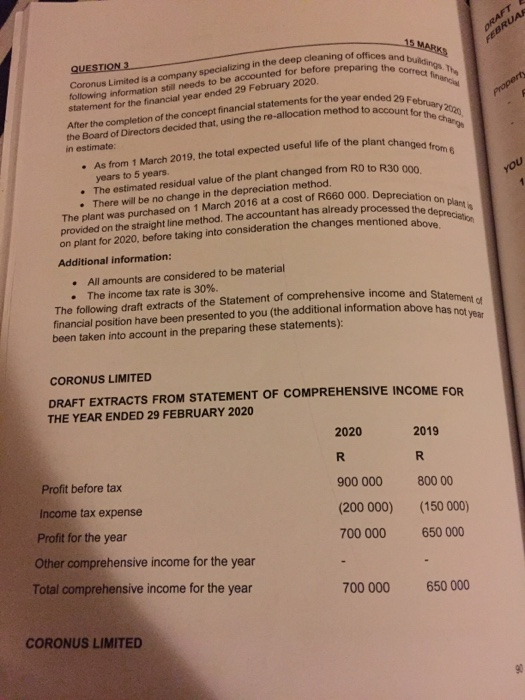

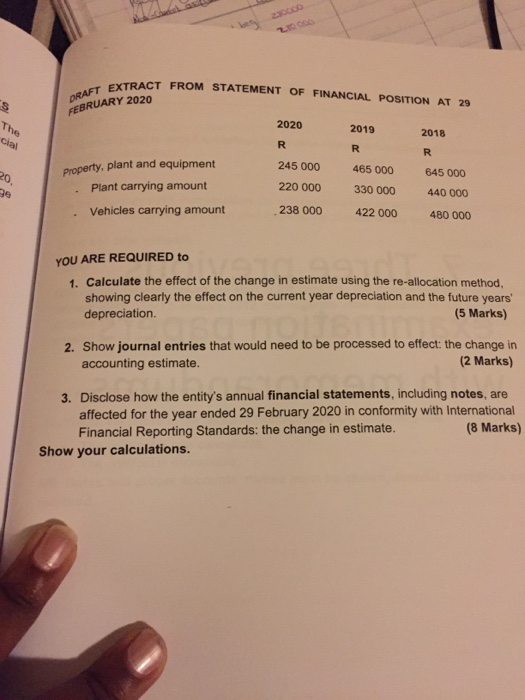

15 MARS FEBRUAR QUESTION 3 Property statement for the financial year ended 29 February 2020. Coronus Limited is a company specializing in the deep cleaning of offices and buildings. The following information still needs to be accounted for before preparing the corred After the completion of the concept financial statements for the year ended 29 February 2020 As from 1 March 2019, the total expected useful life of the plant changed from The plant was purchased on 1 March 2016 at a cost of R660 000. Depreciation on plants provided on the straight line method. The accountant has already processed the depreciation The following draft extracts of the Statement of comprehensive income and Statement of to to . in estimate: YOU 1 years to 5 years. The estimated residual value of the plant changed from RO to R30 000 There will be no change in the depreciation method. on plant for 2020, before taking into consideration the changes mentioned above Additional information: All amounts are considered to be material The income tax rate is 30%. financial position have been presented to you the additional information above has not your been account ) CORONUS LIMITED DRAFT EXTRACTS FROM STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 29 FEBRUARY 2020 2020 2019 R R 900 000 800 00 Profit before tax Income tax expense (200 000) 700 000 (150 000) 650 000 Profit for the year Other comprehensive income for the year Total comprehensive income for the year 700 000 650 000 CORONUS LIMITED 90 DRAFT EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 29 bus 2.30000 s FEBRUARY 2020 The 2020 2019 2018 cial R R R 245 000 465 000 20, 645 000 property, plant and equipment Plant carrying amount Vehicles carrying amount 220 000 330 000 440 000 238 000 422 000 480 000 YOU ARE REQUIRED to 1. Calculate the effect of the change in estimate using the re-allocation method, showing clearly the effect on the current year depreciation and the future years depreciation (5 Marks) 2. Show journal entries that would need to be processed to effect: the change in accounting estimate. (2 Marks) 3. Disclose how the entity's annual financial statements, including notes, are affected for the year ended 29 February 2020 in conformity with International Financial Reporting Standards: the change in estimate. (8 Marks) Show your calculations