Answered step by step

Verified Expert Solution

Question

1 Approved Answer

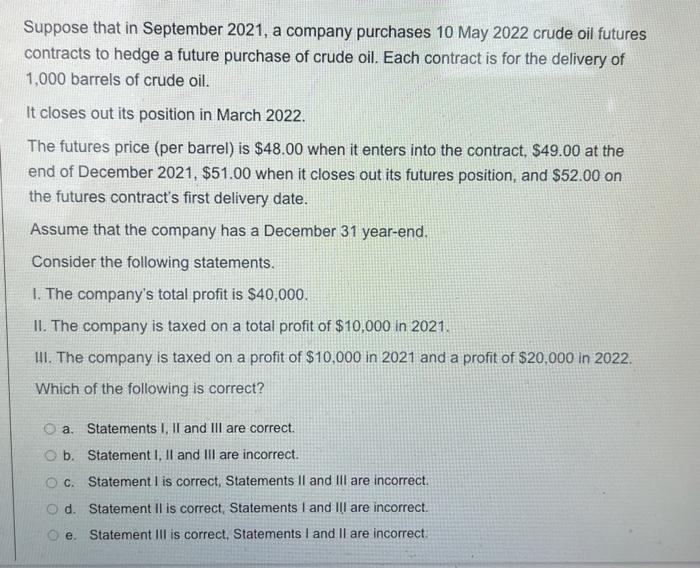

15 Suppose that in September 2021, a company purchases 10 May 2022 crude oil futures contracts to hedge a future purchase of crude oil. Each

15

Suppose that in September 2021, a company purchases 10 May 2022 crude oil futures contracts to hedge a future purchase of crude oil. Each contract is for the delivery of 1,000 barrels of crude oil. It closes out its position in March 2022. The futures price (per barrel) is $48.00 when it enters into the contract. $49.00 at the end of December 2021, $51.00 when it closes out its futures position, and $52.00 on the futures contract's first delivery date. Assume that the company has a December 31 year-end. Consider the following statements. 1. The company's total profit is $40,000. II. The company is taxed on a total profit of $10,000 in 2021. III. The company is taxed on a profit of $10,000 in 2021 and a profit of $20,000 in 2022. Which of the following is correct? a. Statements I, II and III are correct. ob. Statement I, II and III are incorrect. O C. Statement I is correct, Statements II and III are incorrect. d. Statement Il is correct, Statements I and Ill are incorrect. e. Statement III is correct, Statements I and II are incorrect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started