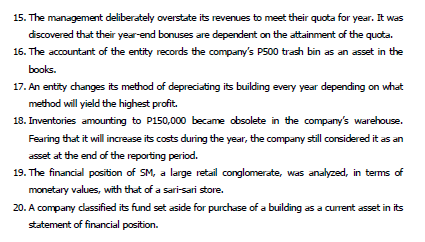

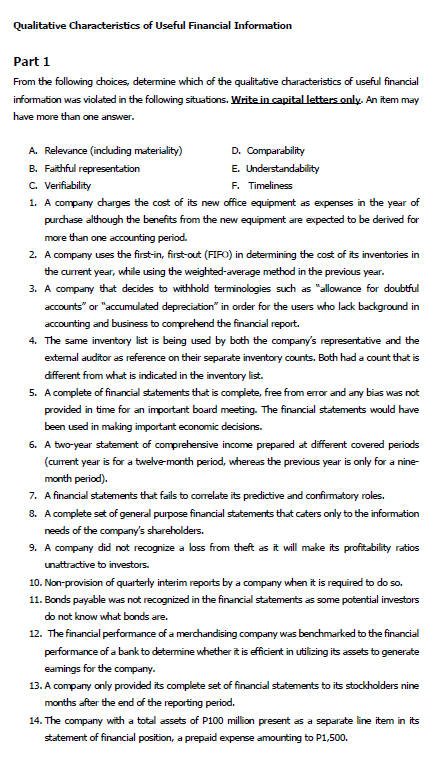

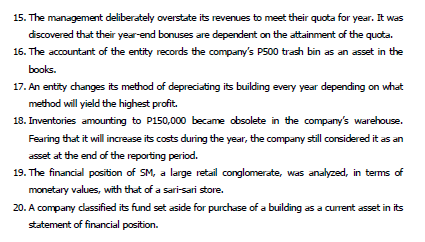

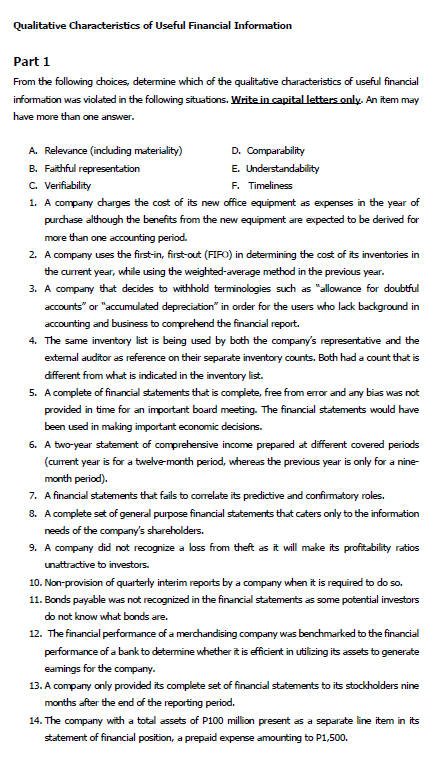

15. The management deliberately overstate its revenues to meet their quota for year. It was discovered that their year-end bonuses are dependent on the attainment of the quota. 15. The accountant of the entity records the company's P500 trash bin as an asset in the books. 17. An entity changes its method of depreciating its building every year depending on what method will yield the highest profit. 18. Inventories amourting to P150,000 became obsolete in the company's warehouse. Fearing that it will increase its costs during the year, the company still considered it as an asset at the end of the reporting period. 19. The financial position of SM, a large retail conglomerate, was analyzed, in terms of monetary values, with that of a sari-sari store. 20. A company cassified its fund set aside for purchase of a building as a current asset in its statement of financial position. Qualitative Characteristics of Useful Financial Information Part 1 From the following choices, determine which of the qualitative characteristics of useful financial information was violated in the following situations. Write in capital letters only. An item may have more than one answer. A. Relevance (including materiality) D. Comparability B. Faithful representation E. Understandability C. Verifiability F. Timeliness 1. A company charges the cost of its new office equipment as expenses in the year of purchase although the benefits from the new equipment are expected to be derived for more than one accounting period. 2. A company uses the firstin, first-out (FIFO) in determining the cost of its inventories in the current year, while using the weighted average method in the previous year. 3. A company that decides to withhold terminologies such as "allowance for doubtful accounts" or "accumulated depreciation in order for the users who lack background in accounting and business to comprehend the financial report. 4. The same inventory list is being used by both the company's representative and the external auditor as reference on their separate inventory counts. Both had a count that is different from what is indicated in the inventory list. 5. A complete of financial statements that is complete, free from error and any bias was not provided in time for an important board meeting. The financial statements would have been used in making important economic decisions. 6. A two-year statement of comprehensive income prepared at different covered periods (current year is for a twelve-month period, whereas the previous year is only for a nine- month period). 7. A financial statements that fails to correlate its predictive and confirmatory roles. 8. A complete set of general purpose financial statements that caters only to the information needs of the company's shareholders. 9. A company did not recognize a loss from theft as it will make its profitability ratios unattractive to investors 10. Non-provision of quarterly interim reports by a company when it is required to do so. 11. Bonds payable was not recognized in the financial statements as some potential investors do not know what bonds are. 12. The financial performance of a merchandising company was benchmarked to the financial performance of a bank to determine whether it is efficient in utilizing its assets to generate earnings for the company. 13. A company only provided its complete set of financial statements to its stockholders nine months after the end of the reporting period. 