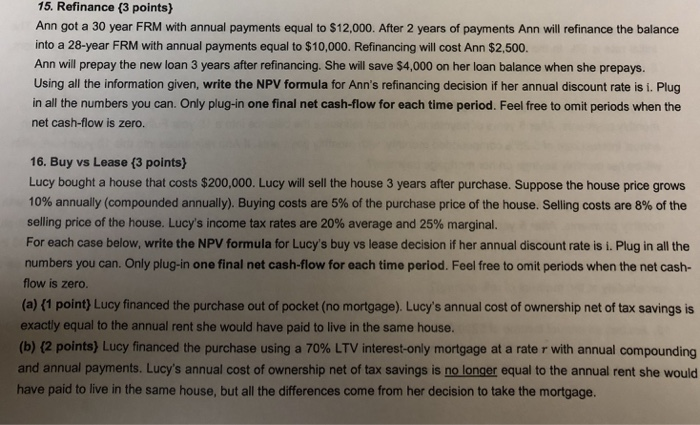

15. Refinance (3 points) Ann got a 30 year FRM with annual payments equal to $12,000. After 2 years of payments Ann will refinance the balance into a 28-year FRM with annual payments equal to $10,000. Refinancing will cost Ann $2,500. Ann will prepay the new loan 3 years after refinancing. She will save $4,000 on her loan balance when she prepays. Using all the information given, write the NPV formula for Ann's refinancing decision if her annual discount rate is i. Plug in all the numbers you can. Only plug-in one final net cash-flow for each time period. Feel free to omit periods when the net cash-flow is zero. 16,. Buy vs Lease (3 points) Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house, Lucy's income tax rates are 20% average and 25% marginal. For each case below, write the NPV formula for Lucy's buy vs lease decision if her annual discount rate is i. Plug in all the numbers you can. Only plug-in one final net cash-flow for each time period. Feel free to omit periods when the net cash- flow is zero (a) (1 point) Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. (b) (2 points) Lucy financed the purchase using a 70% LTV interest-only mortgage at a rate r with annual compounding and annual payments. Lucy's annual cost of ownership net of tax savings is no longer equal to the annual rent she would have paid to live in the same house, but all the differences come from her decision to take the mortgage. 15. Refinance (3 points) Ann got a 30 year FRM with annual payments equal to $12,000. After 2 years of payments Ann will refinance the balance into a 28-year FRM with annual payments equal to $10,000. Refinancing will cost Ann $2,500. Ann will prepay the new loan 3 years after refinancing. She will save $4,000 on her loan balance when she prepays. Using all the information given, write the NPV formula for Ann's refinancing decision if her annual discount rate is i. Plug in all the numbers you can. Only plug-in one final net cash-flow for each time period. Feel free to omit periods when the net cash-flow is zero. 16,. Buy vs Lease (3 points) Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house, Lucy's income tax rates are 20% average and 25% marginal. For each case below, write the NPV formula for Lucy's buy vs lease decision if her annual discount rate is i. Plug in all the numbers you can. Only plug-in one final net cash-flow for each time period. Feel free to omit periods when the net cash- flow is zero (a) (1 point) Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. (b) (2 points) Lucy financed the purchase using a 70% LTV interest-only mortgage at a rate r with annual compounding and annual payments. Lucy's annual cost of ownership net of tax savings is no longer equal to the annual rent she would have paid to live in the same house, but all the differences come from her decision to take the mortgage