Answered step by step

Verified Expert Solution

Question

1 Approved Answer

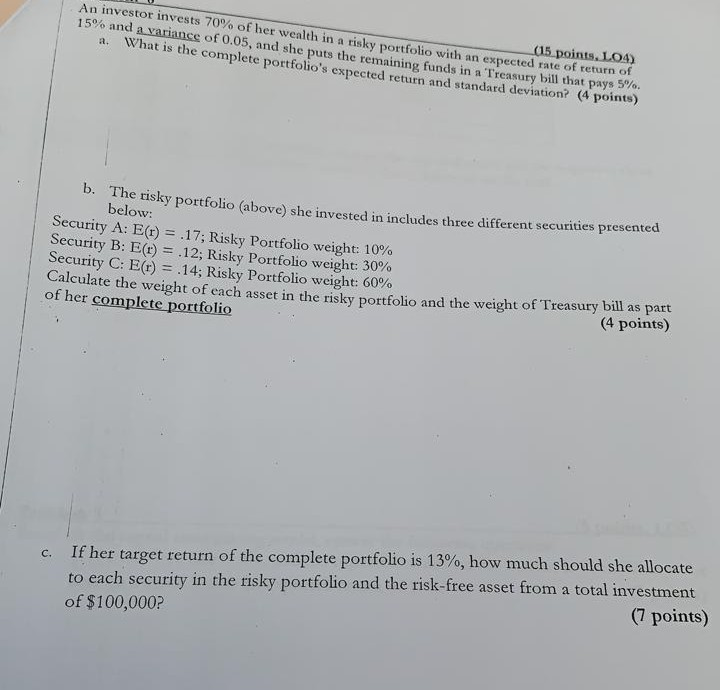

(15 points L04) An investor invests 70% of her wealth in a risky portfolio with an expected rate of retum 15% and a variance of

(15 points L04) An investor invests 70% of her wealth in a risky portfolio with an expected rate of retum 15% and a variance of 0.05, and she puts the remaining funds in a Treasury bill that pay a. What is the complete portfolio's expected return and standard deviation? (point b. The risky portfolio (above) she invested y Portfolio (above) she invested in includes three different securities presented below: Security A: E(T) = .17; Risky Portfolio weight: 10% Security B: E(t) = .12; Risky Portfolio weight: 30% Security C: E(r) = .14; Risky Portfolio weight: 60% Calculate the weight of each asset in the risky P e une weight of each asset in the risky portfolio and the weight of Treasury bull as part of her complete portfolio (4 points) c. If her target return of the complete portfolio is 13%, how much should she allocate to each security in the risky portfolio and the risk-free asset from a total investment of $100,000? (7 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started