Answered step by step

Verified Expert Solution

Question

1 Approved Answer

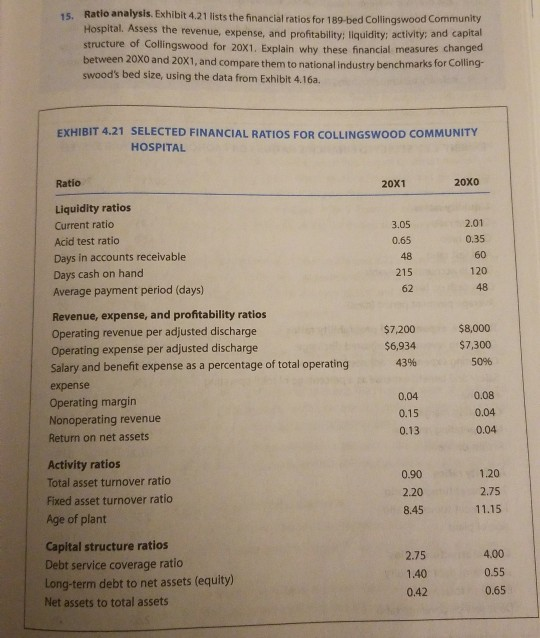

15. Ratio analysis. Exhibit 4.21 lists the financial ratios for 189 bed Collingswood Community Hospital. Assess the revenue, expense, and profitability: liquidity: activity, and capital

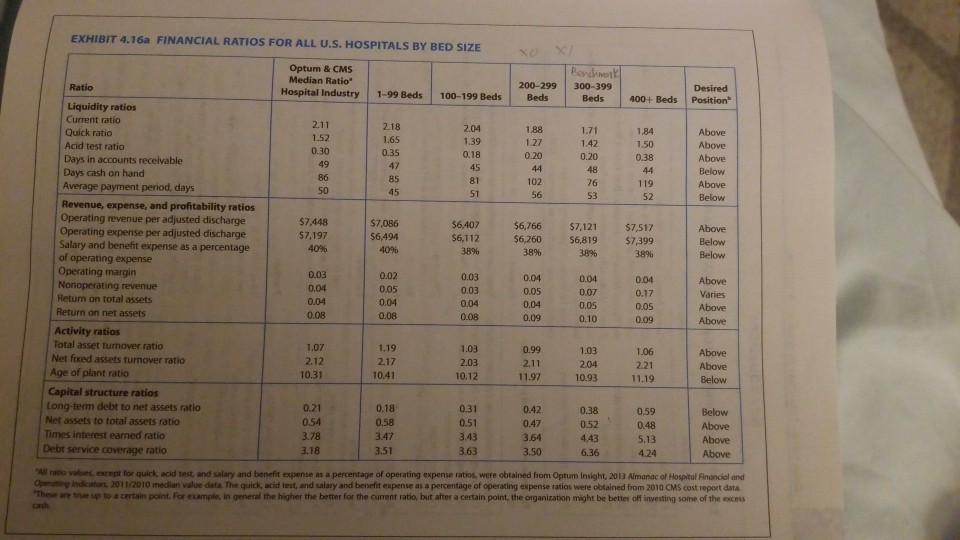

15. Ratio analysis. Exhibit 4.21 lists the financial ratios for 189 bed Collingswood Community Hospital. Assess the revenue, expense, and profitability: liquidity: activity, and capital structure of Collingswood for 20X1. Explain why these financial measures changed between 20X0 and 20x1, and compare them to national industry benchmarks for Colling- swood's bed size, using the data from Exhibit 4.16a. EXHIBIT 4.21 SELECTED FINANCIAL RATIOS FOR COLLINGSWOOD COMMUNITY HOSPITAL Ratio 20X1 20x0 3.05 0.65 48 215 62 2.01 0.35 60 120 48 Liquidity ratios Current ratio Acid test ratio Days in accounts receivable Days cash on hand Average payment period (days) Revenue, expense, and profitability ratios Operating revenue per adjusted discharge Operating expense per adjusted discharge Salary and benefit expense as a percentage of total operating expense Operating margin Nonoperating revenue Return on net ass $7,200 $6,934 43% $8,000 $7,300 50% 0.04 0.15 0.13 0.08 0.04 0.04 Activity ratios Total asset turnover ratio Fixed asset turnover ratio Age of plant 0.90 2.20 8.45 1.20 2.75 11.15 4.00 Capital structure ratios Debt service coverage ratio Long-term debt to net assets (equity) Net assets to total assets 2.75 1.40 0.42 0.55 0.65 EXHIBIT 4.16a FINANCIAL RATIOS FOR ALL U.S. HOSPITALS BY BED SIZE Optum & CMS Median Ratio Hospital Industry Ratio Benchwork 300-399 Beds 1-99 Beds 200-299 Beds 100-199 Beds 400+ Beds Desired Position 2.11 1.52 0.30 49 86 50 2.18 1.65 0.35 47 85 45 2.04 1.39 0.18 45 81 51 1.88 1.27 0.20 44 102 56 1.71 1.42 0.20 48 76 53 1.84 1.50 0.38 44 119 52 Above Above Above Below Above Below $7,448 $7,197 40% $7,086 $6,494 40% $6,407 $6,112 3896 $6,766 $6,260 38% $7,121 $6,819 38% $7,517 $7,399 38% Above Below Below Liquidity ratios Current ratio Quick ratio Acid test ratio Days in accounts receivable Days cash on hand Average payment period, days Revenue, expense, and profitability ratios Operating revenue per adjusted discharge Operating expense per adjusted discharge Salary and benefit expense as a percentage of operating expense Operating margin Nonoperating revenue Return on total assets Return on net assets Activity ratios Total asset turnover ratio Net fixed assets turnover ratio Age of plant ratio Capital structure ratios Long-term debt to net assets ratio Net assets to total assets ratio Times interest earned ratio Debt service coverage ratio 0.03 0.04 0.04 0.08 0.02 0.05 0.04 0.08 0.03 0.03 0.04 0.08 0.04 0.05 0.04 0.09 0.04 0.07 0.05 0.10 0.04 0.17 0.05 0.09 Above Varies Above Above 1.07 2.12 10.31 1.19 2.17 10.41 1.03 2.03 10.12 0.99 2.11 11.97 1.03 2.04 10.93 1.06 2.21 11.19 Above Above Below 0.21 0.54 3.78 3.18 0.18 0.58 3.47 3.51 0.31 0.51 3.43 3.63 0.42 0.47 3.64 3.50 0.38 0.52 4.43 6.36 0.59 0.48 5.13 4.24 Below Above Above Above All ratio values, except for quick acld test and salary and benefit expense as a percentage of operating expense ratios were obtained from Optum Insight, 2013 Almanac of Hospital Financial and Operating indicators. 2011/2010 median value data. The quick, acid test, and salary and benefit expense as a percentage of operating expense ratios were obtained from 2010 CMS cost report data. These are true up to a certain point. For example, in general the higher the better for the current ratio, but after a certain point, the organization might be better off investing some of the excess

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started