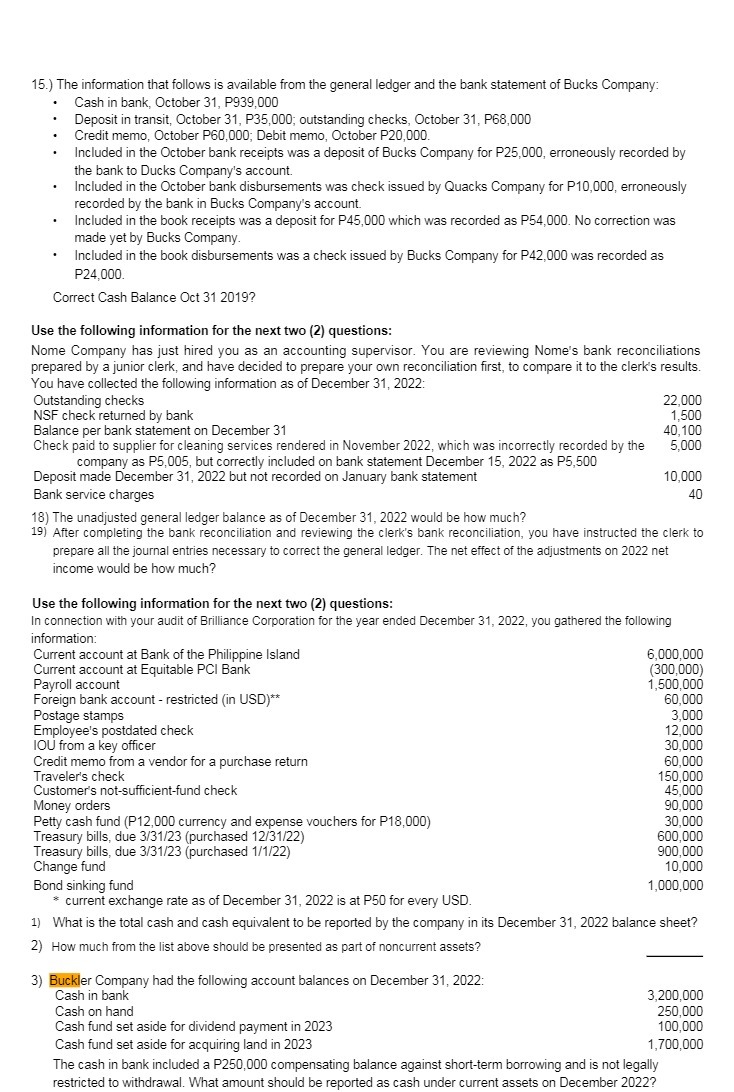

15.) The information that follows is available from the general ledger and the bank statement of Bucks Company: Cash in bank, October 31, P939,000 Deposit in transit, October 31, P35,000; outstanding checks, October 31, P68,000 Credit memo, October P60,000; Debit memo, October P20,000 Included in the October bank receipts was a deposit of Bucks Company for P25,000, erroneously recorded by the bank to Ducks Company's account. Included in the October bank disbursements was check issued by Quacks Company for P10,000, erroneously recorded by the bank in Bucks Company's account. Included in the book receipts was a deposit for P45,000 which was recorded as P54,000. No correction was made yet by Bucks Company. Included in the book disbursements was a check issued by Bucks Company for P42,000 was recorded as P24,000. Correct Cash Balance Oct 31 2019? Use the following information for the next two (2) questions: Nome Company has just hired you as an accounting supervisor. You are reviewing Nome's bank reconciliations prepared by a junior clerk, and have decided to prepare your own reconciliation first, to compare it to the clerk's results. You have collected the following information as of December 31, 2022: Outstanding checks 22,000 NSF check returned by bank 1,500 Balance per bank statement on December 31 40, 100 Check paid to supplier for cleaning services rendered in November 2022, which was incorrectly recorded by the 5,000 company as P5,005, but correctly included on bank statement December 15, 2022 as P5,500 Deposit made December 31, 2022 but not recorded on January bank statement 10,000 Bank service charges 40 18) The unadjusted general ledger balance as of December 31, 2022 would be how much? 19) After completing the bank reconciliation and reviewing the clerk's bank reconciliation, you have instructed the clerk to prepare all the journal entries necessary to correct the general ledger. The net effect of the adjustments on 2022 net income would be how much? Use the following information for the next two (2) questions: In connection with your audit of Brilliance Corporation for the year ended December 31, 2022, you gathered the following information: Current account at Bank of the Philippine Island 6,000,000 Current account at Equitable PCI Bank (300,000) Payroll account 1,500,000 Foreign bank account - restricted (in USD)** 60,000 Postage stamps 3,000 Employee's postdated check 12,000 IOU from a key officer 30,000 Credit memo from a vendor for a purchase return 60,000 Traveler's check 150,000 Customer's not-sufficient-fund check 45,000 Money orders 90,000 Petty cash fund (P12,000 currency and expense vouchers for P18,000) 30,000 Treasury bills, due 3/31/23 (purchased 12/31/22) 600,000 Treasury bills, due 3/31/23 (purchased 1/1/22) 900,000 Change fund 10,000 Bond sinking fund 1,000,000 current exchange rate as of December 31, 2022 is at P50 for every USD. 1) What is the total cash and cash equivalent to be reported by the company in its December 31, 2022 balance sheet? 2) How much from the list above should be presented as part of noncurrent assets? 3) Buckler Company had the following account balances on December 31, 2022: Cash in bank 3,200,000 Cash on hand 250,000 Cash fund set aside for dividend payment in 2023 100,000 Cash fund set aside for acquiring land in 2023 1,700,000 The cash in bank included a P250,000 compensating balance against short-term borrowing and is not legally restricted to withdrawal. What amount should be reported as cash under current assets on December 2022