 40%. After 5 years, the equipment can be sold for 35% of its acquisition cost. Because the company is a start-up with an unproven track record, the required return for this project is 23%. Should you invest in this company? (15 marks) Theranes, a small privately held company, claims to have devised rapid blood tests that required only very small amounts of blood to test for a wide range of illnesses. The potential demand for this product in the next five years is as follows: Production of the blood test will require $13M in net working capital to start and additional net working capital investments each year equal to 35% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5 , there is no NWC cash flow occurring for Year 4.) Total fixed costs are $950,000 per year, variable production costs are $190 per unit, and the tests are priced at $295 each. The company bought some land six years ago for $2.8 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $3.2 million. The company wants to build its new manufacturing plant on this land; the plant will cost $4.3 million to build, and the site requires $825,000 worth of grading before it is suitable for construction. The warehouse falls into class 1 with a CCA tax rate of 4%. The equipment needed to begin production has an installed cost of $20.5 million. The machinery falls into Class 8 for CCA purposes (20%) and the marginal tax rate is 40%. After 5 years, the equipment can be sold for 35% of its acquisition cost. Because the company is a start-up with an unproven track record, the required return for this project is 23%. Should you invest in this company