Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. Peeta Corporation, a calendar-year taxpayer, was organized and actively began operations on July 1, current year, and incurred legal fees to obtain a corporate

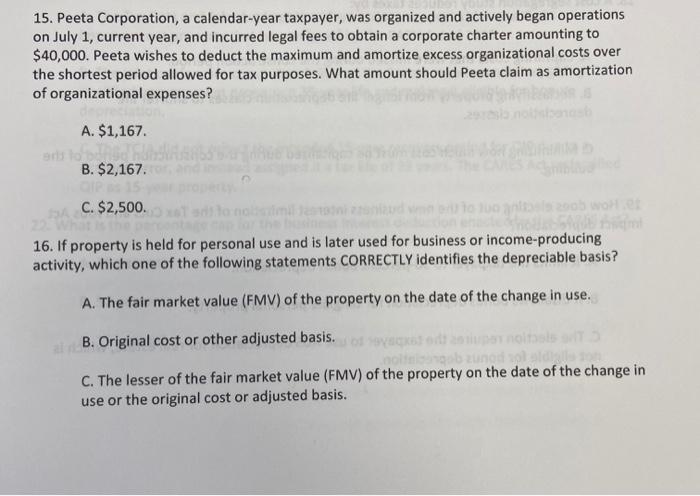

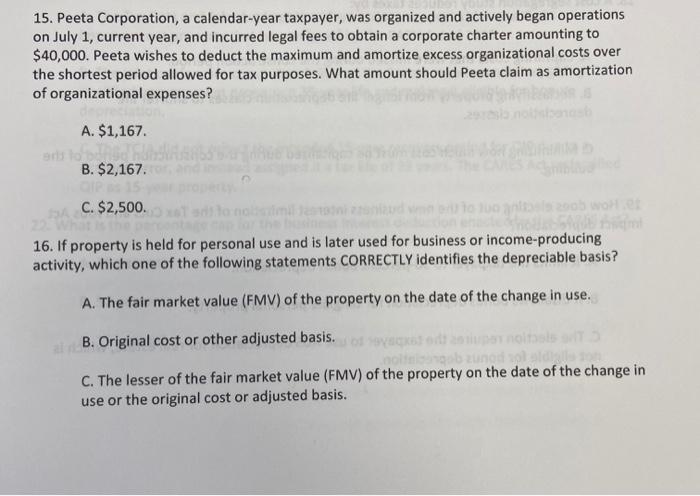

15. Peeta Corporation, a calendar-year taxpayer, was organized and actively began operations on July 1, current year, and incurred legal fees to obtain a corporate charter amounting to $40,000. Peeta wishes to deduct the maximum and amortize excess organizational costs over the shortest period allowed for tax purposes. What amount should Peeta claim as amortization of organizational expenses? A. $1,167. B. $2,167 C. $2,500. 16. If property is held for personal use and is later used for business or income-producing activity, which one of the following statements CORRECTLY identifies the depreciable basis? A. The fair market value (FMV) of the property on the date of the change in use. B. Original cost or other adjusted basis. C. The lesser of the fair market value (FMV) of the property on the date of the change in use or the original cost or adjusted basis

15. Peeta Corporation, a calendar-year taxpayer, was organized and actively began operations on July 1, current year, and incurred legal fees to obtain a corporate charter amounting to $40,000. Peeta wishes to deduct the maximum and amortize excess organizational costs over the shortest period allowed for tax purposes. What amount should Peeta claim as amortization of organizational expenses? A. $1,167. B. $2,167 C. $2,500. 16. If property is held for personal use and is later used for business or income-producing activity, which one of the following statements CORRECTLY identifies the depreciable basis? A. The fair market value (FMV) of the property on the date of the change in use. B. Original cost or other adjusted basis. C. The lesser of the fair market value (FMV) of the property on the date of the change in use or the original cost or adjusted basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started