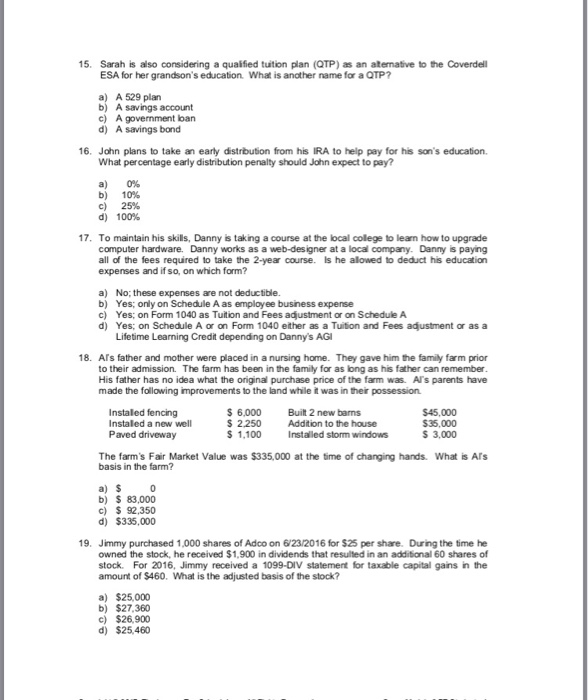

15. Sarah is also considering a qualified tution plan (QTP) as an atenative to the Coverdell ESA for her grandson's education What is another name for a QTP? a) A 529 plan b) A savings account c) A govenment ban d) A savings band 16. John plans to take an early distrbution from his IRA to help pay for his son's education. What percentage early distribution penalty should John expect to pay? a) b) c) d) 0% 10% 25% 100% 1. To maintain his skills, Danny is taking a course at the local college to learn how to upgrade computer hardware. Danny works as a web-designer at a local company. Danny is paying all of the fees required to take the 2-year course. Is he alowed to deduct his education expenses and if so, on which form? a) No; these b) Yes; only on Schedule A as employee business expense c) Yes; on Form 1040 as Tuition and Fees adjustment or on Schedule A d) Yes; on Schedule A or on Form 1040 either as a Tuiton and Fees adjustment or as a expenses are not deductible. Lifetime Learning Credit depending on Danny's AG 18. Ars father and mother were placed in a nursing home. They gave him the family farm prior to their admission. The farm has been in the family for as long as his father can remember His father has no idea what the oniginal purchase price of the farm was. AIs parents have made the following improvements to the land while it was in their possession Instaled fencing S 6,000 Bi 2 new bams S 2250 Addition to the house S 1,100 nstalled storm windows $45,000 $35,000 S 3,000 Instaled a new well Paved driveway The farm's Fair Market Value was $335,000 at the time of changing hands. What is Ars basis in the farm? a)$ b) 83,000 c) $92,350 d) $335,000 19. Jimmy purchased 1,000 shares of Adco on 6/23/2016 for $25 per share. During the time he owned the stock, he received $1,900 in dividends that resulted in an additional 60 shares of stock. For 2016, Jimmy received a 1099-DIV statement for taxable capital gains in the amount of $460, What is the adjusted basis of the stock? a) $25,000 b) $27,360 c) $26,900 d) $25,460