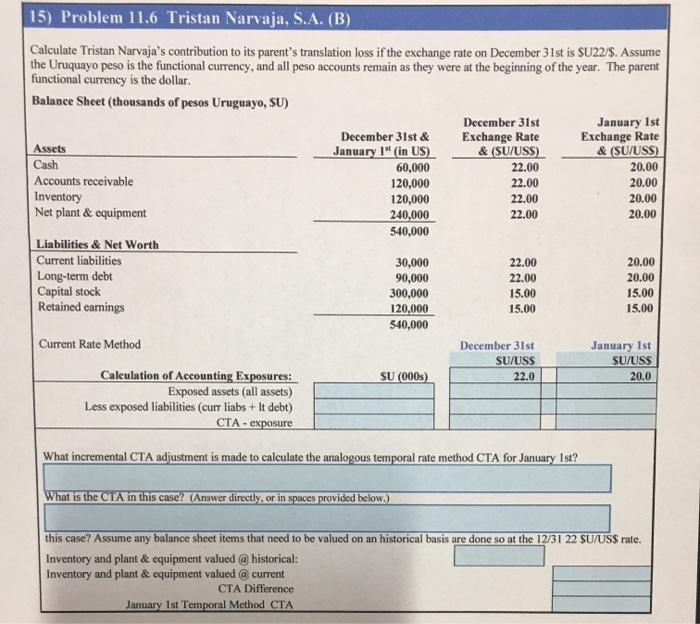

15) Problem 11.6 Tristan Narvaja, S.A. (B) Calculate Tristan Narvaja's contribution to its parent's translation loss if the exchange rate on December 31st is SU22/S. Assume the Uruquayo peso is the functional currency, and all peso accounts remain as they were at the beginning of the year. The parent functional currency is the dollar Balance Sheet (thousands of pesos Uruguayo, SU) December 31st January 1st December 31st & Exchange Rate Exchange Rate Assets January 1" (in US) & (SU/USS) & (SU/USS) Cash 60,000 22.00 20,00 Accounts receivable 120,000 22.00 20.00 Inventory 120,000 22.00 20.00 Net plant & equipment 240,000 22.00 20.00 540,000 Liabilities & Net Worth Current liabilities 30,000 22.00 20.00 Long-term debt 90,000 22.00 20.00 Capital stock 300,000 15.00 15.00 Retained earnings 120,000 15.00 15.00 540,000 Current Rate Method December 31st January 1st SU/USS SU/USS Calculation of Accounting Exposures: SU (000s) 22.0 20.0 Exposed assets (all assets) Less exposed liabilities (curr liabs + It debt) CTA - exposure What incremental CTA adjustment is made to calculate the analogous temporal rate method CTA for January Ist? What is the CIA in this case? (Answer directly, or in spaces provided below.) this case? Assume any balance sheet items that need to be valued on an historical basis are done so at the 12/31 22 $U/USS rate. Inventory and plant & equipment valued @historical: Inventory and plant & equipment valued current CTA Difference January 1st Temporal Method CTA 15) Problem 11.6 Tristan Narvaja, S.A. (B) Calculate Tristan Narvaja's contribution to its parent's translation loss if the exchange rate on December 31st is SU22/S. Assume the Uruquayo peso is the functional currency, and all peso accounts remain as they were at the beginning of the year. The parent functional currency is the dollar Balance Sheet (thousands of pesos Uruguayo, SU) December 31st January 1st December 31st & Exchange Rate Exchange Rate Assets January 1" (in US) & (SU/USS) & (SU/USS) Cash 60,000 22.00 20,00 Accounts receivable 120,000 22.00 20.00 Inventory 120,000 22.00 20.00 Net plant & equipment 240,000 22.00 20.00 540,000 Liabilities & Net Worth Current liabilities 30,000 22.00 20.00 Long-term debt 90,000 22.00 20.00 Capital stock 300,000 15.00 15.00 Retained earnings 120,000 15.00 15.00 540,000 Current Rate Method December 31st January 1st SU/USS SU/USS Calculation of Accounting Exposures: SU (000s) 22.0 20.0 Exposed assets (all assets) Less exposed liabilities (curr liabs + It debt) CTA - exposure What incremental CTA adjustment is made to calculate the analogous temporal rate method CTA for January Ist? What is the CIA in this case? (Answer directly, or in spaces provided below.) this case? Assume any balance sheet items that need to be valued on an historical basis are done so at the 12/31 22 $U/USS rate. Inventory and plant & equipment valued @historical: Inventory and plant & equipment valued current CTA Difference January 1st Temporal Method CTA