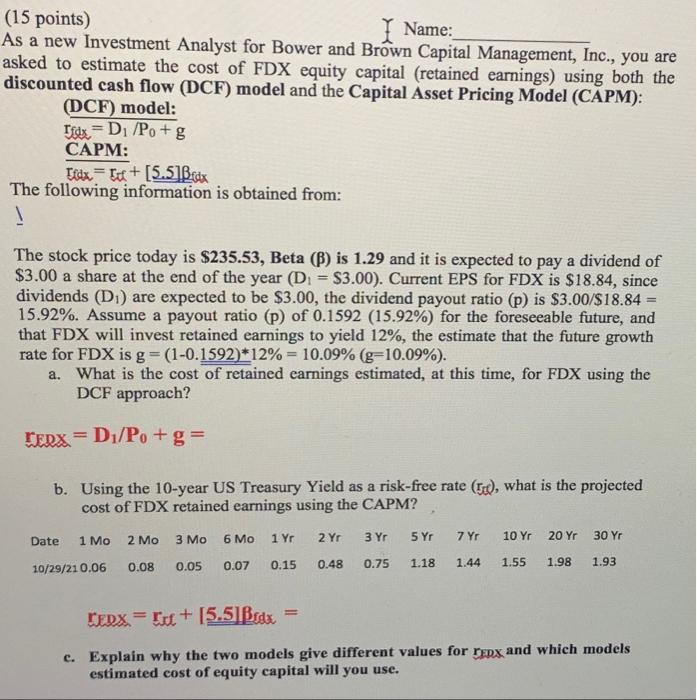

(15 points) Name: As a new Investment Analyst for Bower and Brown Capital Management, Inc., you are asked to estimate the cost of FDX equity capital (retained earnings) using both the discounted cash flow (DCF) model and the Capital Asset Pricing Model (CAPM): (DCF) model: Tidx.= D/P, +g CAPM: Efdx = Tu + [5.5] Brax The following information is obtained from: The stock price today is $235.53, Beta () is 1.29 and it is expected to pay a dividend of $3.00 a share at the end of the year (D = $3.00). Current EPS for FDX is $18.84, since dividends (D) are expected to be $3.00, the dividend payout ratio (p) is $3.00/$18.84 = 15.92%. Assume a payout ratio (p) of 0.1592 (15.92%) for the foreseeable future, and that FDX will invest retained earnings to yield 12%, the estimate that the future growth rate for FDX is g=(1-0.1592)*12% = 10.09% (g=10.09%). a. What is the cost of retained earnings estimated, at this time, for FDX using the DCF approach? TERX. = D/P, + g = b. Using the 10-year US Treasury Yield as a risk-free rate (), what is the projected cost of FDX retained earnings using the CAPM? Date 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Y 3 Yr 5 Yr 7 Yr 30 Yr 10 Yr 20 Yr 0.08 0.05 0.07 0.15 0.48 0.75 10/29/21 0.06 1.18 1.44 1.55 1.98 1.93 LEDX = d+ [5.51Bida c. Explain why the two models give different values for renx and which models estimated cost of equity capital will you use. (15 points) Name: As a new Investment Analyst for Bower and Brown Capital Management, Inc., you are asked to estimate the cost of FDX equity capital (retained earnings) using both the discounted cash flow (DCF) model and the Capital Asset Pricing Model (CAPM): (DCF) model: Tidx.= D/P, +g CAPM: Efdx = Tu + [5.5] Brax The following information is obtained from: The stock price today is $235.53, Beta () is 1.29 and it is expected to pay a dividend of $3.00 a share at the end of the year (D = $3.00). Current EPS for FDX is $18.84, since dividends (D) are expected to be $3.00, the dividend payout ratio (p) is $3.00/$18.84 = 15.92%. Assume a payout ratio (p) of 0.1592 (15.92%) for the foreseeable future, and that FDX will invest retained earnings to yield 12%, the estimate that the future growth rate for FDX is g=(1-0.1592)*12% = 10.09% (g=10.09%). a. What is the cost of retained earnings estimated, at this time, for FDX using the DCF approach? TERX. = D/P, + g = b. Using the 10-year US Treasury Yield as a risk-free rate (), what is the projected cost of FDX retained earnings using the CAPM? Date 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Y 3 Yr 5 Yr 7 Yr 30 Yr 10 Yr 20 Yr 0.08 0.05 0.07 0.15 0.48 0.75 10/29/21 0.06 1.18 1.44 1.55 1.98 1.93 LEDX = d+ [5.51Bida c. Explain why the two models give different values for renx and which models estimated cost of equity capital will you use