Answered step by step

Verified Expert Solution

Question

1 Approved Answer

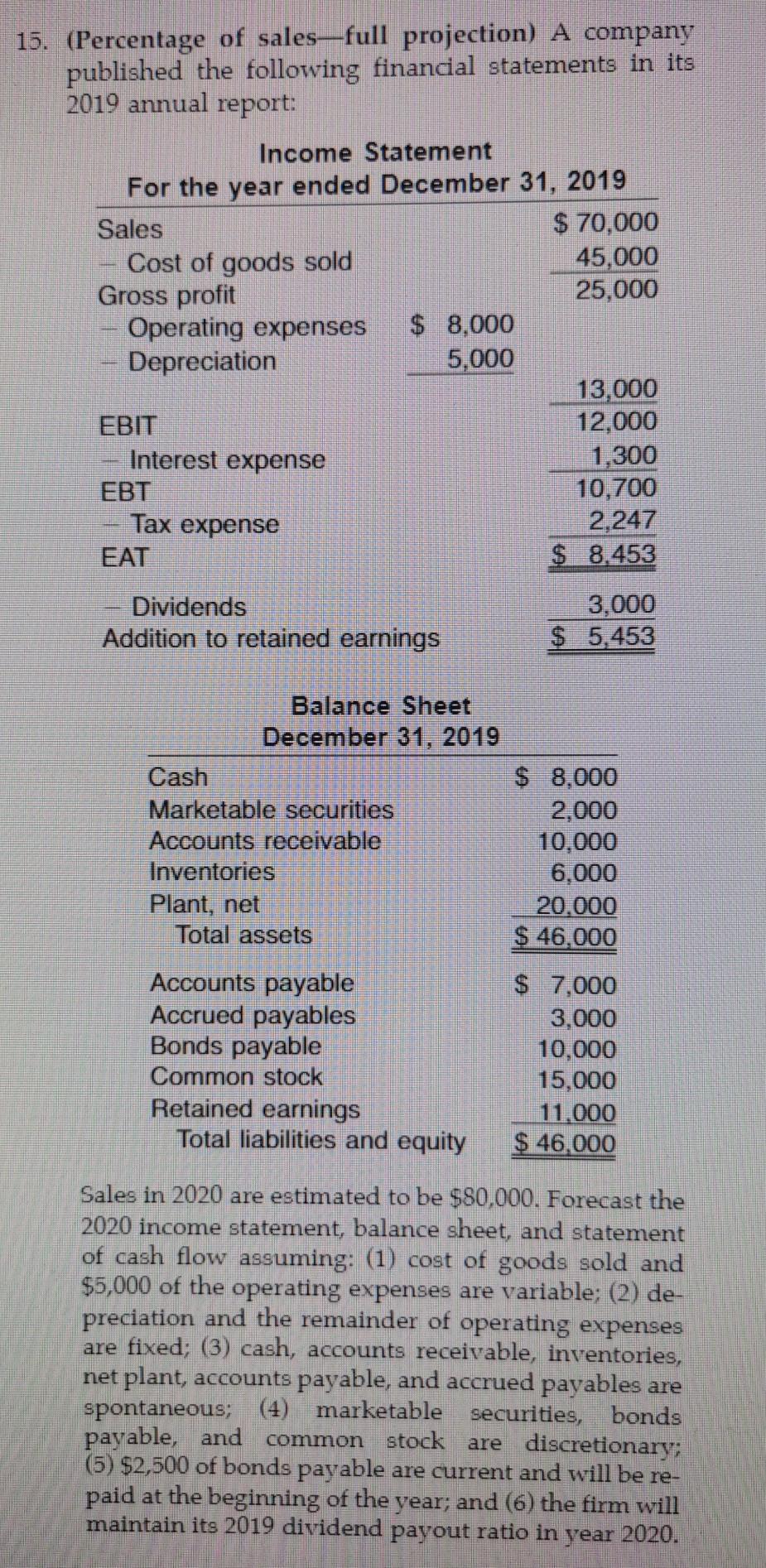

15. (Percentage of sales-full projection) A company published the following financial statements in its 2019 annual report: Income Statement For the year ended December 31,

15. (Percentage of sales-full projection) A company published the following financial statements in its 2019 annual report: Income Statement For the year ended December 31, 2019 Sales $ 70,000 Cost of goods sold 45,000 Gross profit 25,000 Operating expenses $ 8.000 Depreciation 5,000 13,000 EBIT 12,000 Interest expense 1,300 EBT 10,700 Tax expense 2,247 EAT $ 8.453 Dividends Addition to retained earnings 3,000 $ 5,453 Balance Sheet December 31, 2019 Cash $ 8,000 Marketable securities 2,000 Accounts receivable 10,000 Inventories 6,000 Plant, net 20.000 Total assets $ 46.000 Accounts payable Accrued payables Bonds payable Common stock Retained earnings Total liabilities and equity $ 7,000 3,000 10,000 15,000 11,000 $ 46,000 Sales in 2020 are estimated to be $80,000. Forecast the 2020 income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and $5,000 of the operating expenses are variable; (2) de- preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary; (5) $2,500 of bonds payable are current and will be re- paid at the beginning of the year; and (6) the firm will maintain its 2019 dividend payout ratio in year 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started