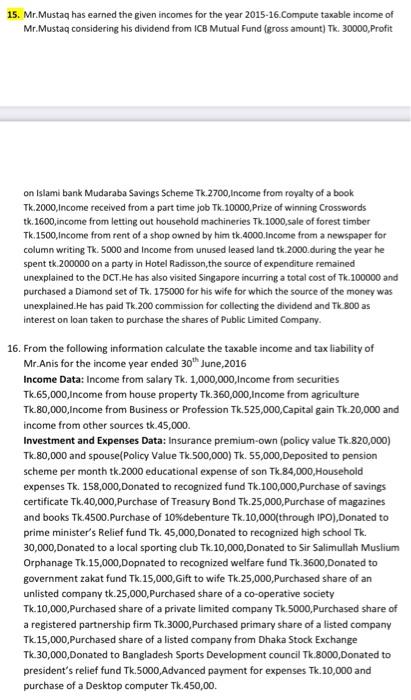

15. Mr. Mustaq has earned the given incomes for the year 2015-16.Compute taxable income of Mr. Mustaq considering his dividend from ICB Mutual Fund (gross amount) Tk. 30000, Profit on Islami bank Mudaraba Savings Scheme Tk.2700, income from royalty of a book Tk. 2000, Income received from a part time job Tk. 10000, Prize of winning Crosswords tk. 1600, income from letting out household machineries Tk. 1000, sale of forest timber Tk. 1500,Income from rent of a shop owned by him tk.4000.Income from a newspaper for column writing Tk. 5000 and Income from unused leased land tk. 2000. during the year he spent tk 200000 on a party in Hotel Radisson, the source of expenditure remained unexplained to the DCT.He has also visited Singapore incurring a total cost of Tk.100000 and purchased a Diamond set of Tk. 175000 for his wife for which the source of the money was unexplained.He has paid Tk.200 commission for collecting the dividend and Tk 800 as interest on loan taken to purchase the shares of Public Limited Company. 16. From the following information calculate the taxable income and tax liability of Mr.Anis for the income year ended 30 June 2016 Income Data: Income from salary Tk. 1,000,000,Income from securities Tk.65,000,Income from house property Tk. 360,000,Income from agriculture Tk.80,000,Income from Business or Profession Tk.525,000, Capital gain Tk.20,000 and income from other sources tk. 45,000 Investment and Expenses Data: Insurance premium-own (policy value Tk.820,000) Tk.80,000 and spouse(Policy Value Tk.500,000) Tk. 55,000, Deposited to pension scheme per month tk. 2000 educational expense of son Tk.84,000, Household expenses Tk. 158,000, Donated to recognized fund Tk.100,000, Purchase of savings certificate Tk.40,000, Purchase of Treasury Bond Tk.25,000, Purchase of magazines and books Tk. 4500. Purchase of 10%debenture Tk. 10,000(through IPO),Donated to prime minister's Relief fund Tk. 45,000,Donated to recognized high school Tk. 30,000, Donated to a local sporting club Tk. 10,000,Donated to Sir Salimullah Muslium Orphanage Tk.15,000, Dopnated to recognized welfare fund Tk. 3600, Donated to government zakat fund Tk. 15,000, Gift to wife Tk.25,000, Purchased share of an unlisted company tk. 25,000, Purchased share of a co-operative society Tk.10,000, Purchased share of a private limited company Tk. 5000, Purchased share of a registered partnership firm Tk. 3000, Purchased primary share of a listed company Tk.15,000, Purchased share of a listed company from Dhaka Stock Exchange Tk. 30,000,Donated to Bangladesh Sports Development council Tk.8000, Donated to president's relief fund Tk.5000, Advanced payment for expenses Tk. 10,000 and purchase of a Desktop computer Tk.450,00 15. Mr. Mustaq has earned the given incomes for the year 2015-16.Compute taxable income of Mr. Mustaq considering his dividend from ICB Mutual Fund (gross amount) Tk. 30000, Profit on Islami bank Mudaraba Savings Scheme Tk.2700, income from royalty of a book Tk. 2000, Income received from a part time job Tk. 10000, Prize of winning Crosswords tk. 1600, income from letting out household machineries Tk. 1000, sale of forest timber Tk. 1500,Income from rent of a shop owned by him tk.4000.Income from a newspaper for column writing Tk. 5000 and Income from unused leased land tk. 2000. during the year he spent tk 200000 on a party in Hotel Radisson, the source of expenditure remained unexplained to the DCT.He has also visited Singapore incurring a total cost of Tk.100000 and purchased a Diamond set of Tk. 175000 for his wife for which the source of the money was unexplained.He has paid Tk.200 commission for collecting the dividend and Tk 800 as interest on loan taken to purchase the shares of Public Limited Company. 16. From the following information calculate the taxable income and tax liability of Mr.Anis for the income year ended 30 June 2016 Income Data: Income from salary Tk. 1,000,000,Income from securities Tk.65,000,Income from house property Tk. 360,000,Income from agriculture Tk.80,000,Income from Business or Profession Tk.525,000, Capital gain Tk.20,000 and income from other sources tk. 45,000 Investment and Expenses Data: Insurance premium-own (policy value Tk.820,000) Tk.80,000 and spouse(Policy Value Tk.500,000) Tk. 55,000, Deposited to pension scheme per month tk. 2000 educational expense of son Tk.84,000, Household expenses Tk. 158,000, Donated to recognized fund Tk.100,000, Purchase of savings certificate Tk.40,000, Purchase of Treasury Bond Tk.25,000, Purchase of magazines and books Tk. 4500. Purchase of 10%debenture Tk. 10,000(through IPO),Donated to prime minister's Relief fund Tk. 45,000,Donated to recognized high school Tk. 30,000, Donated to a local sporting club Tk. 10,000,Donated to Sir Salimullah Muslium Orphanage Tk.15,000, Dopnated to recognized welfare fund Tk. 3600, Donated to government zakat fund Tk. 15,000, Gift to wife Tk.25,000, Purchased share of an unlisted company tk. 25,000, Purchased share of a co-operative society Tk.10,000, Purchased share of a private limited company Tk. 5000, Purchased share of a registered partnership firm Tk. 3000, Purchased primary share of a listed company Tk.15,000, Purchased share of a listed company from Dhaka Stock Exchange Tk. 30,000,Donated to Bangladesh Sports Development council Tk.8000, Donated to president's relief fund Tk.5000, Advanced payment for expenses Tk. 10,000 and purchase of a Desktop computer Tk.450,00