14. The company with a total assets of P100 million present as a separate line item in its statement of financial position, a prepaid expense amounting to P1,500. 15. The management deliberately overstate its revenues to meet their quota for year. It was discovered that their year-end bonuses are dependent on the attainment of the quota. 15. The accountant of the entity records the company's P500 trash bin as an asset in the books. 17. An entity changes its method of depreciating its building every year depending on what method will yield the highest profit. 18. Inventories amourting to P150,000 became obsolete in the company's warehouse. Fearing that it will increase its costs during the year, the company still considered it as an asset at the end of the reporting period. 19. The financial position of SM, a large retail conglomerate, was analyzed, in terms of monetary values, with that of a sari-sari store. 20. A company cassified its fund set aside for purchase of a building as a current asset in its statement of financial position. Qualitative Characteristics of Useful Financial Information Part 1 From the following choices, determine which of the qualitative characteristics of useful financial information was violated in the following situations. Write in capital letters only. An item may have more than one answer. A. Relevance (including materiality) D. Comparability B. Faithful representation E. Understandability C. Verifiability F. Timeliness 1. A company charges the cost of its new office equipment as expenses in the year of purchase although the benefits from the new equipment are expected to be derived for more than one accounting period. 2. A company uses the firstin, first-out (FIFO) in determining the cost of its inventories in the current year, while using the weighted average method in the previous year. 3. A company that decides to withhold terminologies such as "allowance for doubtful accounts" or "accumulated depreciation in order for the users who lack background in accounting and business to comprehend the financial report. 4. The same inventory list is being used by both the company's representative and the external auditor as reference on their separate inventory counts. Both had a count that is different from what is indicated in the inventory list. 5. A complete of financial statements that is complete, free from error and any bias was not provided in time for an important board meeting. The financial statements would have been used in making important economic decisions. 6. A two-year statement of comprehensive income prepared at different covered periods (current year is for a twelve-month period, whereas the previous year is only for a nine- month period). 7. A financial statements that fails to correlate its predictive and confirmatory roles. 8. A complete set of general purpose financial statements that caters only to the information needs of the company's shareholders. 9. A company did not recognize a loss from theft as it will make its profitability ratios unattractive to investors 10. Non-provision of quarterly interim reports by a company when it is required to do so. 11. Bonds payable was not recognized in the financial statements as some potential investors do not know what bonds are. 12. The financial performance of a merchandising company was benchmarked to the financial performance of a bank to determine whether it is efficient in utilizing its assets to generate earnings for the company. 13. A company only provided its complete set of financial statements to its stockholders nine months after the end of the reporting period. 14. The company with a total assets of P100 million present as a separate line item in its statement of financial position, a prepaid expense amounting to P1,500