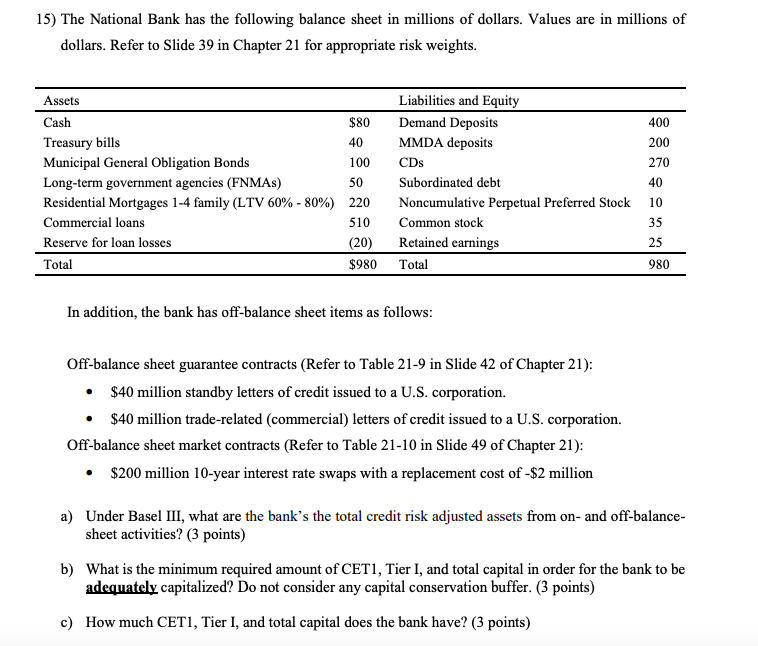

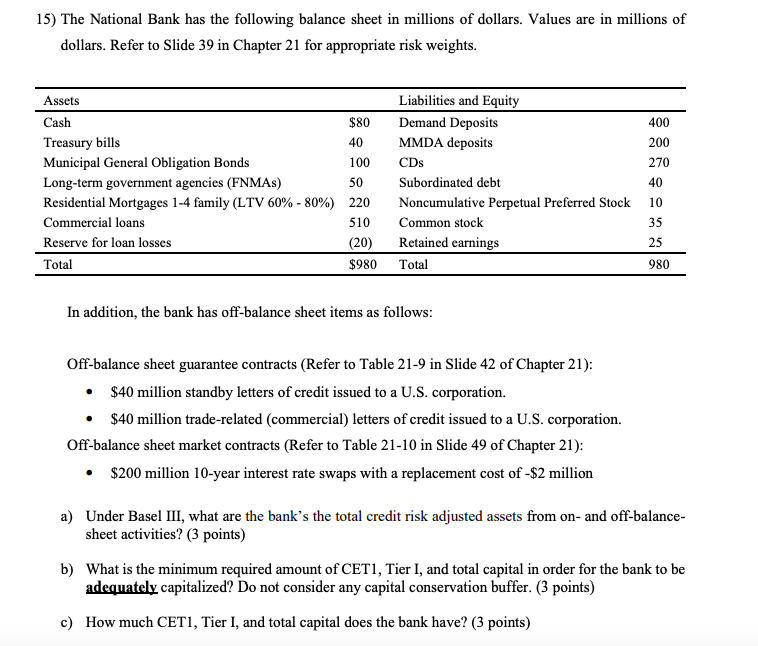

15) The National Bank has the following balance sheet in millions of dollars. Values are in millions of dollars. Refer to Slide 39 in Chapter 21 for appropriate risk weights. 40 400 200 270 Assets Cash $80 Treasury bills Municipal General Obligation Bonds 100 Long-term government agencies (FNMAS) 50 Residential Mortgages 1-4 family (LTV 60% -80%) 220 Commercial loans 510 Reserve for loan losses (20) Total $980 Liabilities and Equity Demand Deposits MMDA deposits CDs Subordinated debt Noncumulative Perpetual Preferred Stock Common stock Retained earnings Total 40 10 35 25 980 In addition, the bank has off-balance sheet items as follows: Off-balance sheet guarantee contracts (Refer to Table 21-9 in Slide 42 of Chapter 21): $40 million standby letters of credit issued to a U.S. corporation. $40 million trade-related (commercial) letters of credit issued to a U.S. corporation. Off-balance sheet market contracts (Refer to Table 21-10 in Slide 49 of Chapter 21): $200 million 10-year interest rate swaps with a replacement cost of -$2 million a) Under Basel III, what are the bank's the total credit risk adjusted assets from on- and off-balance- sheet activities? (3 points) b) What is the minimum required amount of CET1, Tier I, and total capital in order for the bank to be adequately capitalized? Do not consider any capital conservation buffer. (3 points) c) How much CETI, Tier I, and total capital does the bank have? (3 points) 15) The National Bank has the following balance sheet in millions of dollars. Values are in millions of dollars. Refer to Slide 39 in Chapter 21 for appropriate risk weights. 40 400 200 270 Assets Cash $80 Treasury bills Municipal General Obligation Bonds 100 Long-term government agencies (FNMAS) 50 Residential Mortgages 1-4 family (LTV 60% -80%) 220 Commercial loans 510 Reserve for loan losses (20) Total $980 Liabilities and Equity Demand Deposits MMDA deposits CDs Subordinated debt Noncumulative Perpetual Preferred Stock Common stock Retained earnings Total 40 10 35 25 980 In addition, the bank has off-balance sheet items as follows: Off-balance sheet guarantee contracts (Refer to Table 21-9 in Slide 42 of Chapter 21): $40 million standby letters of credit issued to a U.S. corporation. $40 million trade-related (commercial) letters of credit issued to a U.S. corporation. Off-balance sheet market contracts (Refer to Table 21-10 in Slide 49 of Chapter 21): $200 million 10-year interest rate swaps with a replacement cost of -$2 million a) Under Basel III, what are the bank's the total credit risk adjusted assets from on- and off-balance- sheet activities? (3 points) b) What is the minimum required amount of CET1, Tier I, and total capital in order for the bank to be adequately capitalized? Do not consider any capital conservation buffer. (3 points) c) How much CETI, Tier I, and total capital does the bank have? (3 points)